Question: Loan Analysis Case Study Question: 1) You are a Risk Manager for this bank. What risk measures and all the Qualitative and Quantitative Risk

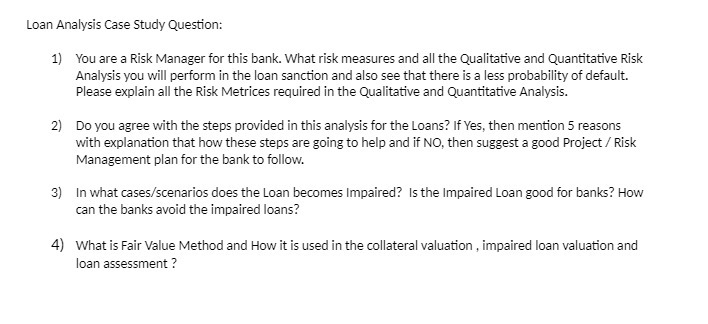

Loan Analysis Case Study Question: 1) You are a Risk Manager for this bank. What risk measures and all the Qualitative and Quantitative Risk Analysis you will perform in the loan sanction and also see that there is a less probability of default. Please explain all the Risk Metrices required in the Qualitative and Quantitative Analysis. 2) Do you agree with the steps provided in this analysis for the Loans? If Yes, then mention 5 reasons with explanation that how these steps are going to help and if NO, then suggest a good Project / Risk Management plan for the bank to follow. 3) In what cases/scenarios does the Loan becomes Impaired? Is the Impaired Loan good for banks? How can the banks avoid the impaired loans? 4) What is Fair Value Method and How it is used in the collateral valuation, impaired loan valuation and loan assessment?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts