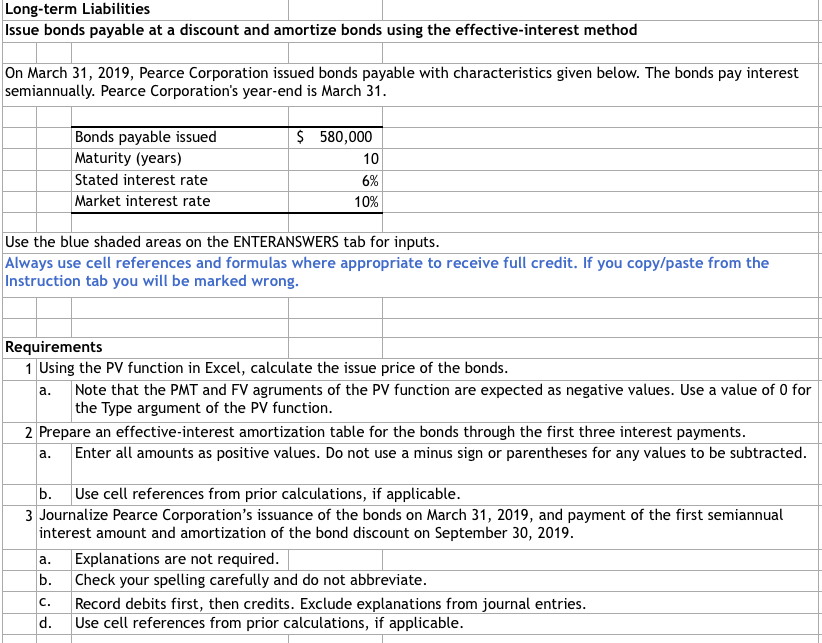

Question: Long-term Liabilities Issue bonds payable at a discount and amortize bonds using the effective-interest method On March 31, 2019, Pearce Corporation issued bonds payable with

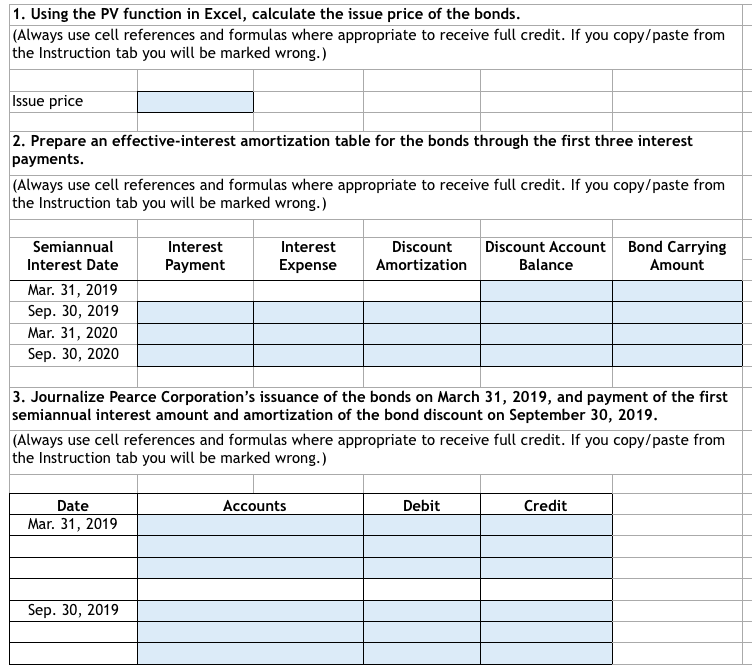

Long-term Liabilities Issue bonds payable at a discount and amortize bonds using the effective-interest method On March 31, 2019, Pearce Corporation issued bonds payable with characteristics given below. The bonds pay interest semiannually. Pearce Corporation's year-end is March 31. $ Bonds payable issued Maturity (years) Stated interest rate Market interest rate 580,000 10 6% 10% Use the blue shaded areas on the ENTERANSWERS tab for inputs Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instruction tab you wil be marked wrong Requirements 1 Using the PV function in Excel, calculate the issue price of the bonds Note that the PMT and FV agruments of the PV function are expected as negative values. Use a value of 0 for the Type argument of the PV function a. 2 Prepare an effective-interest amortization table for the bonds through the first three interest payments a. Enter all amounts as positive values. Do not use a minus sign or parentheses for any values to be subtracted b. 3 Journalize Pearce Corporation's issuance of the bonds on March 31, 2019, and payment of the first semiannual Use cell references from prior calculations, if applicable interest amount and amortization of the bond discount on September 30, 2019 a. Explanations are not required b. Check your spelling carefully and do not abbreviate C.Record debits first, then credits. Exclude explanations from journal entries d. Use cell references from prior calculations, if applicable 1. Using the PV function in Excel, calculate the issue price of the bonds (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instruction tab you will be marked wrong.) Issue price 2. Prepare an effective-interest amortization table for the bonds through the first three interest payments. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instruction tab you will be marked wrong.) Semiannual Interest Date Mar. 31, 2019 Sep. 30, 2019 Mar. 31, 2020 Sep. 30, 2020 Interest Payment Interest Expense Discount Discount Account Bond Carrying Amortization Balance Amount 3. Journalize Pearce Corporation's issuance of the bonds on March 31, 2019, and payment of the first semiannual interest amount and amortization of the bond discount on September 30, 2019 (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instruction tab you will be marked wrong.) Debit Date Mar. 31, 2019 Accounts Credit Sep. 30, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts