Question: Look at Schedule 2 : What is the additional tax for? Tanner expects his gross profit to be about the same in 2 0 2

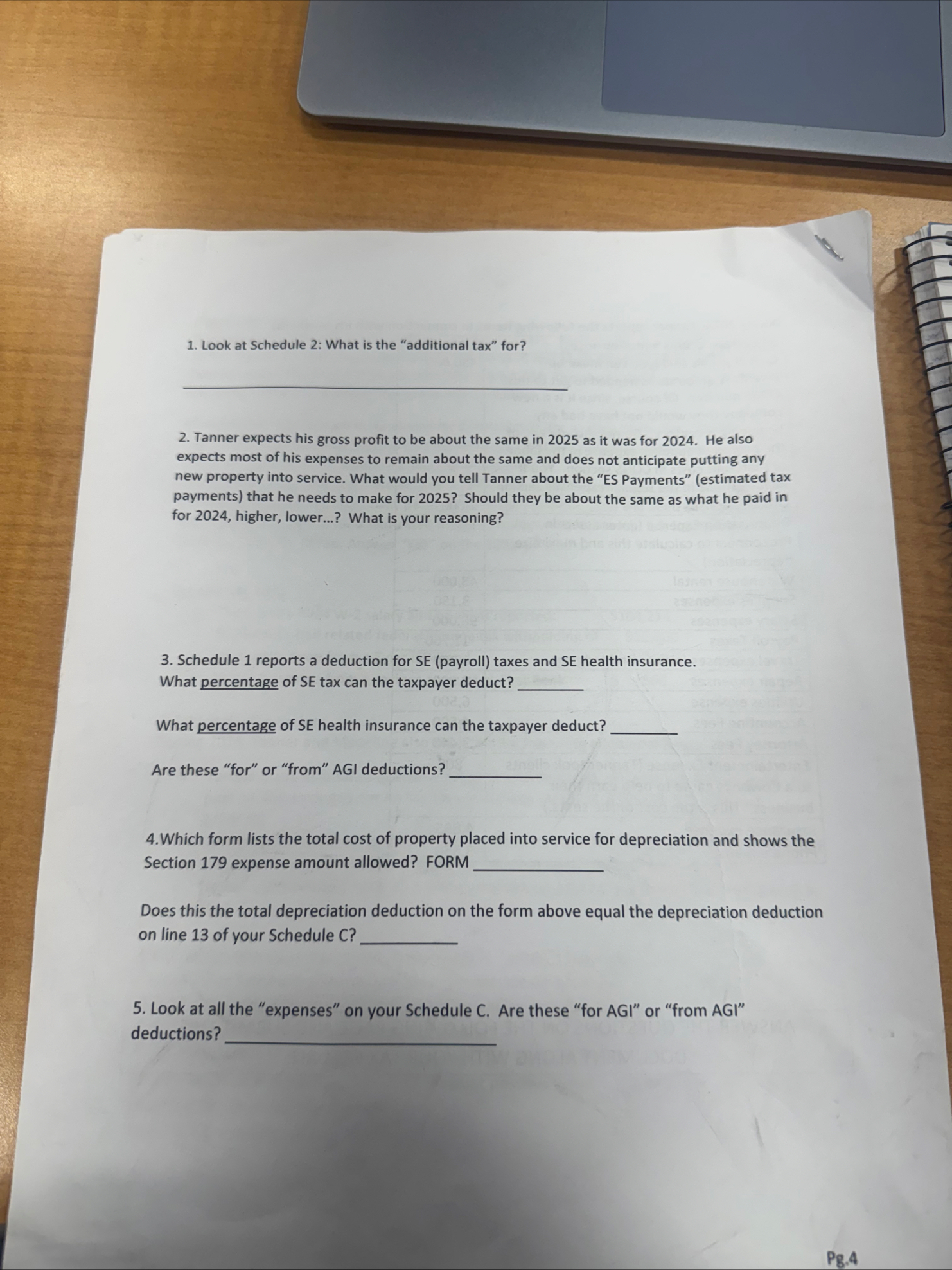

Look at Schedule : What is the "additional tax" for?

Tanner expects his gross profit to be about the same in as it was for He also expects most of his expenses to remain about the same and does not anticipate putting any new property into service. What would you tell Tanner about the ES Payments" estimated tax payments that he needs to make for Should they be about the same as what he paid in for higher, lower...? What is your reasoning?

Schedule reports a deduction for SE payroll taxes and SE health insurance. What percentage of SE tax can the taxpayer deduct?

What percentage of SE health insurance can the taxpayer deduct?

Are these "for" or "from" AGI deductions?

Which form lists the total cost of property placed into service for depreciation and shows the Section expense amount allowed? FORM

Does this the total depreciation deduction on the form above equal the depreciation deduction on line of your Schedule C

Look at all the "expenses" on your Schedule C Are these "for AGI" or "from AGI" deductions:

Pg

During Tanner reports the following items in connection with his business:

tableSales less returns and allowancesCost of goods sold you can make up inventory amounts as needed to get to this COGS number. Of course, since it is a new company they would not have had any beginning inventory Do not include any of the payroll or supplies expense in the labor or materials costs in COGS section. You'll include those in the regular expenses section.,Office Expenses,Depreciation Expense enter assets in Proconnect to calculate this and maximize depreciationWarehouse rental,Supplies expenses,Salary expenses,Payroll Taxes,Travel expenses airfare and lodgingRepair expenses,Utilities expense,Accounting Fees,Attorney Fees,Entertainment Expense Tanner took clients to a Cowboys game to help earn their business. This is the cost of the seats.Insurance expense,Phone expense,

ANSWER THE QUESTIONS ON THE FOLLOWING PAGE AND SUBMIT THIS DOCUMENT ALONG WITH YOUR TAX RETURN:

Pg

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock