Question: Long Corp. has a convertible bond issue outstanding. Each bond, with a face value of $1,000, can be converted into common shar a rate of

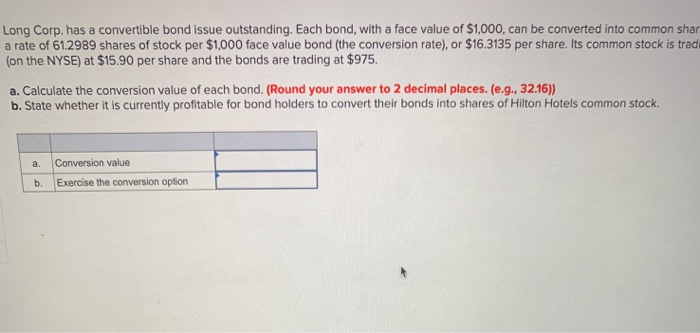

Long Corp. has a convertible bond issue outstanding. Each bond, with a face value of $1,000, can be converted into common shar a rate of 61.2989 shares of stock per $1,000 face value bond (the conversion rate), or $16.3135 per share. Its common stock is trad (on the NYSE) at $15.90 per share and the bonds are trading at $975. a. Calculate the conversion value of each bond. (Round your answer to 2 decimal places. (e.g., 32.16)) b. State whether it is currently profitable for bond holders to convert their bonds into shares of Hilton Hotels common stock. a. Conversion value Exercise the conversion option b

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock