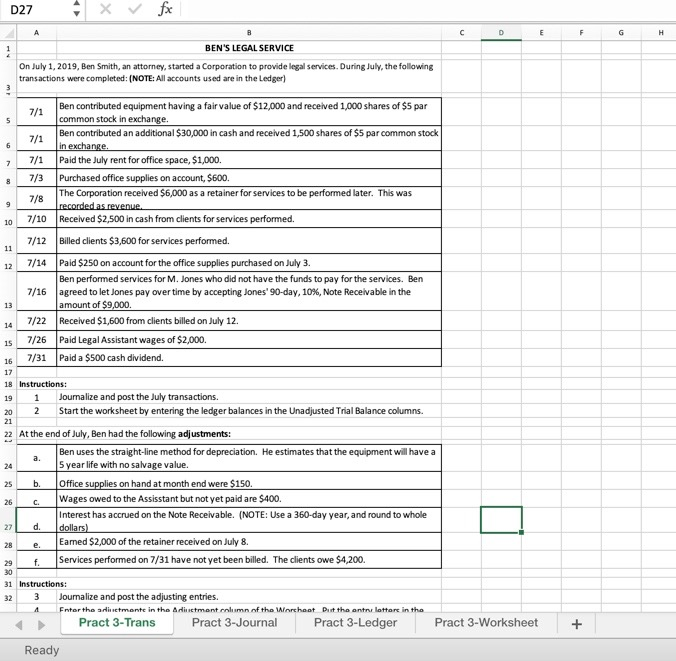

Question: Looking for adjusting entries. D27 x C D E F H 1 BEN'S LEGAL SERVICE On July 1, 2019, Ben Smith, an attorney, started a

Looking for adjusting entries.

D27 x C D E F H 1 BEN'S LEGAL SERVICE On July 1, 2019, Ben Smith, an attorney, started a Corporation to provide legal services. During July, the following transactions were completed: (NOTE: All accounts used are in the Ledger) 3 5 6 7 8 9 10 11 12 13 14 15 7/1 Ben contributed equipment having a fair value of $12,000 and received 1,000 shares of $5 par common stock in exchange. Ben contributed an additional $30,000 in cash and received 1,500 shares of $5 par common stock 7/1 in exchange. 7/1 Paid the July rent for office space, $1,000. 7/3 Purchased office supplies on account, $600. 7/8 The Corporation received $6,000 as a retainer for services to be performed later. This was recorded as revenue. 7/10 Received $2,500 in cash from clients for services performed. 7/12 Billed clients $3,600 for services performed. 7/14 Paid $250 on account for the office supplies purchased on July 3. Ben performed services for M. Jones who did not have the funds to pay for the services. Ben 7/16 agreed to let Jones pay over time by accepting Jones' 90-day, 10%, Note Receivable in the amount of $9,000. 7/22 Received $1,600 from clients billed on July 12. 7/26 Paid Legal Assistant wages of $2,000. 16 7/31 Paid a $500 cash dividend. 17 18 Instructions: 19 1 Journalize and post the July transactions. 20 2 Start the worksheet by entering the ledger balances in the Unadjusted Trial Balance columns. 21 22 At the end of July, Ben had the following adjustments: Ben uses the straight-line method for depreciation. He estimates that the equipment will have a 5 year life with no salvage value. Office supplies on hand at month end were $150. Wages owed to the Assisstant but not yet paid are $400. Interest has accrued on the Note Receivable. (NOTE: Use a 360-day year, and round to whole dollars) Eamed $2,000 of the retainer received on July 8. 29 f. Services performed on 7/31 have not yet been billed. The clients owe $4,200. 30 31 Instructions: 32 3 Journalize and post the adjusting entries. A Enter the adictmonte in the Adictmont column of the Worshoot Dut the entry letters in the Pract 3-Trans Pract 3-Journal Pract 3-Ledger Pract 3-Worksheet a. 24 25 b. 26 C. 27 d. 28 e. + Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts