Question: Long-term notes payable amortization schedule Patrick's Delivery Services is buying a van to help with deliveries. The cost of the vehicle is S3S000 the interest

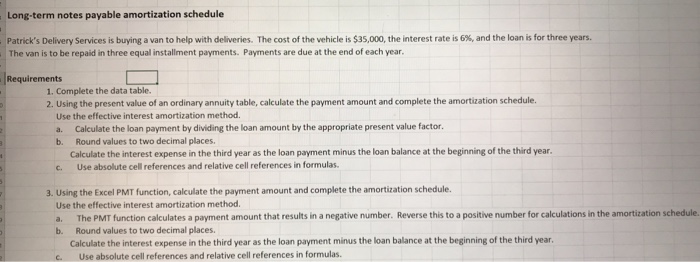

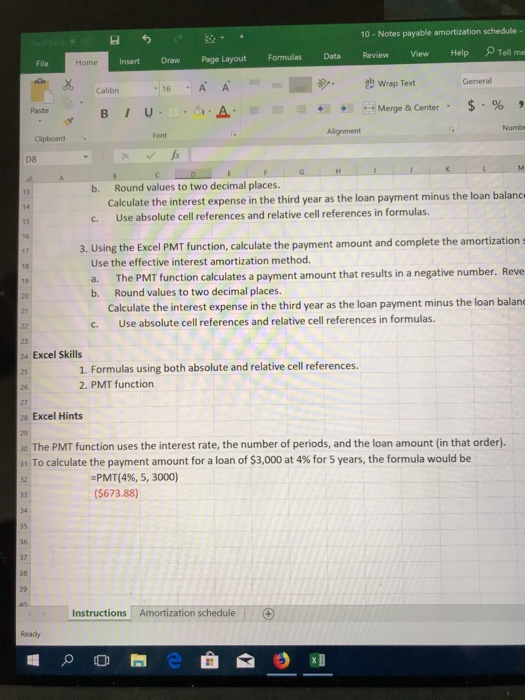

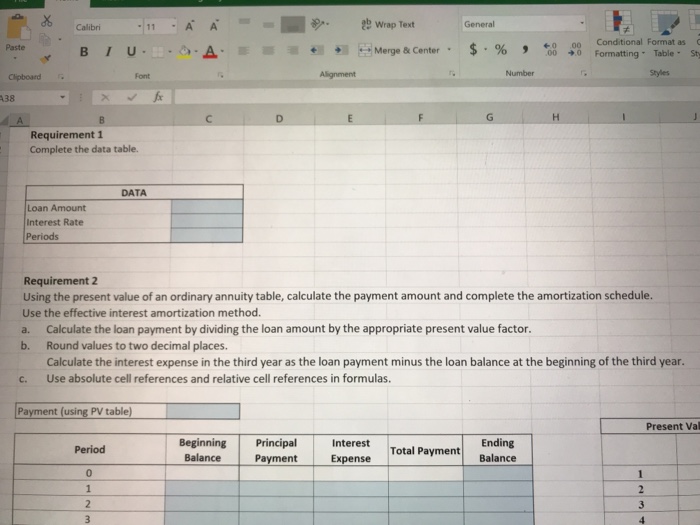

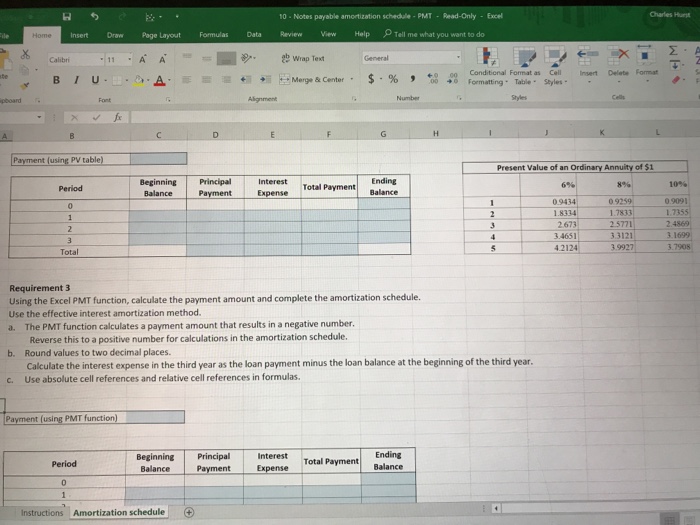

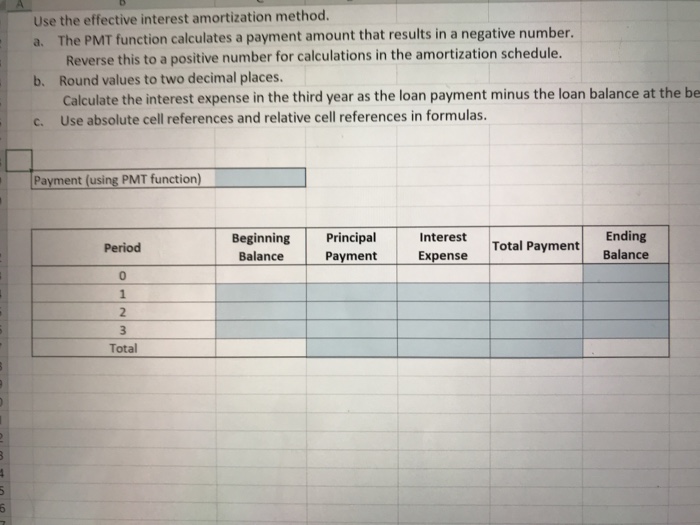

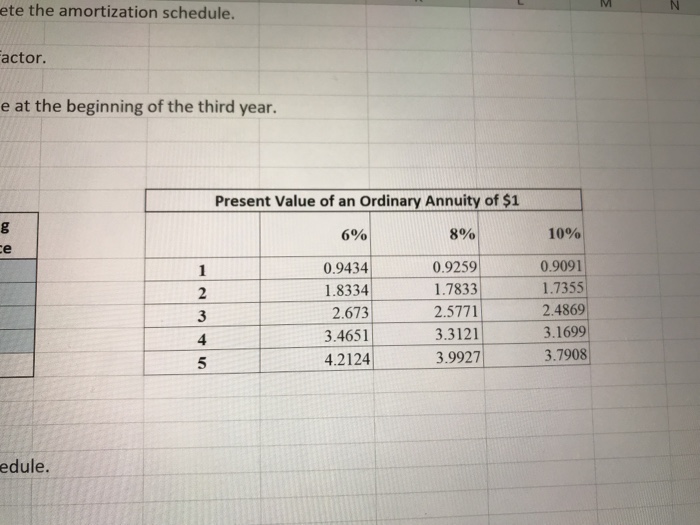

Long-term notes payable amortization schedule Patrick's Delivery Services is buying a van to help with deliveries. The cost of the vehicle is S3S000 the interest rate is 6% and the loan is for three years. The van is to be repaid in three equal installment payments. Payments are due at the end of each year Requirements 1. Complete the data table. 2. Using the present value of an ordinary annuity table, calculate the payment amount and complete the amortization schedule Use the effective interest amortization method. a. Calculate the loan payment by dividing the loan amount by the appropriate present value factor b. Round values to two decimal places. Calculate the interest expense in the third year as the loan payment minus the loan balance at the beginning of the third year c. Use absolute cell references and relative cell references in formulas. 3. Using the Excel PMT function, calculate the payment amount and complete the amortization schedule. Use the effective interest amortization method. a. The PMT function calculates a payment amount that results in a negative number. Reverse this to a positive number for calculations in the amortization schedule. b. Round values to two decimal places Calculate the interest expense in the third year as the loan payment minus the loan balance at the beginning of the third year c. Use absolute cell references and relative cell references in formulas

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts