Question: Locute IRC Subtutle A Chapter 1 Subchapter A Part I a . For ummamed individuals, what is the tax rate if taxable income is not

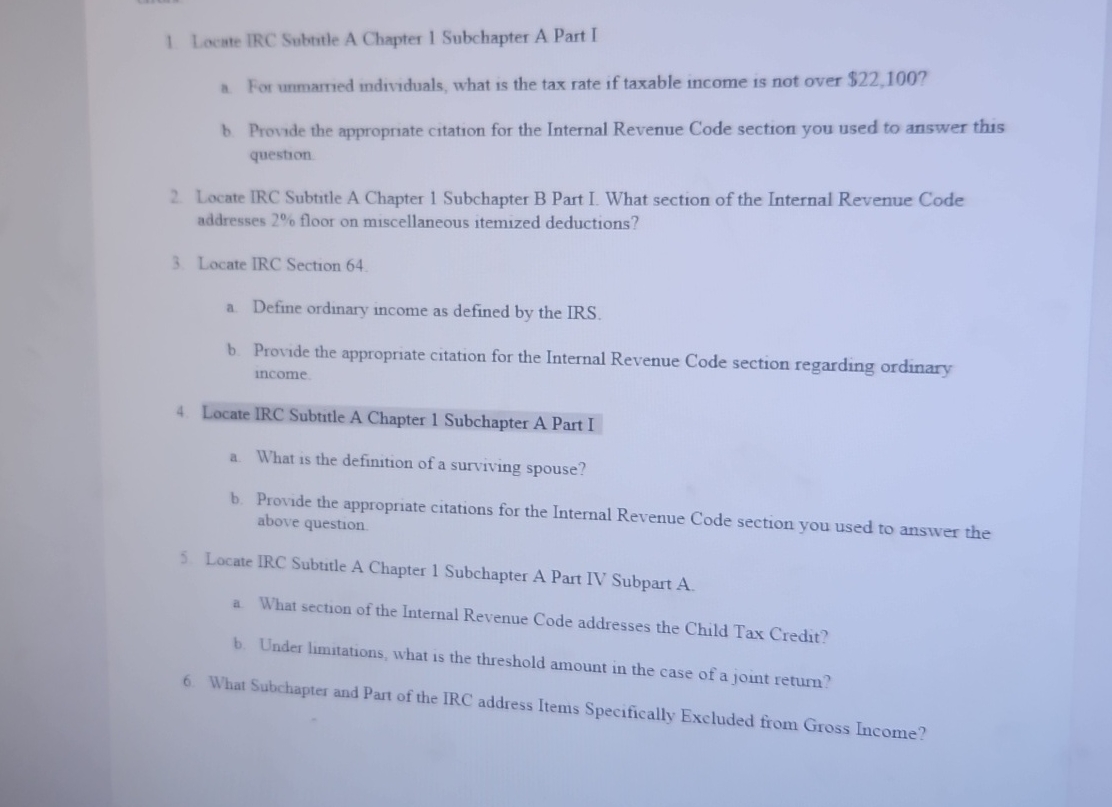

Locute IRC Subtutle A Chapter Subchapter A Part I

a For ummamed individuals, what is the tax rate if taxable income is not over $

b Provide the appropriate citation for the Internal Revenue Code section you used to answer this question.

Locate IRC Subtitle A Chapter Subchapter B Part I. What section of the Internal Revenue Code addresses floor on miscellaneous itemized deductions?

Locate IRC Section

a Define ordinary income as defined by the IRS.

b Provide the appropriate citation for the Internal Revenue Code section regarding ordinary income.

Locate IRC Subtitle A Chapter Subchapter A Part I

a What is the definition of a surviving spouse?

b Provide the appropriate citations for the Internal Revenue Code section you used to answer the above question.

Locate IRC Subtitle A Chapter Subchapter A Part IV Subpart A

a What section of the Internal Revenue Code addresses the Child Tax Credit?

b Under limitations what is the threshold amount in the case of a joint return?

What Subchapter and Part of the IRC address Items Specifically Excluded from Gross Income?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock