Question: Load Funds. What is the difference between no-load and load mutual funds? How do loads affect a fund's return? Why do some investors purchase load

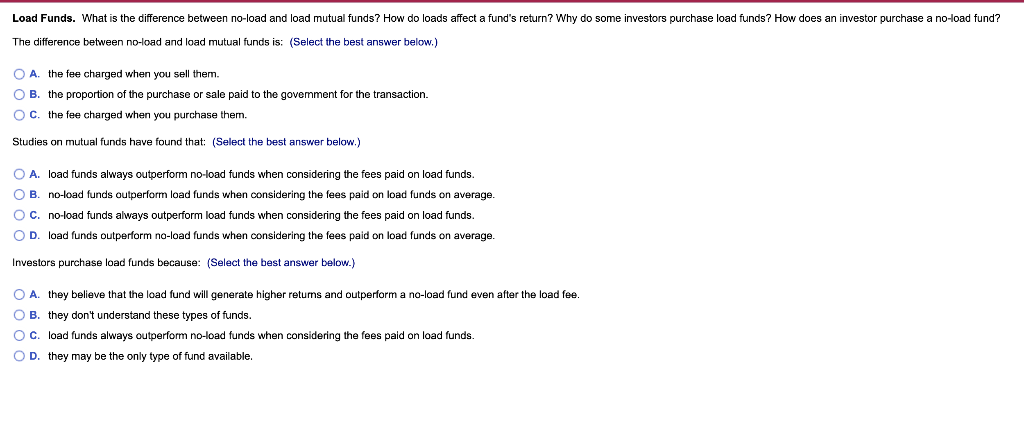

Load Funds. What is the difference between no-load and load mutual funds? How do loads affect a fund's return? Why do some investors purchase load funds? How does an investor purchase a no-load fund? The difference between no-load and load mutual funds is: (Select the best answer below.) O A. the fee charged when you sell them. OB. the proportion of the purchase or sale paid to the govemment for the transaction. O C. the fee charged when you purchase them. Studies on mutual funds have found that: (Select the best answer below.) O A. load funds always outperform no-load funds when considering the fees paid on load funds. OB. no-load funds outperform load funds when considering the fees paid on load funds on average. O c. no-load funds always outperform load funds when considering the fees paid on load funds. OD. load funds outperform no-load funds when considering the fees paid on load funds on average. Investors purchase load funds because: (Select the best answer below.) O A. they believe that the load fund will generate higher returns and outperform a no-load fund even after the load fee. OB. they don't understand these types of funds. O C. load funds always outperform no-load funds when considering the fees paid on load funds. OD. they may be the only type of fund available

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts