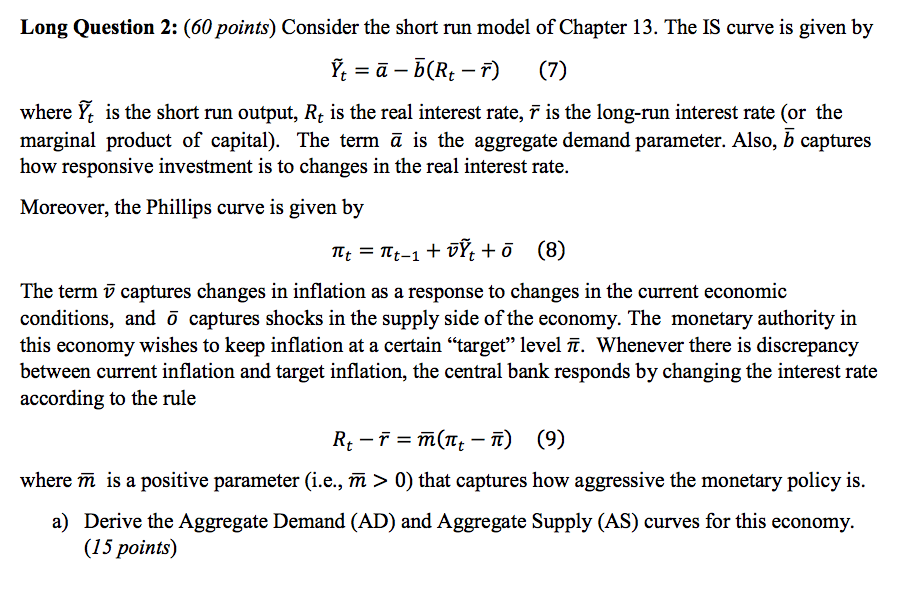

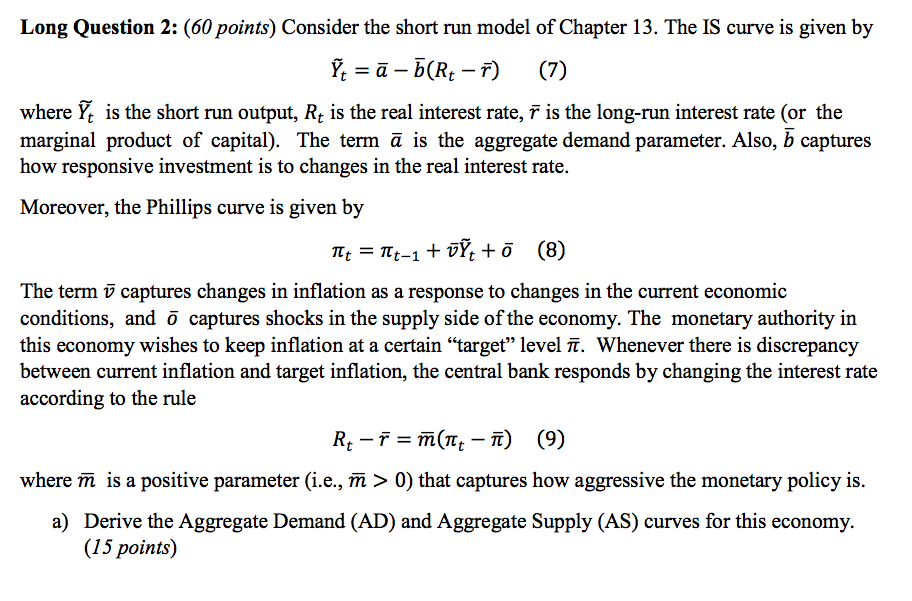

Question: Long Question 2: (60 points) Consider the short run model of Chapter 13. The IS crrrve is given by ?t = E EOE: 1F) (7)

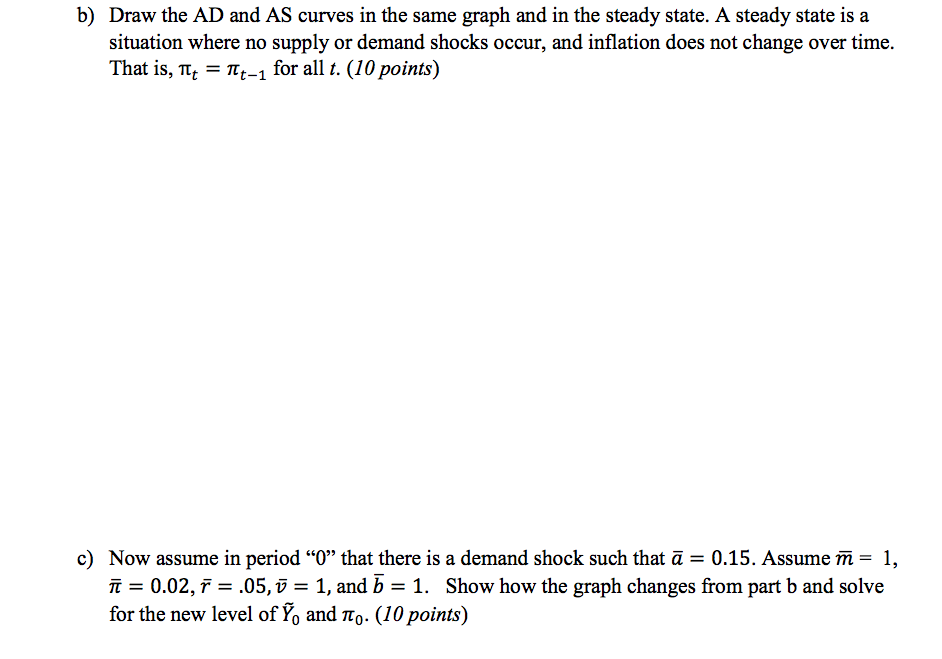

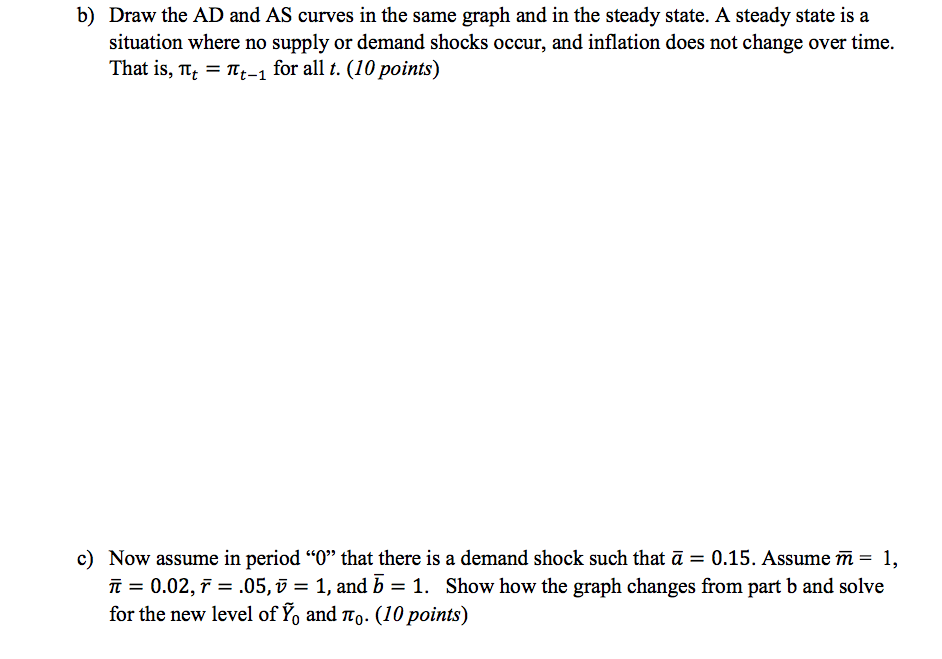

Long Question 2: (60 points) Consider the short run model of Chapter 13. The IS crrrve is given by ?t = E EOE: 1F) (7) where 17: is the short run output, Rt is the real interest rate, F is the long-run interest rate (or the marginal product of capital). The term a is the aggregate demand parameter. Also, 5 captures how responsive investment is to changes in the real interest rate. Moreover, the Phillips curve is given by ''t = \"Ft1 + 171:: + 0 (B) The term 13 captures changes in ination as a response to changes in the current economic conditions, and 5 captures shocks in the supply side of the economy. The monetary authority in this economy wishes to keep ination at a certain \"target\" level 7?. Whenever there is discrepancy between current ination and target ination, the central bank responds by changing the interest rate according to the rule where 171 is a positive parameter (i.e., 1?: > D) that captures how aggressive the monetary policy is. a) Derive the Aggregate Demand (AD) and Aggregate Supply (AS) curves for this economy. (15 points) b) Draw the AD and AS curves in the same graph and in the steady state. A steady state is a situation where no supply or demand shocks occur, and ination does not change over time. That is, 1!: = 't_1 for all I. (10 points) :3) Now assume in period \"0\" that there is a demand shock such that a = 0.15. Assume 1?: = 1, ' = 0.02, 1" = 115,13 = 1, and E = 1. Show how the graph changes from part b and solve for the new level of a and n0. (Ipoints')

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts