Question: looking for answer with the npv approach You have been hired as consultants for Yippee! Manufacturing Company. Yippee! is considering several projects and has provided

looking for answer with the npv approach

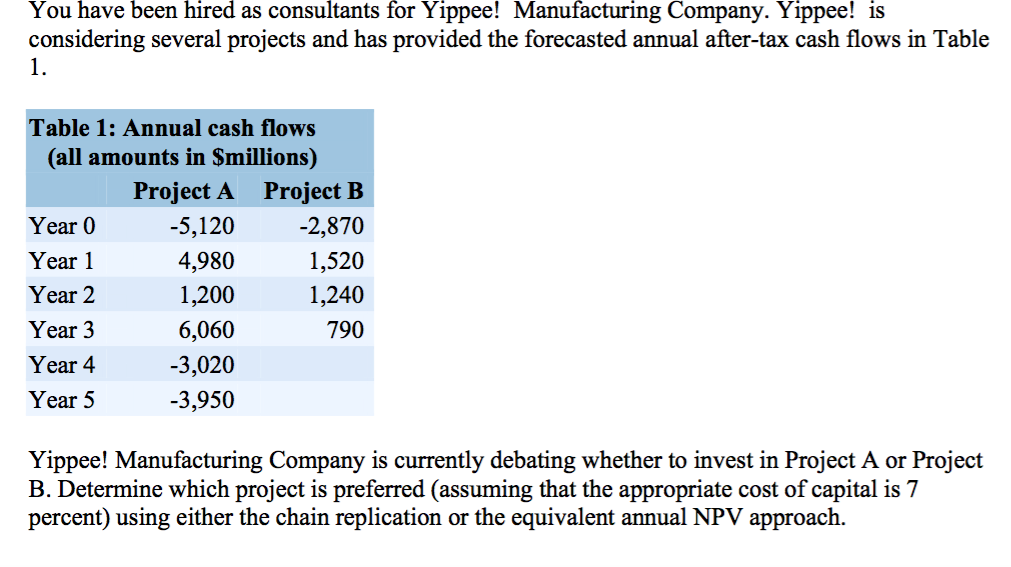

You have been hired as consultants for Yippee! Manufacturing Company. Yippee! is considering several projects and has provided the forecasted annual after-tax cash flows in Table Table 1: Annual cash flows (all amounts in Smillions) Project A 5,120 4,980 1,200 6,060 -3,020 -3,950 Project B -2,870 1,520 1,240 790 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Yippee! Manufacturing Company is currently debating whether to invest in Project A or Project B. Determine which project is preferred (assuming that the appropriate cost of capital is 7 percent) using either the chain replication or the equivalent annual NPV approach

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts