Question: Looking for some help with this multiple regression problem, questions a,b,c should be correct. I am just looking for some help with the rest. fffAnancial

Looking for some help with this multiple regression problem, questions a,b,c should be correct. I am just looking for some help with the rest.

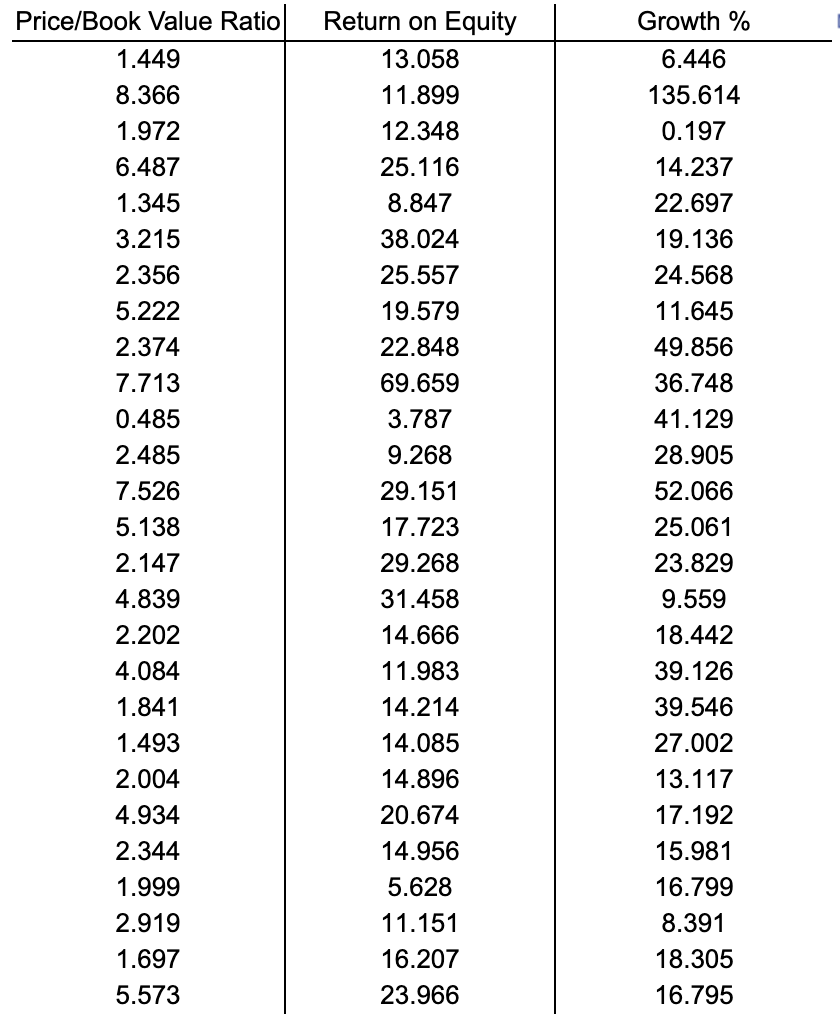

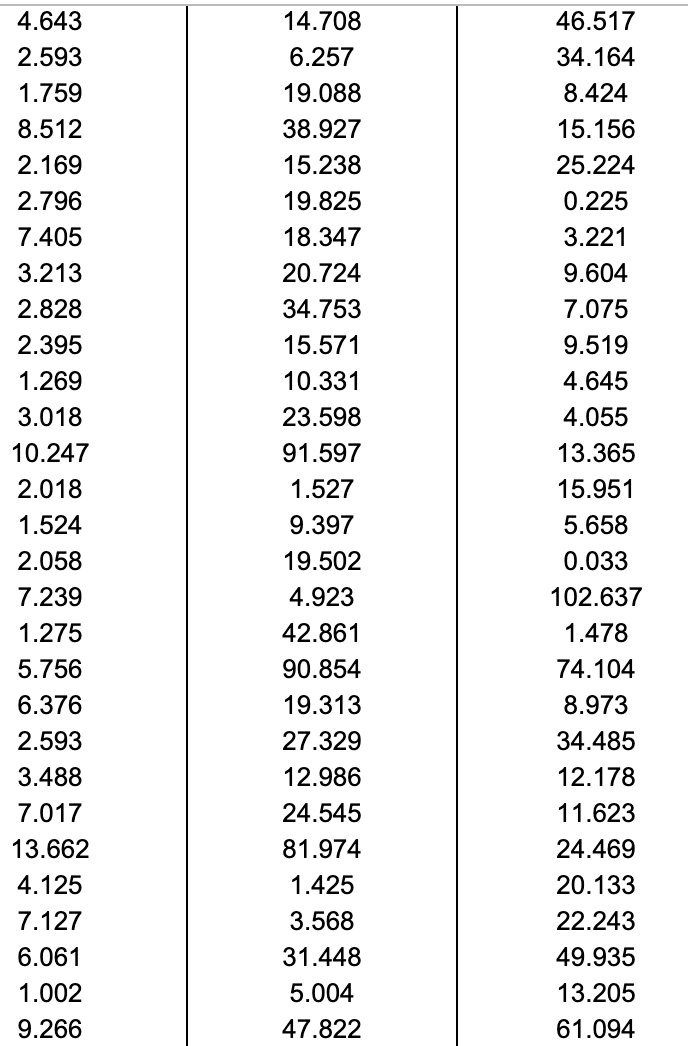

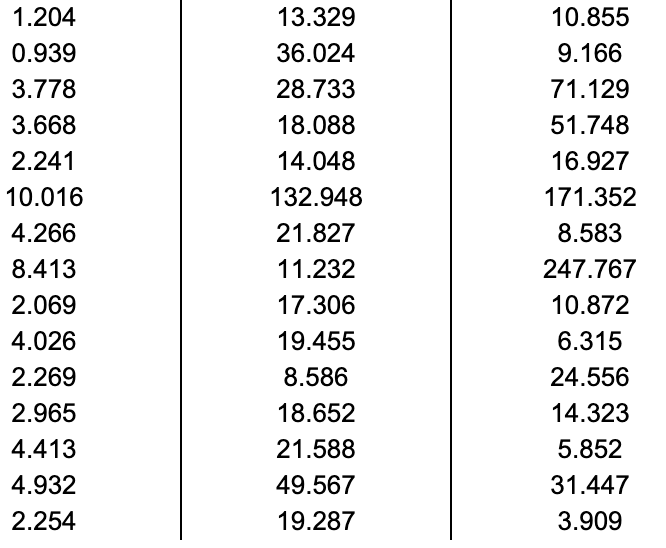

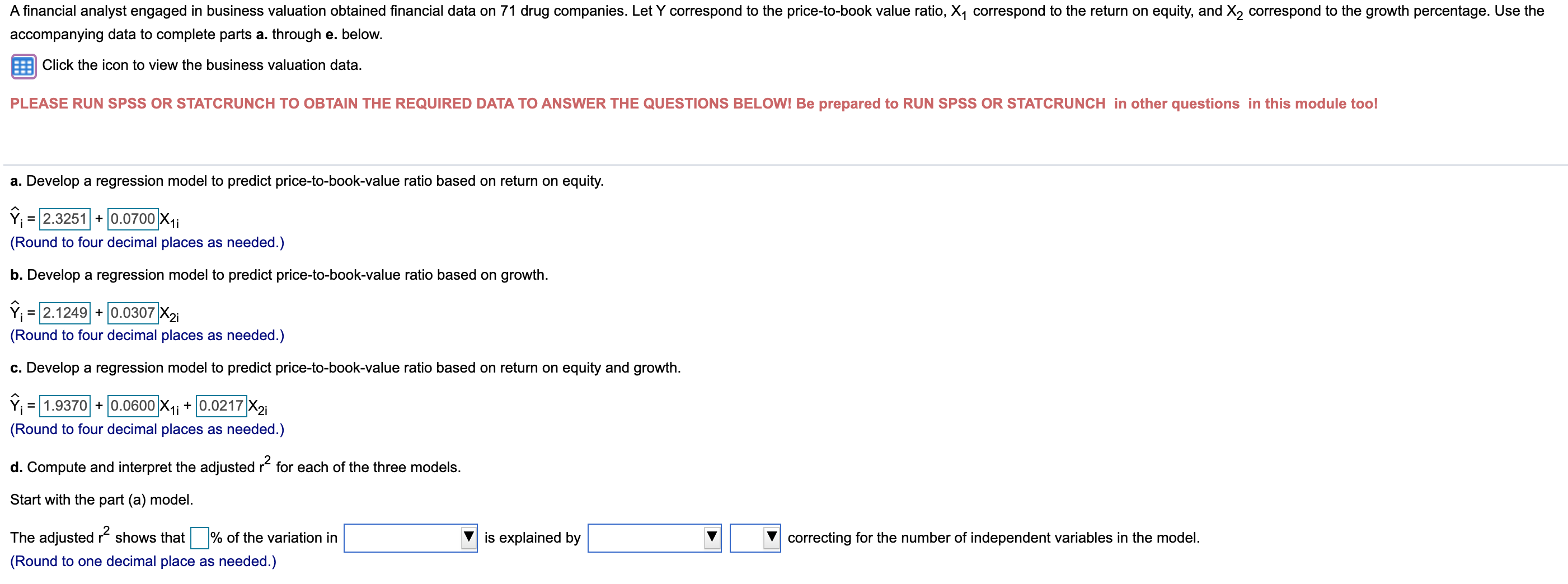

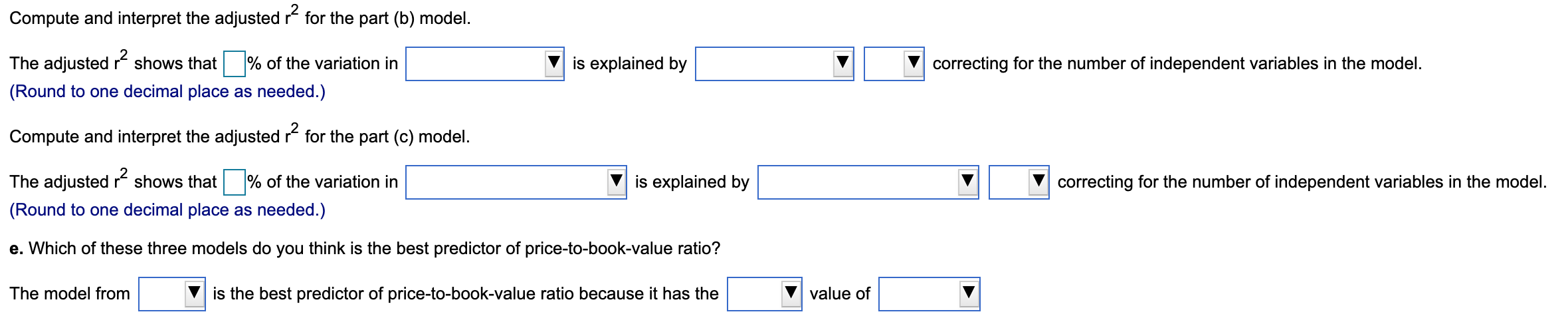

\f\f\fAnancial analyst engaged in business valuation obtained nancial data on 71 drug companies. Let Y correspond to the price-tobook value ratio, X1 correspond to the return on equity. and X2 correspond to the growth percentage. Use the accompanying data to complete park a. through 6. below. Click the icon to view the business valuation data. PLEASE RUN SPSS OR STATCRUNCH TO OBTAIN THE REQUIRED DATA TO ANSWER THE QUESTIONS BELOW! Be prepared to RUN SPSS OR STATCRUNCH in other questions in this module too! a. Develop a regression model to predict prioe-to-bookvalue ratio based on return on equity. a = 2.3251 + 0.0700 x1i (Round to four decimal places as needed.) b. Develop a regression model to predict prioe-to-bookvalue ratio based on growth. 9. = 2.1249 + 0.0307 x2i (Round to four decimal places as needed.) 1:. Develop a regression model to predict prioe-to-bookvalue ratio based on return on equity and growth Vi = 1.9370 + 0.0600 X1i + 0.0217 XZi (Round to four decimal places as needed.) d. Compute and interpret the adjusted r2 for each of the three models. Start with the part (a) model. The adjusted r2 shows that % of the variation in V is explained by (Round to one decimal place as needed.) l

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts