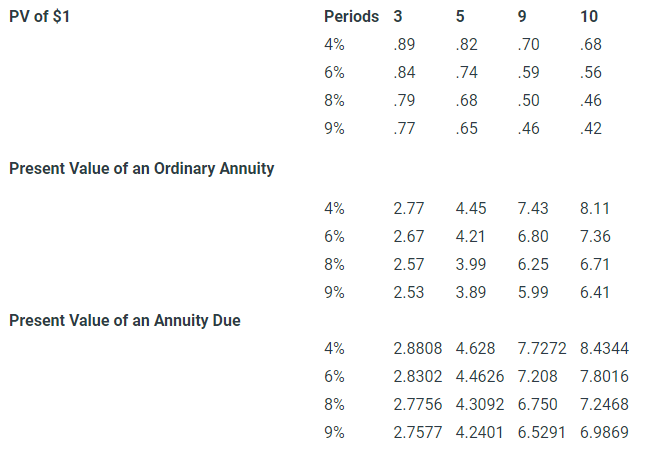

Question: Long-Term Notes Receivable and TVM. Use the following present value tables to help answer the following questions. * Do not round any answer until your

Long-Term Notes Receivable and TVM. Use the following present value tables to help answer the following questions.

*Do not round any answer until your final answer. Round your final answer to the nearest whole dollar. When entering your final answer, do not use commas or $ sign. (Sorry...Blackboard is very sensitive and will mark your answer incorrect due to rounding and punctuation.)

Part I. On April 1, 2020, ABC Company rendered services to Jones Company in exchange for a three year, $400,000, 8% note. Payments of P&I (Principal & Interest) are due each April 1st, with the first payment due immediately. December 31st is the fiscal year end for ABC. Jones' normal cost to borrow is 8%.

Required: Use the above information to answer the next (4) questions:

| 1. Determine the dollar amount of the cash payment of P&I to be remitted each April 1st: | $[Question_1] |

| 2. Determine the Service Revenue ABC can recognize on April 1, 2020. | $__________________________________________ |

| 3. Determine the Total Interest Revenue that ABC will recognize on this note for the year ended December 31, 2021. | $_____________________________________ |

| 4. Prepare a partial Balance Sheet for this Note Receivable as of December 31, 2020: | Current Assets: Interest Receivable $_____________________ Note Receivable $_____________________ Long-Term Investments: Note Receivable $_____________________ |

PV of $1 5 5 9 10 .82 .68 Periods 3 4% .89 6% .84 8% .79 9% .77 .74 .70 .59 .50 .56 .46 .68 .65 .46 .42 Present Value of an Ordinary Annuity 4% 4.45 7.43 8.11 2.77 2.67 6% 4.21 6.80 7.36 8% 2.57 3.99 6.25 6.71 9% 2.53 3.89 5.99 6.41 Present Value of an Annuity Due 4% 6% 2.8808 4.628 7.7272 8.4344 2.8302 4.4626 7.208 7.8016 2.7756 4.3092 6.750 7.2468 2.7577 4.2401 6.5291 6.9869 8% 9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts