Question: Looking for 3,4, and 5 only Suite 1 What is the total Annual Base Rent of the Property? $210,000 Tenant Sub Shop World's Best Coffee

Looking for 3,4, and 5 only

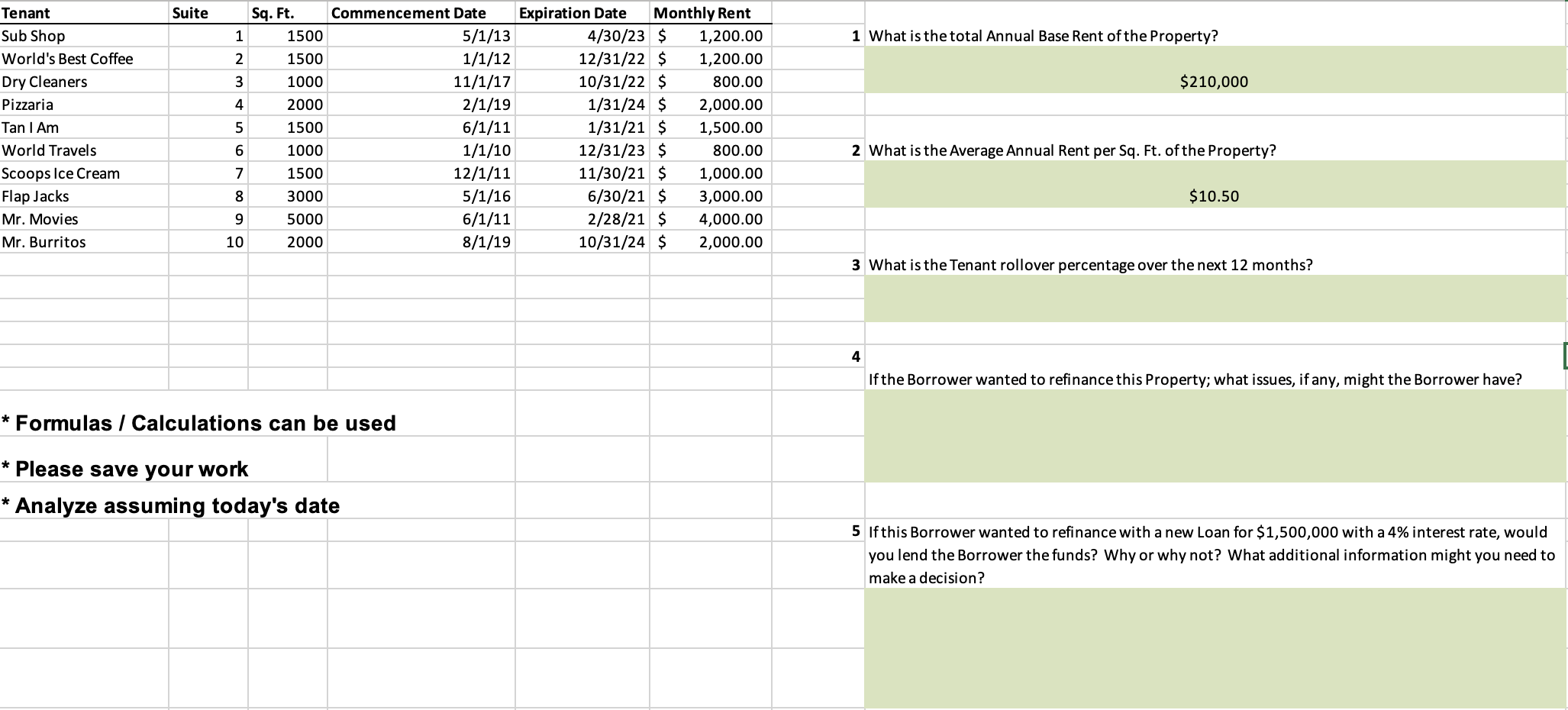

Suite 1 What is the total Annual Base Rent of the Property? $210,000 Tenant Sub Shop World's Best Coffee Dry Cleaners Pizzaria Tan I Am World Travels Scoops Ice Cream Flap Jacks Mr. Movies Mr. Burritos Sq. Ft. Commencement Date 1 1500 5/1/13 2 1500 1/1/12 3 1000 11/1/17 4 2000 2/1/19 5 1500 6/1/11 6 1000 1/1/10 7 1500 12/1/11 8 3000 5/1/16 9 5000 6/1/11 10 2000 8/1/19 Expiration Date Monthly Rent 4/30/23 $ 1,200.00 12/31/22 $ 1,200.00 10/31/22 $ 800.00 1/31/24 $ 2,000.00 1/31/21 $ 1,500.00 12/31/23 $ 800.00 11/30/21 $ 1,000.00 6/30/21 $ 3,000.00 2/28/21 $ 4,000.00 10/31/24 $ 2,000.00 2 What is the Average Annual Rent per Sq. Ft. of the Property? $10.50 3 What is the Tenant rollover percentage over the next 12 months? 4 If the Borrower wanted to refinance this Property; what issues, if any, might the Borrower have? * Formulas / Calculations can be used * Please save your work Analyze assuming today's date * 5 If this Borrower wanted to refinance with a new Loan for $1,500,000 with a 4% interest rate, would you lend the Borrower the funds? Why or why not? What additional information might you need to make a decision? Suite 1 What is the total Annual Base Rent of the Property? $210,000 Tenant Sub Shop World's Best Coffee Dry Cleaners Pizzaria Tan I Am World Travels Scoops Ice Cream Flap Jacks Mr. Movies Mr. Burritos Sq. Ft. Commencement Date 1 1500 5/1/13 2 1500 1/1/12 3 1000 11/1/17 4 2000 2/1/19 5 1500 6/1/11 6 1000 1/1/10 7 1500 12/1/11 8 3000 5/1/16 9 5000 6/1/11 10 2000 8/1/19 Expiration Date Monthly Rent 4/30/23 $ 1,200.00 12/31/22 $ 1,200.00 10/31/22 $ 800.00 1/31/24 $ 2,000.00 1/31/21 $ 1,500.00 12/31/23 $ 800.00 11/30/21 $ 1,000.00 6/30/21 $ 3,000.00 2/28/21 $ 4,000.00 10/31/24 $ 2,000.00 2 What is the Average Annual Rent per Sq. Ft. of the Property? $10.50 3 What is the Tenant rollover percentage over the next 12 months? 4 If the Borrower wanted to refinance this Property; what issues, if any, might the Borrower have? * Formulas / Calculations can be used * Please save your work Analyze assuming today's date * 5 If this Borrower wanted to refinance with a new Loan for $1,500,000 with a 4% interest rate, would you lend the Borrower the funds? Why or why not? What additional information might you need to make a decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts