Question: Looking for correct and rounded as indicated answers from A-C. Please see drop down bars that I have linked for the options. The options are

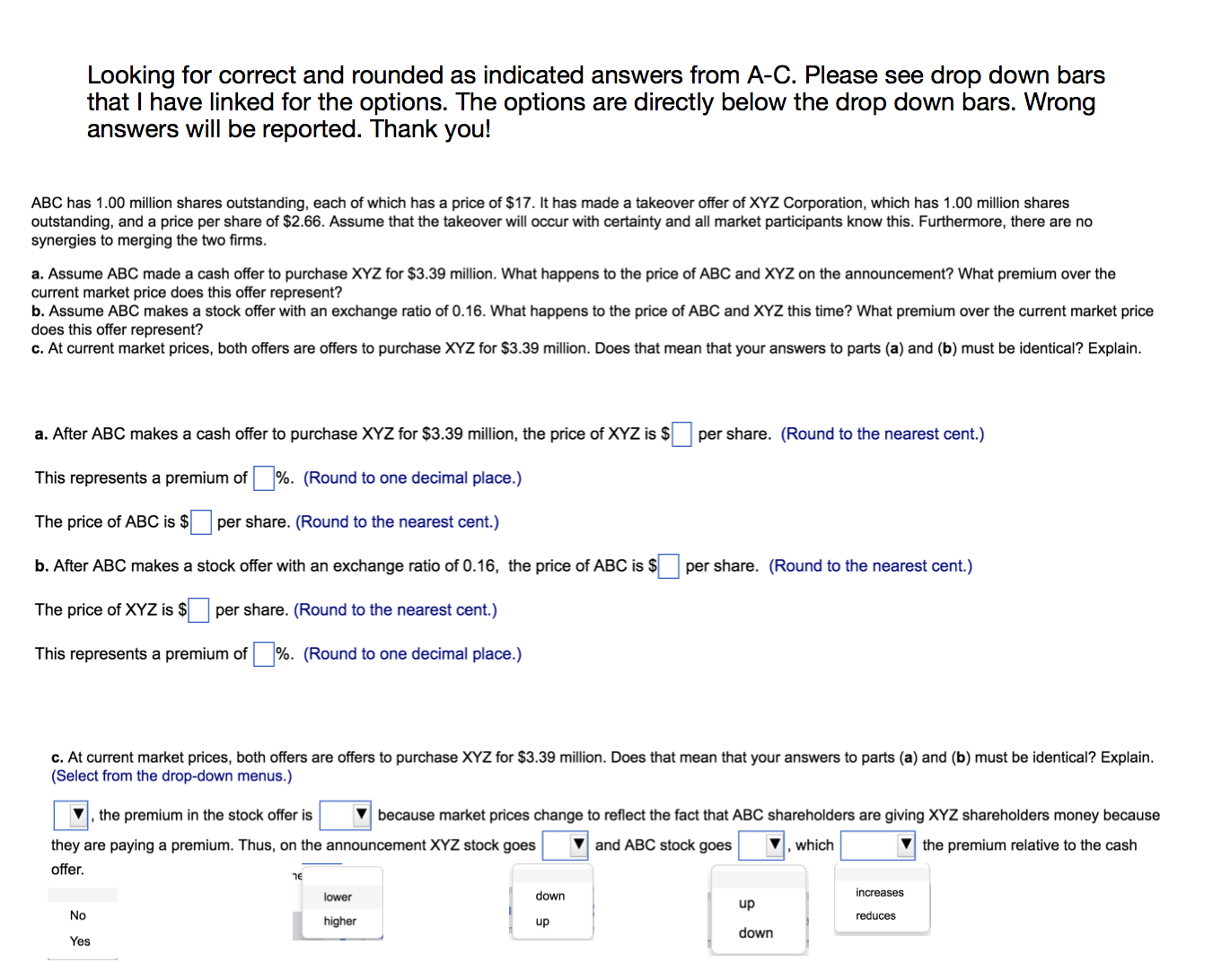

Looking for correct and rounded as indicated answers from A-C. Please see drop down bars that I have linked for the options. The options are directly below the drop down bars. Wrong answers will be reported. Ihank you! ABC has 1.00 million shares outstanding, each of which has a price of $17. It has made a takeover offer of XYZ Corporation, which has 1.00 million shares outstanding, and a price per share of $2.66. Assume that the takeover will occur with certainty and all market participants know this. Furthermore, there are no synergies to merging the two firms a. Assume ABC made a cash offer to purchase XYZ for $3.39 million. What happens to the price of ABC and XYZ on the announcement? What premium over the current market price does this offer represent? b. Assume ABC makes a stock offer with an exchange ratio of 0.16. What happens to the price of ABC and XYZ this time? What premium over the current market price does this offer represent? c. At current market prices, both offers are offers to purchase XYZ for $3.39 million. Does that mean that your answers to parts (a) and (b) must be identical? Explain a. After ABC makes a cash offer to purchase XYZ for $3.39 million, the price of XYZ is $per share. (Round to the nearest cent.) This represents a premium of | %. (Round to one decimal place.) The price of ABC is $ per share. (Round to the nearest cent.) b. After ABC makes a stock offer with an exchange ratio of 0.16, the price of ABC is $per share. (Round to the nearest cent.) The price of XYZ is $per share. (Round to the nearest cent.) This represents a premium of | %. (Round to one decimal place.) c. At current market prices, both offers are offers to purchase XYZ for $3.39 million. Does that mean that your answers to parts (a) and (b) must be identical? Explain (Select from the drop-down menus.) ? , the premium in the stock offer is they are paying a premium. Thus, on the announcement XYZ stock goes offer | because market prices change to reflect the fact that ABC shareholders are giving XYZ shareholders money because ? and ABC stock goes ? , which the premium relative to the cash ne lower down increases up No reduces higher up down Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts