Question: look at the example then solve the problem. The answer's format should be as same as the example problem. The problem can be done on

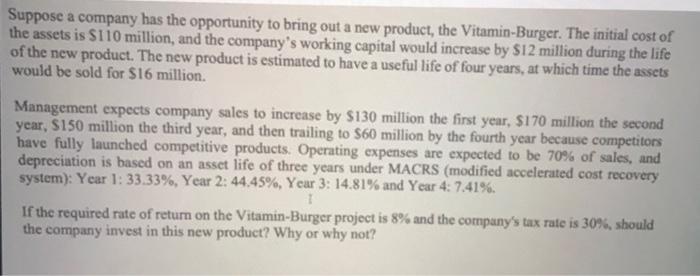

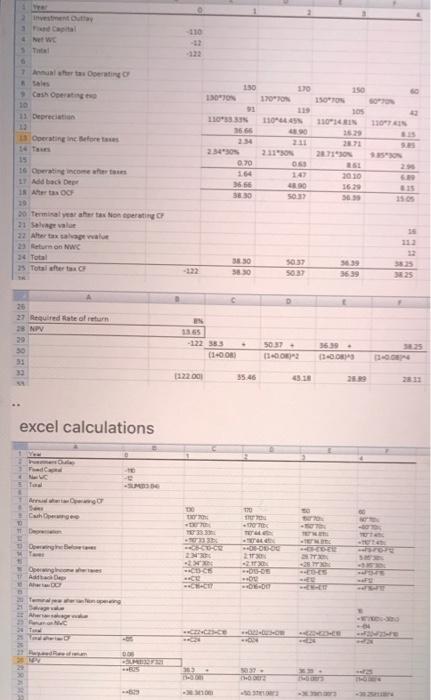

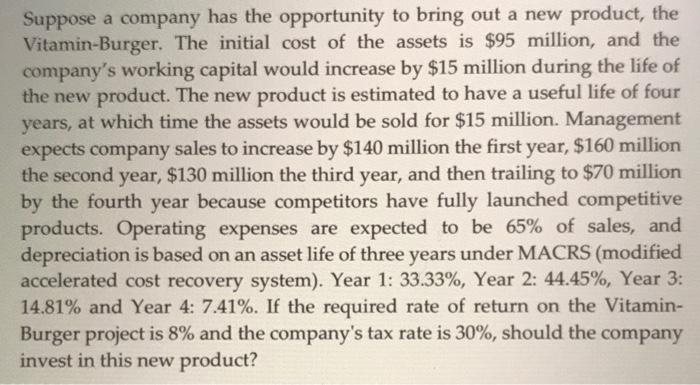

Suppose a company has the opportunity to bring out a new product, the Vitamin-Burger. The initial cost of the assets is $110 million, and the company's working capital would increase by $12 million during the life of the new product. The new product is estimated to have a useful life of four years, at which time the assets would be sold for $16 million. Management expects company sales to increase by $130 million the first year, S170 million the second year, S150 million the third year, and then trailing to S60 million by the fourth year because competitors have fully launched competitive products. Operating expenses are expected to be 70% of sales, and depreciation is based on an asset life of three years under MACRS (modified accelerated cost recovery system): Year 1: 33.33%, Year 2: 44.45%, Year 3: 14.81% and Year 4: 7.41%. 1 If the required rate of return on the Vitamin-Burger project is 8% and the company's tax rate is 30%, should the company invest in this new product? Why or why not? w 110 -12 Th 7 het ergo 150 10 Cash Orange 1300 17070 150 ISOTON 105 110 14 RIN 11 Deprecat 105N 3565 11044 110T EIN Operating increas 2071 2071 211 2.11 SON 05 147 255 16 Certing income Addbach Dee IN AOC 090 164 36 3830 2010 1629 20 Terminal year tax on CF 21 Sale 22 Artxapewe 23 Return on NC 34 Total 25 Total arts 350 3830 50:37 5037 36 39 3825 C D 27 Required to return 28 NPV -122 383 (1400 30 33 SOST- 1102 SE25 13.00 1222001 35.46 4310 29 2833 excel calculations ed TU TE - TEL w De TEN 13 1723 ce TUT TT Down -00-00-00 20 ZITO HE - Downgram CROCE 2 -- CORO women DE BUS 303 The Suppose a company has the opportunity to bring out a new product, the Vitamin-Burger. The initial cost of the assets is $95 million, and the company's working capital would increase by $15 million during the life of the new product. The new product is estimated to have a useful life of four years, at which time the assets would be sold for $15 million. Management expects company sales to increase by $140 million the first year, $160 million the second year, $130 million the third year, and then trailing to $70 million by the fourth year because competitors have fully launched competitive products. Operating expenses are expected to be 65% of sales, and depreciation is based on an asset life of three years under MACRS (modified accelerated cost recovery system). Year 1: 33.33%, Year 2: 44.45%, Year 3: 14.81% and Year 4: 7.41%. If the required rate of return on the Vitamin- Burger project is 8% and the company's tax rate is 30%, should the company invest in this new product

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts