Question: Lockheed Martin won a contract to build and launch a satellite for Vietnam Posts and Telecommunications Group at the cost of $400,000,000. Assume the satellite

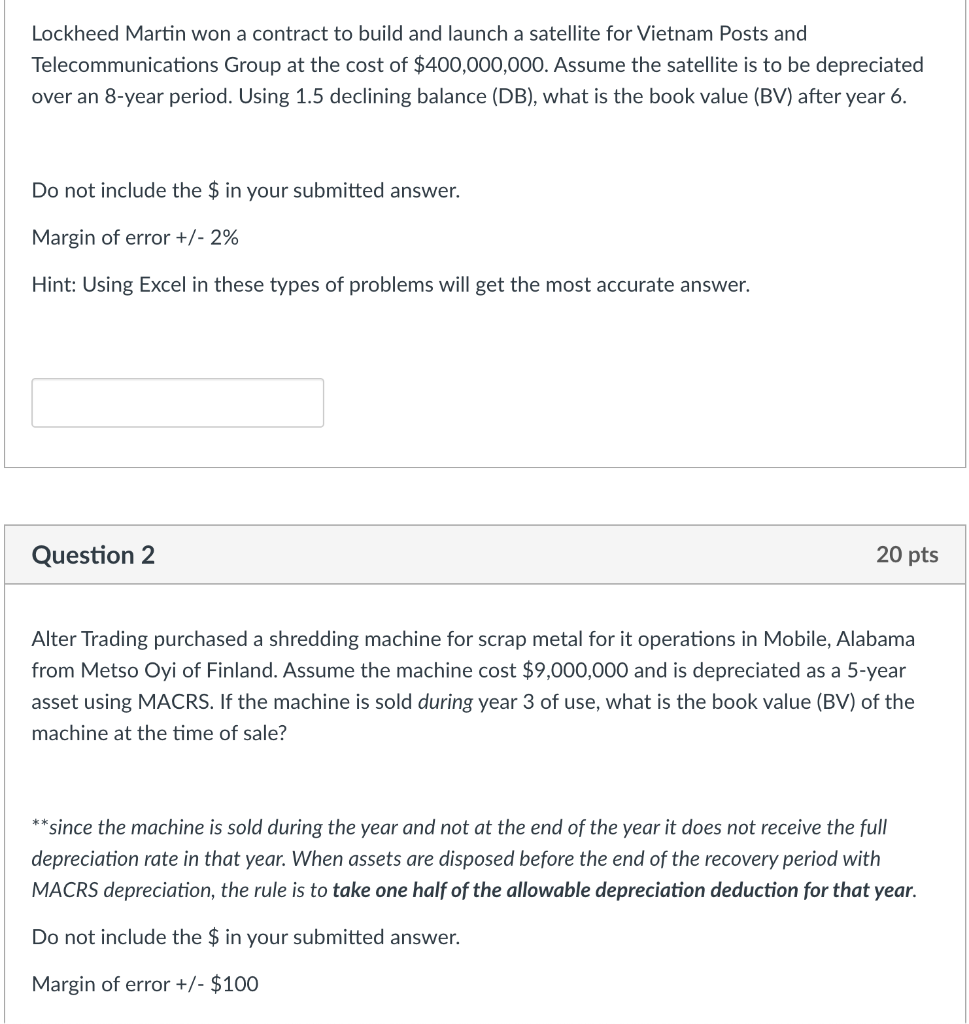

Lockheed Martin won a contract to build and launch a satellite for Vietnam Posts and Telecommunications Group at the cost of $400,000,000. Assume the satellite is to be depreciated over an 8-year period. Using 1.5 declining balance (DB), what is the book value (BV) after year 6. Do not include the $ in your submitted answer. Margin of error +/- 2% Hint: Using Excel in these types of problems will get the most accurate answer. Question 2 20 pts Alter Trading purchased a shredding machine for scrap metal for it operations in Mobile, Alabama from Metso Oyi of Finland. Assume the machine cost $9,000,000 and is depreciated as a 5-year asset using MACRS. If the machine is sold during year 3 of use, what is the book value (BV) of the machine at the time of sale? **since the machine is sold during the year and not at the end of the year it does not receive the full depreciation rate in that year. When assets are disposed before the end of the recovery period with MACRS depreciation, the rule is to take one half of the allowable depreciation deduction for that year. Do not include the $ in your submitted answer. Margin of error +/- $100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts