Question: LONG ANSWER QUESTION - 1 question, 50 marks (80 mlnutes). During the year ending December 31, 2020, Callista earned a gross salary of $64,000. Her

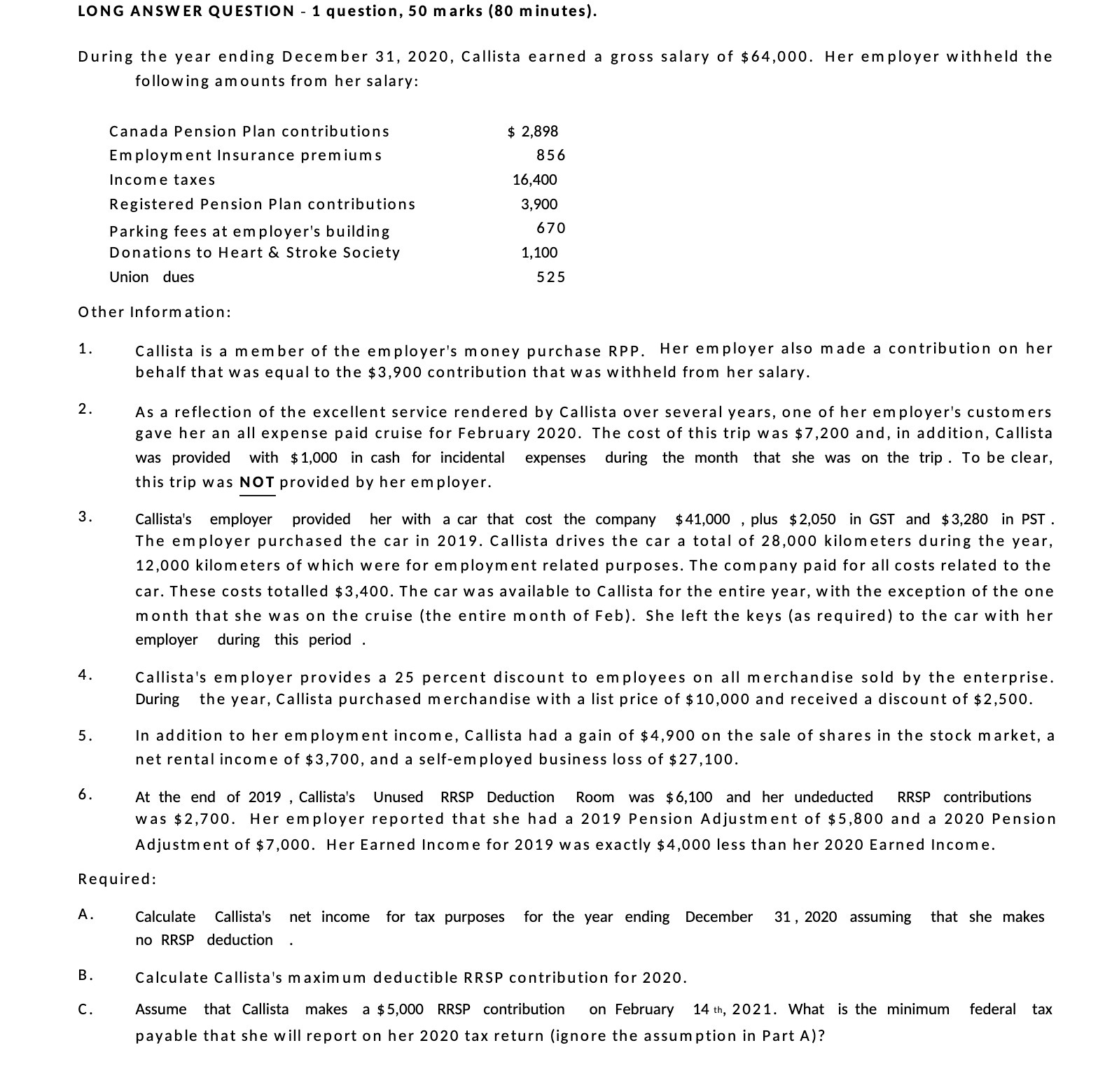

LONG ANSWER QUESTION - 1 question, 50 marks (80 mlnutes). During the year ending December 31, 2020, Callista earned a gross salary of $64,000. Her employer withheld the following amounts from her salary: Canada Pension Plan contributions $ 2,898 Employment Insurance premiums 856 Income taxes 16,400 Registered Pension Plan contributions 3,900 Parking fees at employer's building 670 Donations to Heart & Stroke Society 1,100 Union dues 525 Other Information: 1- Callista is a member of the em ployer's money purchase RPP. Her employer 8'50 made a COHtrTbUtiO on her behalf that was equal to the $3,900 contribution that was withheld from her salary. 2- As a reflection of the excellent service rendered by Callista over several years, one of her employer's customers gave her an all expense paid cruise for February 2020. The cost of this trip was $7,200 and, in addition, Callista was provided with $1,000 in cash for incidental expenses during the month that she was on the trip. To be clear, this trip was NOT provided by her em ployer. 3- Callista's employer provided her with a car that cost the company $41,000 ,plus $2,050 in GSI' and $3,280 in PST. The employer purchased the car in 2019. Callista drives the car a total of 28,000 kilometers during the year, 12,000 kilometers of which were for employment related purposes. The company paid for all costs related to the car. These costs totalled $3,400. The car was available to Callista for the entire year, with the exception of the one month that she was on the cruise (the entire month of Feb). She left the keys (as required) to the car with her employer during this period . 4- Callista's employer provides a 25 percent discount to employees on all merchandise sold by the enterprise. During the year, Callista purchased merchandise with a list price of $10,000 and received a discount of $2,500. 5. In addition to her employment income, Callista had a gain of $4,900 on the sale of shares in the stock market, a net rental income of $3,700, and a self-employed business loss of $27,100. 6- At the end of 2019 ,Callista's Unused RRSP Deduction Room was $6,100 and her undeducted RRSP contributions was $2,700. Her employer reported that she had a 2019 Pension Adjustment of $5,800 and a 2020 Pension Adjustment of $7,000. Her Earned Income for 2019 was exactly $4,000 less than her 2020 Earned Income. Required: A- Calculate Callista's net income for tax purposes for the year ending December 31,2020 assuming that she makes no RRSP deduction 3- Calculate Callista's maximum deductible RRSP contribution for 2020. C. Assume that Callista makes a $5,000 RRSP contribution on February 14 th, 2021. What is the minimum federal tax payable that she will report on her 2020 tax return (ignore the assumption in Part A)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts