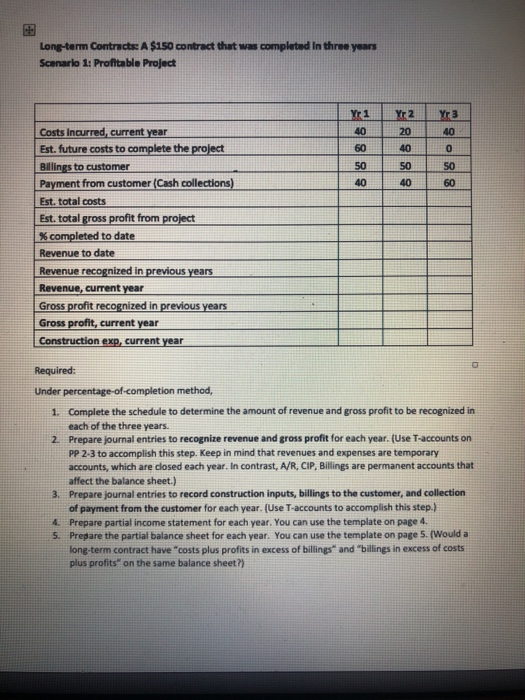

Question: Long-term Contracts: A $150 contract that was completed In three years Scenario 1: Profitable Project Costs incurred, current year Est. future costs to complete the

Long-term Contracts: A $150 contract that was completed In three years Scenario 1: Profitable Project Costs incurred, current year Est. future costs to complete the project Billings to customer Payment from customer (Cash collections) Est. total costs Est. total gross profit from project % completed to date Revenue to date Revenue recognized in previous years Revenue, current year Gross profit recognized in previous years Gross profit, current year Construction exp, current year 40 60 50 40 20 40 5050 40 40 0 60 Required: Under percentage-of-completion method, Complete the schedule to determine the amount of revenue and gross profit to be recognized in each of the three years Prepare journal entries to recognize revenue and gross profit for each year. (Use T-accounts on PP 2-3 to accomplish this step. Keep in mind that revenues and expenses are temporary accounts, which are closed each year. In contrast, A/R, CIP, Billings are permanent accounts that affect the balance sheet.) Prepare journal entries to record construction inputs, billings to the customer, and collection of payment from the customer for each year. (Use T-accounts to accomplish this step.) Prepare partial income statement for each year. You can use the template on page 4. Prepare the partial balance sheet for each year. You can use the template on page 5(Would a long-term contract have"costs plus profits in excess of billings* and "billings in excess of costs plus profits" on the same balance sheet?) 1. 2. 3. 4. . 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts