Question: Looking for help solving this difficult piece. Thanks Question 4: Assume a bank is in the process of restructuring a $4 million dollar non-amortizing loan

Looking for help solving this difficult piece. Thanks

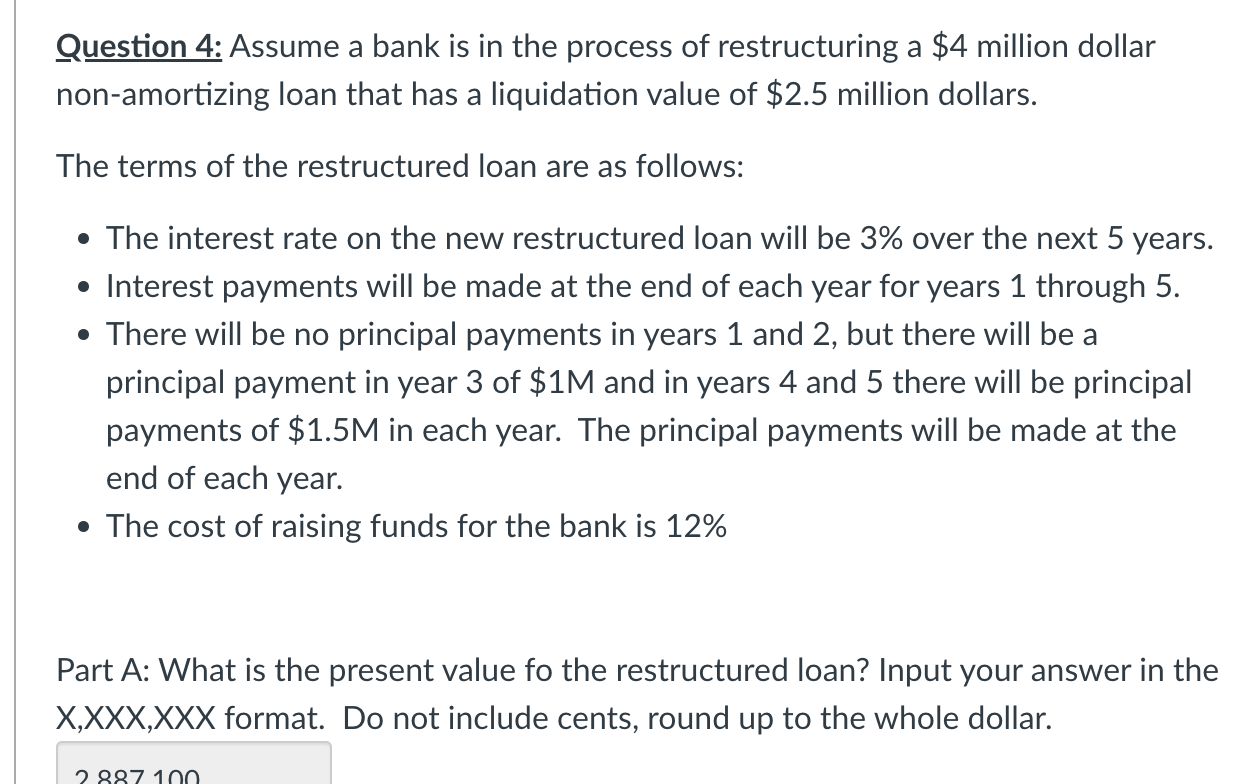

Question 4: Assume a bank is in the process of restructuring a $4 million dollar non-amortizing loan that has a liquidation value of $2.5 million dollars. The terms of the restructured loan are as follows: - The interest rate on the new restructured loan will be 3% over the next 5 years. - Interest payments will be made at the end of each year for years 1 through 5. - There will be no principal payments in years 1 and 2 , but there will be a principal payment in year 3 of $1M and in years 4 and 5 there will be principal payments of $1.5M in each year. The principal payments will be made at the end of each year. - The cost of raising funds for the bank is 12% Part A: What is the present value fo the restructured loan? Input your answer in the X,XXX,XXX format. Do not include cents, round up to the whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts