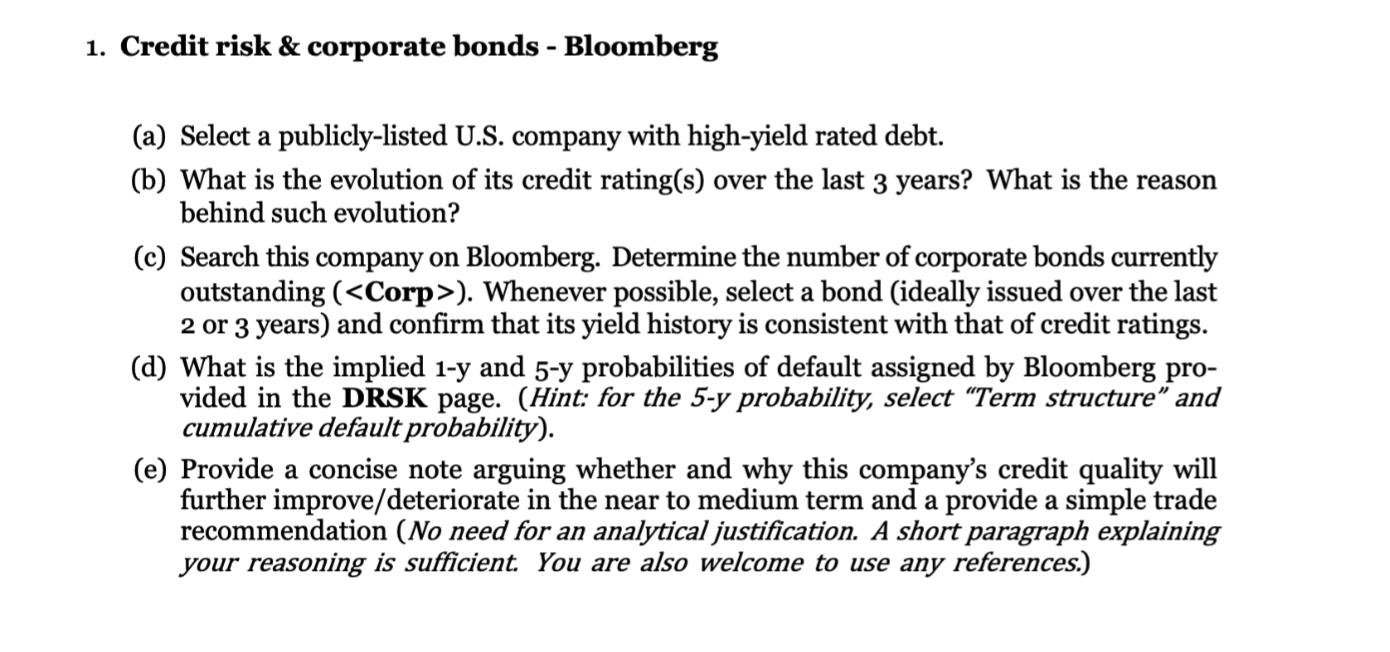

Question: Looking for help on my fixed income work. it's pretty open in terms of how to find answers. 1 . Credit risk & corporate

Looking for help on my fixed income work. it's pretty open in terms of how to find answers. Credit risk & corporate bonds Bloomberg

a Select a publiclylisted US company with highyield rated debt.

b What is the evolution of its credit ratings over the last years? What is the reason behind such evolution?

c Search this company on Bloomberg. Determine the number of corporate bonds currently outstanding Whenever possible, select a bond ideally issued over the last or years and confirm that its yield history is consistent with that of credit ratings.

d What is the implied mathrmy and mathrmy probabilities of default assigned by Bloomberg provided in the DRSK page. Hint: for the y probability, select "Term structure" and cumulative default probability

e Provide a concise note arguing whether and why this company's credit quality will further improvedeteriorate in the near to medium term and a provide a simple trade recommendation No need for an analytical justification. A short paragraph explaining your reasoning is sufficient. You are also welcome to use any references. Credit risk & sovereign debt

Several countries have recently been subject to a heightened scrutiny over their sovereign debt situation over the last years. Some of these include for example: Argentina, Colombia, Ghana, Italy, Lebanon, South Africa, and Turkey.

Select two countries from this list or other ones in a similar sovereign debt situation and report the corresponding credit ratings and year CDS spreads.

List key factors that have recently impacted positively or negatively their sovereign risk. Explain.

Determine and compare their debtgdp ratios. Given markets' shortmediumterm expectations about the growth rate and borrowing costs of these countries, would you expect their debtgdp ratio to increase or decrease? What factorspolicies may potentially improve it or deteriorate it further?

Provide a trading recommendation in light of your analysis.

This is an open question. Multiple answers are possible eg there are different data sources and ways to measure government debt, with possibly conflicting numbers You are welcome to use any source of information you like and make assumptions, if needed. Please be concise and focus on the key arguments, and make sure to cite your references. Interest Rate Swap

a Using Bloomberg, calculate the value of receiving a forward starting year interest rate swap that starts on March and ends on March The fixed rate is payable monthly and the floating rate is SOFR reset daily and payable monthly. Use the trade date curve date Feb and the settlement datevaluation Feb

b How many March year Treasury futures contracts would you need to hedge against a shift in the yield curve.

c Explain why this would or would not be a perfect hedge.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock