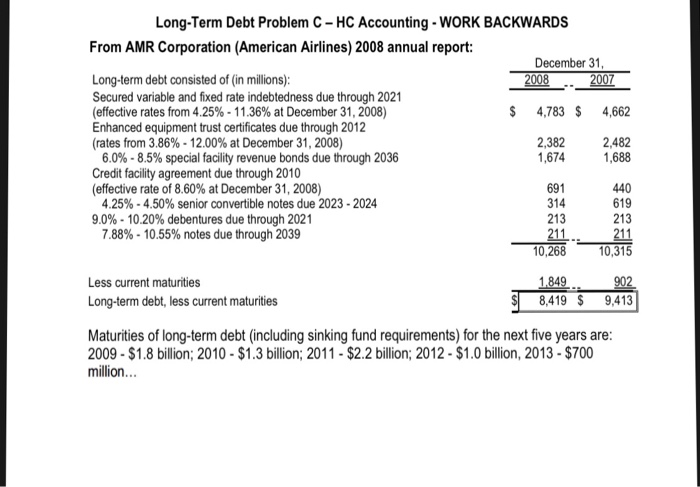

Question: Long-Term Debt Problem C HC Accounting- WORK BACKWARDS From AMR Corporation (American Airlines) 2008 annual report: December 31 Long-term debt consisted of (in millions) Secured

Long-Term Debt Problem C HC Accounting- WORK BACKWARDS From AMR Corporation (American Airlines) 2008 annual report: December 31 Long-term debt consisted of (in millions) Secured variable and fixed rate indebtedness due through 2021 (effective rates from 4.25%-1 1.36% at December 31, 2008) Enhanced equipment trust certificates due through 2012 (rates from 3.86%-12.00% at December 31, 2008) .. 2007 $ 4,783 $ 4,662 2,382 1,674 2,482 1,688 6.0%-8.5% special facility revenue bonds due through 2036 Credit facility agreement due through 2010 (effective rate of 8.60% at December 31, 2008) 691 314 213 211 440 4.25%-4.50% senior convertible notes due 2023-2024 213 211 10,268 0,315 9.0%-10.20% debentures due through 2021 7.88%-10.55% notes due through 2039 Less current maturities Long-term debt, less current maturities 8,419 $ 9,413 Maturities of long-term debt (including sinking fund requirements) for the next five years are 2009-$1.8 billion; 2010-$1.3 billion; 2011-$2.2 billion; 2012-$1.0 billion, 2013-$700 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts