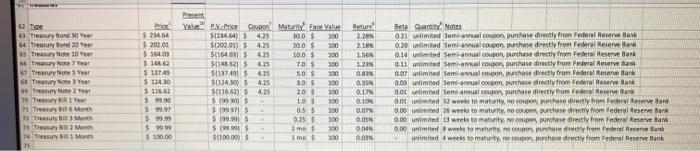

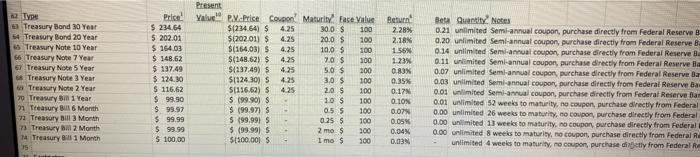

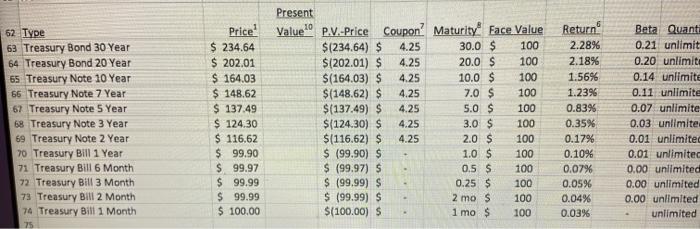

Question: looking for present value. Equations used would also be helpful does this work? heres another pic Y Treasury Bond 10 Year 64 Tond 20 Year

Y Treasury Bond 10 Year 64 Tond 20 Year os Try Note 10 Year Merye Year Try Not Year Treasury New Trang Tr 10 TM 1 1 Trem non The Man 7 Trasy Month Treasury 15 52M64 $ 2020 S609 SI $ 11749 $13410 $ 116 5990 $99.97 5959 $9.00 $10.00 Present Vale Price Coupon Mat Ece Value 01234.643 4.25 10.05 200 50302.01) 54.28 20.0 S 300 $(1543) 425 100S 300 $1146215 425 70 S 5013749 4.25 SOS 500 $1124.30 $ 4.2 105 300 S1600) 4.25 2.05 100 5000 10 51091 0.55 300 5.1999 0.25 $19.95 mais 500 500 DOS mo$ 500 22 21 ISEN 12N ORUN ON 0.17 0109 QON ON Beta Gary Notes 0.25 limited tempuhas directly from Federal Reserve task 0.29 td seni anualcon purchase directly from Federal Reserve Bank 0.14 unlimited Semi- au pon purchase directly from Federal Reserve Bank 0.11unimated Semi-au purchase directly from Preserve 0.07 limited Temuco directly from Federal Reserve 0.01 med Semi- aucoupon Durchasedirectly from Federal Reuwe Bank 0.01 wimbed Semanal coupon Purchasedly from Fee Reserve Bank 001 und wenkstomatit, has directly from Federal Reserved 0.00 united 26 weeks to maturity, couper, purchase dretty from Federal Reserve Bank 0.00 unlimited 13 weeks to maturity, coupon, purchase directly from Federal Reserve Bank 0.00 imited I went to mature coupe purchased from Federaler Bank imited weeks to maturity, or he dretty from Federal Resene Bank ON 00 u Type Treasury Band 30 Year 54 Treasury Bond 20 Year 5 Treasury Note 10 Year 66 Treasury Note 7 Year 67 Treasury Note 5 Year Treasury Note 3 Year Treasury Note 2 Year 70 Treasury Bin 1 Year 21 Treasury Bill Morth 72 Treasury Bill 3 Month 73 Treasury Bill 2 Month 14 Treasury BS 1 Month 15 Price $ 234.64 5 202.01 $164.03 $ 148,62 $ 137.40 $ 124.30 $ 116.62 $99.90 $99.97 $ 99.99 $ 99.99 $ 100,00 Present Value ey.Price Coupon Maturity Eace Value $(234.64) 4.25 30,0 $ 100 $1202.01) $ 4.25 20.0 $ 100 $(164,03) 5 4.25 10,0 $ 100 $(148.62) $ 4.25 7.0 $ 300 $1237.49) 4.25 5.0 $ 200 $[12430) S 4.25 3,0 $ 100 50116.62) S 4.25 2.0 $ 100 $ 199.90) S 105 100 $ 199.971 S 0.55 100 599.99 0.255 100 $199.99) S 2 mo $ 200 $1500.001S 1 mo s 100 2.28% 2.18% 1.56% 1.23% 0.83 0.35% 0.17 0.103 0.07% 0.05% 0.04% 0.03 Be Quantity Notes 0.21 unlimited Semi-annual coupon, purchase directly from Federal Reserve B 0.20 unlimited Semi-annual coupon, purchase directly from Federal Reserve B. 0.14 unlimited Semi-annual coupon, purchase directly from Federal Reserve B 0.11 Unlimited Semi-annual coupon, purchase directly from Federal Reserve 0.07 unlimited Semi-annual coupon, purchase directly from Federal Reserve Ba 0.03 unlimited Semi-annual coupon, purchase directly from Federal Reserve Bas 0.01 unlimited Semi-annual coupon, purchase directly from Federal Reserve Bar 0:01 unlimited 52 weeks to maturity, no coupon, purchase directly from Federal 0.00 unlimited 26 weeks to maturity, no coupon, purchase directly from Federal 0.00 unlimited 13 weeks to maturity, no coupon, purchase directly from Federal 0.00 unlimited 8 weeks to maturity, no coupon, purchase directly from Federal Re unlimited 4 weeks to maturity, coupon, purchase dictly from Federal Re 62 Type 63 Treasury Bond 30 Year 64 Treasury Bond 20 Year 65 Treasury Note 10 Year 66 Treasury Note 7 Year 67 Treasury Note 5 Year 68 Treasury Note 3 Year 69 Treasury Note 2 Year 70 Treasury Bill 1 Year 71 Treasury Bill 6 Month 72 Treasury Bill 3 Month 73 Treasury Bill 2 Month 74 Treasury Bill 1 Month Price? $ 234.64 $ 202.01 $ 164.03 $ 148.62 $ 137.49 $ 124.30 $ 116.62 $ 99.90 $ 99.97 $ 99.99 $ 99.99 $ 100,00 Present Value P.V.-Price Coupon? Maturity Face Value $1234.64) $ 4.25 30.0 $ 100 $1202.01) $ 4.25 20.0 S 100 $(164.03) $ 4.25 10.0 $ 100 $(148.62) $ 4.25 7.0 S 100 $(137.49) $ 4.25 5.0 $ 100 $(124.30) $ 4.25 3.0 $ 100 $(116.62) $ 4.25 2.0 $ 100 $ (99.90) $ 1.0 $ 100 $ (99.97) $ 0.5 S 100 $ (99.99) $ 0.25 $ 100 $ (99.99) $ 2 mo s 100 $(100.00) $ 1 mo $ 100 Return 2.28% 2.18% 1.56% 1.23% 0.83% 0.35% 0.17% 0.10% 0.07% 0.05% 0.04% 0.03% Beta Quant 0.21 unlimit 0.20 unlimiti 0.14 unlimite 0.11 unlimite 0.07 unlimite 0.03 unlimite 0.01 unlimited 0.01 unlimited 0.00 unlimited 0.00 unlimited 0.00 unlimited unlimited . 75 Y Treasury Bond 10 Year 64 Tond 20 Year os Try Note 10 Year Merye Year Try Not Year Treasury New Trang Tr 10 TM 1 1 Trem non The Man 7 Trasy Month Treasury 15 52M64 $ 2020 S609 SI $ 11749 $13410 $ 116 5990 $99.97 5959 $9.00 $10.00 Present Vale Price Coupon Mat Ece Value 01234.643 4.25 10.05 200 50302.01) 54.28 20.0 S 300 $(1543) 425 100S 300 $1146215 425 70 S 5013749 4.25 SOS 500 $1124.30 $ 4.2 105 300 S1600) 4.25 2.05 100 5000 10 51091 0.55 300 5.1999 0.25 $19.95 mais 500 500 DOS mo$ 500 22 21 ISEN 12N ORUN ON 0.17 0109 QON ON Beta Gary Notes 0.25 limited tempuhas directly from Federal Reserve task 0.29 td seni anualcon purchase directly from Federal Reserve Bank 0.14 unlimited Semi- au pon purchase directly from Federal Reserve Bank 0.11unimated Semi-au purchase directly from Preserve 0.07 limited Temuco directly from Federal Reserve 0.01 med Semi- aucoupon Durchasedirectly from Federal Reuwe Bank 0.01 wimbed Semanal coupon Purchasedly from Fee Reserve Bank 001 und wenkstomatit, has directly from Federal Reserved 0.00 united 26 weeks to maturity, couper, purchase dretty from Federal Reserve Bank 0.00 unlimited 13 weeks to maturity, coupon, purchase directly from Federal Reserve Bank 0.00 imited I went to mature coupe purchased from Federaler Bank imited weeks to maturity, or he dretty from Federal Resene Bank ON 00 u Type Treasury Band 30 Year 54 Treasury Bond 20 Year 5 Treasury Note 10 Year 66 Treasury Note 7 Year 67 Treasury Note 5 Year Treasury Note 3 Year Treasury Note 2 Year 70 Treasury Bin 1 Year 21 Treasury Bill Morth 72 Treasury Bill 3 Month 73 Treasury Bill 2 Month 14 Treasury BS 1 Month 15 Price $ 234.64 5 202.01 $164.03 $ 148,62 $ 137.40 $ 124.30 $ 116.62 $99.90 $99.97 $ 99.99 $ 99.99 $ 100,00 Present Value ey.Price Coupon Maturity Eace Value $(234.64) 4.25 30,0 $ 100 $1202.01) $ 4.25 20.0 $ 100 $(164,03) 5 4.25 10,0 $ 100 $(148.62) $ 4.25 7.0 $ 300 $1237.49) 4.25 5.0 $ 200 $[12430) S 4.25 3,0 $ 100 50116.62) S 4.25 2.0 $ 100 $ 199.90) S 105 100 $ 199.971 S 0.55 100 599.99 0.255 100 $199.99) S 2 mo $ 200 $1500.001S 1 mo s 100 2.28% 2.18% 1.56% 1.23% 0.83 0.35% 0.17 0.103 0.07% 0.05% 0.04% 0.03 Be Quantity Notes 0.21 unlimited Semi-annual coupon, purchase directly from Federal Reserve B 0.20 unlimited Semi-annual coupon, purchase directly from Federal Reserve B. 0.14 unlimited Semi-annual coupon, purchase directly from Federal Reserve B 0.11 Unlimited Semi-annual coupon, purchase directly from Federal Reserve 0.07 unlimited Semi-annual coupon, purchase directly from Federal Reserve Ba 0.03 unlimited Semi-annual coupon, purchase directly from Federal Reserve Bas 0.01 unlimited Semi-annual coupon, purchase directly from Federal Reserve Bar 0:01 unlimited 52 weeks to maturity, no coupon, purchase directly from Federal 0.00 unlimited 26 weeks to maturity, no coupon, purchase directly from Federal 0.00 unlimited 13 weeks to maturity, no coupon, purchase directly from Federal 0.00 unlimited 8 weeks to maturity, no coupon, purchase directly from Federal Re unlimited 4 weeks to maturity, coupon, purchase dictly from Federal Re 62 Type 63 Treasury Bond 30 Year 64 Treasury Bond 20 Year 65 Treasury Note 10 Year 66 Treasury Note 7 Year 67 Treasury Note 5 Year 68 Treasury Note 3 Year 69 Treasury Note 2 Year 70 Treasury Bill 1 Year 71 Treasury Bill 6 Month 72 Treasury Bill 3 Month 73 Treasury Bill 2 Month 74 Treasury Bill 1 Month Price? $ 234.64 $ 202.01 $ 164.03 $ 148.62 $ 137.49 $ 124.30 $ 116.62 $ 99.90 $ 99.97 $ 99.99 $ 99.99 $ 100,00 Present Value P.V.-Price Coupon? Maturity Face Value $1234.64) $ 4.25 30.0 $ 100 $1202.01) $ 4.25 20.0 S 100 $(164.03) $ 4.25 10.0 $ 100 $(148.62) $ 4.25 7.0 S 100 $(137.49) $ 4.25 5.0 $ 100 $(124.30) $ 4.25 3.0 $ 100 $(116.62) $ 4.25 2.0 $ 100 $ (99.90) $ 1.0 $ 100 $ (99.97) $ 0.5 S 100 $ (99.99) $ 0.25 $ 100 $ (99.99) $ 2 mo s 100 $(100.00) $ 1 mo $ 100 Return 2.28% 2.18% 1.56% 1.23% 0.83% 0.35% 0.17% 0.10% 0.07% 0.05% 0.04% 0.03% Beta Quant 0.21 unlimit 0.20 unlimiti 0.14 unlimite 0.11 unlimite 0.07 unlimite 0.03 unlimite 0.01 unlimited 0.01 unlimited 0.00 unlimited 0.00 unlimited 0.00 unlimited unlimited . 75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts