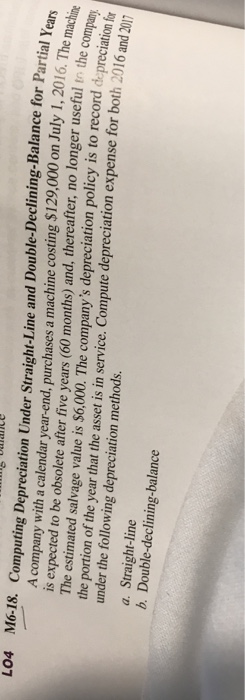

Question: LO4 M6-18. Computing Depreciation Under Straight-Line and Double-Declining-Balance for Partial Yen ears A company with a calendar year end, purchases a machine costing $129,000 on

LO4 M6-18. Computing Depreciation Under Straight-Line and Double-Declining-Balance for Partial Yen ears A company with a calendar year end, purchases a machine costing $129,000 on July 1, 2016.The is expected to be obsolete after five years (60 months) and, thereafter, no longer efue The estimated salvage value is $6,000. The company's depreciation policy is to record depreciat the portion of the year that the asset is in service. Compute depreciation expense for both 2016 under the following depreciation methods. and 2017 a. Straight-line b. Double-declining-balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts