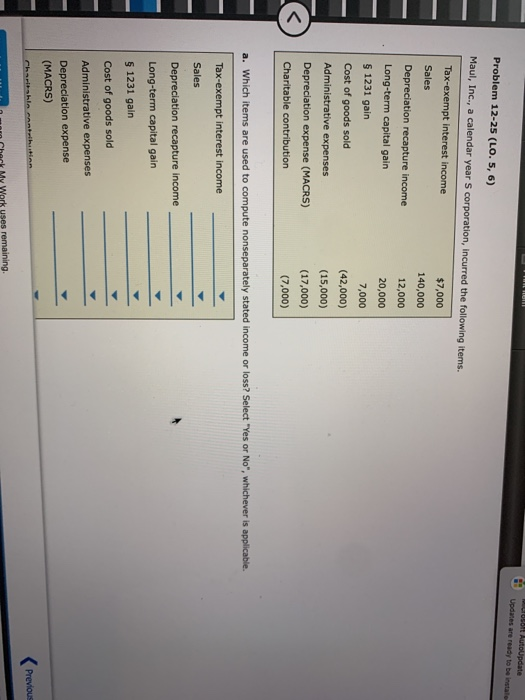

Question: loco AutoUpdate Updates are ready to be instale Problem 12-25 (LO. 5, 6) Maul, Inc., a calendar year S corporation, incurred the following items. Tax-exempt

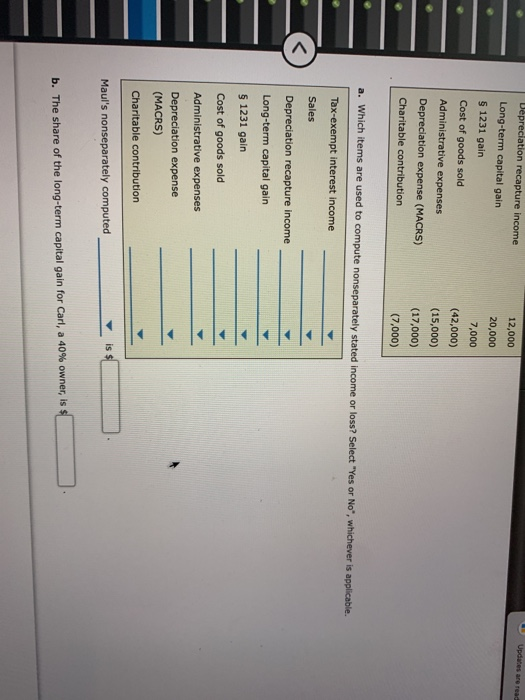

loco AutoUpdate Updates are ready to be instale Problem 12-25 (LO. 5, 6) Maul, Inc., a calendar year S corporation, incurred the following items. Tax-exempt interest income Sales Depreciation recapture income Long-term capital gain $ 1231 gain Cost of goods sold Administrative expenses Depreciation expense (MACRS) Charitable contribution $7,000 140,000 12,000 20,000 7,000 (42,000) (15,000) (17,000) (7,000) a. Which items are used to compute nonseparately stated income or loss? Select "Yes or No", whichever is applicable. Tax-exempt interest income Sales Depreciation recapture income Long-term capital gain 1231 gain Cost of goods sold Administrative expenses Depreciation expense (MACRS) Charitable atribution Previous H m m Check My Work uses remaining. Depreciation recapture income Long-term capital gain S 1231 gain Cost of goods sold Administrative expenses Depreciation expense (MACRS) Charitable contribution 12,000 20,000 7,000 (42,000) (15,000) (17,000) (7,000) a. Which items are used to compute nonseparately stated income or loss? Select "Yes or No", whichever is applicable. Tax-exempt interest Income Sales Depreciation recapture income Long-term capital gain 1231 gain Cost of goods sold Administrative expenses Depreciation expense (MACRS) Charitable contribution Maul's nonseparately computed b. The share of the long-term capital gain for Carl, a 40% owner, is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts