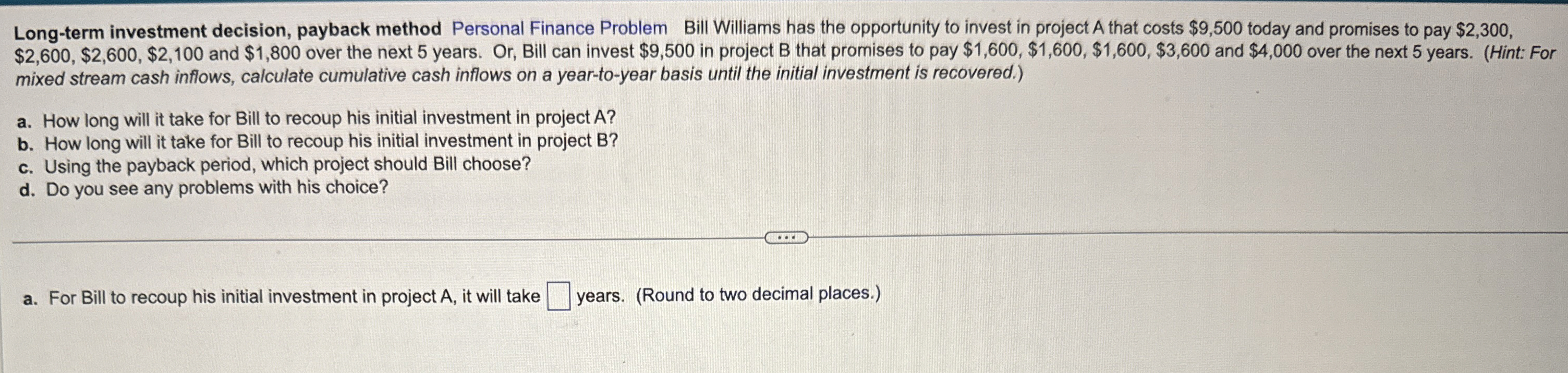

Question: Long - term investment decision, payback method Personal Finance Problem Bill Williams has the opportunity to invest in project A that costs $ 9 ,

Longterm investment decision, payback method Personal Finance Problem Bill Williams has the opportunity to invest in project A that costs $ today and promises to pay $

$$$ and $ over the next years. Or Bill can invest $ in project that promises to pay $$$$ and $ over the next years. Hint: For

mixed stream cash inflows, calculate cumulative cash inflows on a yeartoyear basis until the initial investment is recovered.

a How long will it take for Bill to recoup his initial investment in project

b How long will it take for Bill to recoup his initial investment in project

c Using the payback period, which project should Bill choose?

d Do you see any problems with his choice?

a For Bill to recoup his initial investment in projectA, it will take

years. Round to two decimal places.

Longterm investment decision, payback method Personal Finance Problem Bill Williams has the opportunity to invest in project A that costs $ today and promises to pay $

$$$ and $ over the next years. Or Bill can invest $ in project that promises to pay $$$$ and $ over the next years. Hint: For

mixed stream cash inflows, calculate cumulative cash inflows on a yeartoyear basis until the initial investment is recovered.

a How long will it take for Bill to recoup his initial investment in project

b How long will it take for Bill to recoup his initial investment in project

c Using the payback period, which project should Bill choose?

d Do you see any problems with his choice?

a For Bill to recoup his initial investment in projectA, it will take

years. Round to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock