Question: Looking for help with this problem. I thought that we were taking the Gain * 16% for year 1 and then the Loss * 32%

Looking for help with this problem. I thought that we were taking the Gain * 16% for year 1 and then the Loss * 32% for year 2. But I think I am missing something.

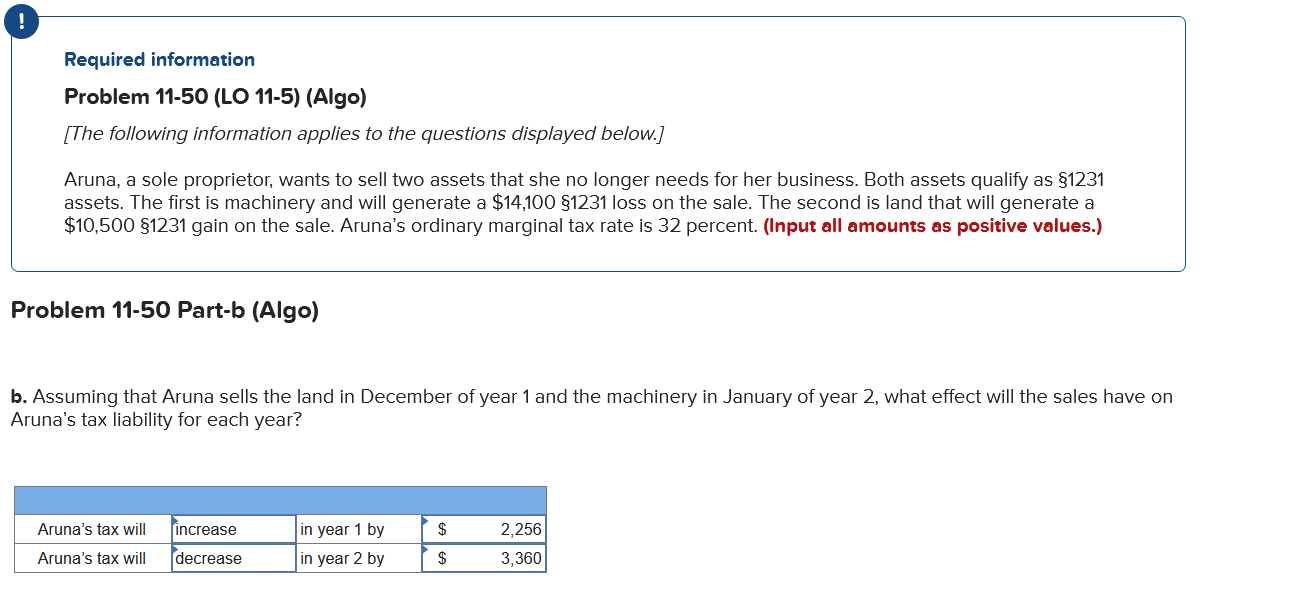

! Required information Problem 11-50 (LO 11-5) (Algo) [The following information applies to the questions displayed below.) Aruna, a sole proprietor, wants to sell two assets that she no longer needs for her business. Both assets qualify as $1231 assets. The first is machinery and will generate a $14,100 $1231 loss on the sale. The second is land that will generate a $10,500 $1231 gain on the sale. Aruna's ordinary marginal tax rate is 32 percent. (Input all amounts as positive values.) Problem 11-50 Part-b (Algo) b. Assuming that Aruna sells the land in December of year 1 and the machinery in January of year 2, what effect will the sales have on Aruna's tax liability for each year? increase $ Aruna's tax will Aruna's tax will in year 1 by in year 2 by 2,256 3,360 decrease $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts