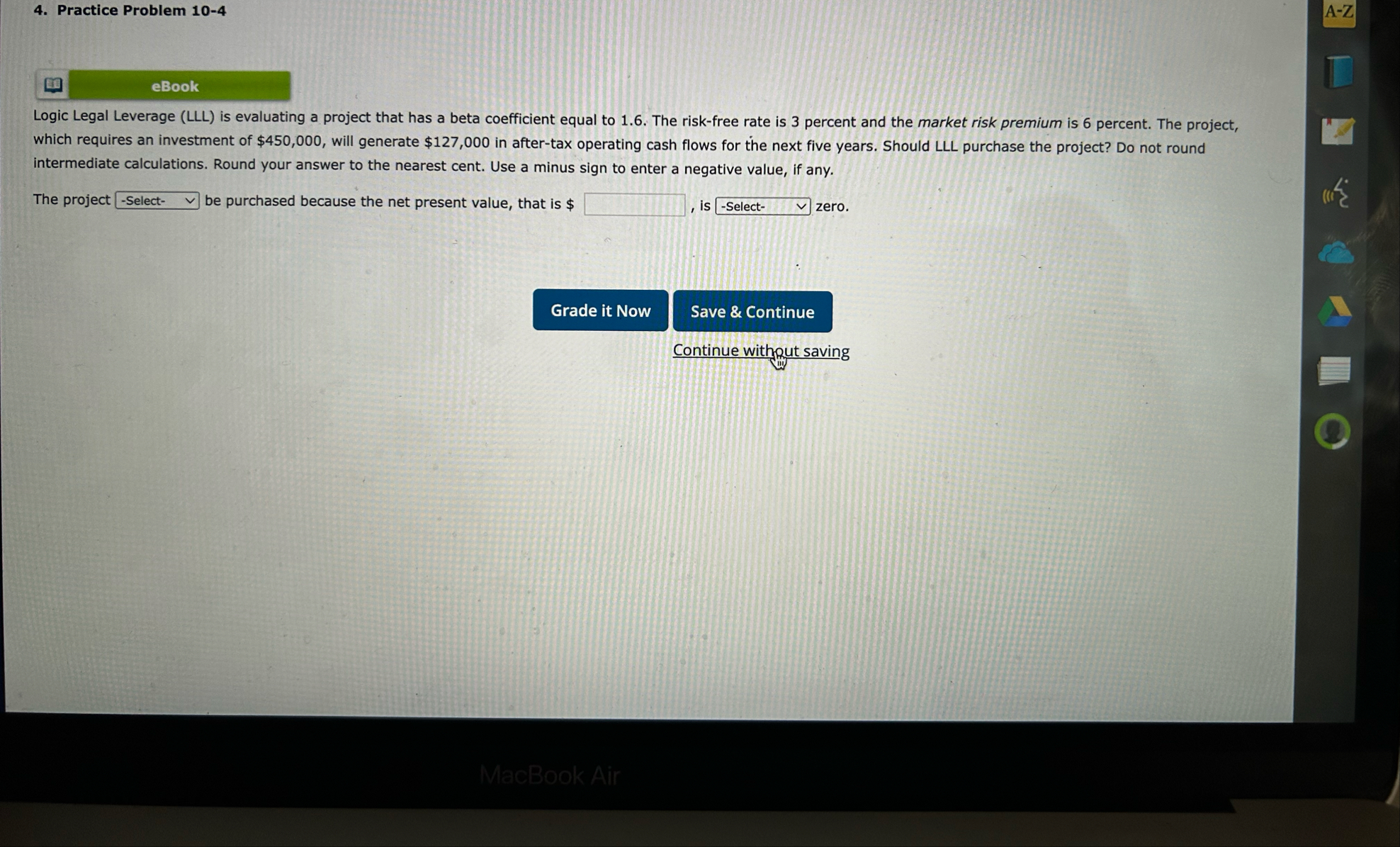

Question: Logic Legal Leverage ( LLL ) is evaluating a project that has a beta coefficient equal to 1 . 6 . The risk - free

Logic Legal Leverage LLL is evaluating a project that has a beta coefficient equal to The riskfree rate is percent and the market risk premium is percent. The project, which requires an investment of $ will generate $ in aftertax operating cash flows for the next five years. Should LLL purchase the project? Do not round intermediate calculations. Round your answer to the nearest cent. Use a minus sign to enter a negative value, if any.

The project be purchased because the net present value, that is $ is zero.

Continue withrut saving

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock