Question: looking for (step 2 )only. please use keyboard writing the solution The question solution for step 1. Required: 1. Prepare a spreadsheet with following columns.

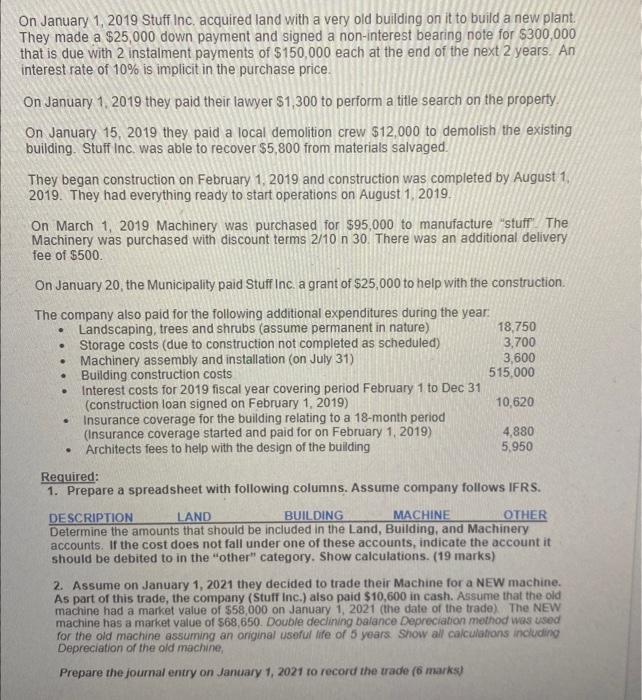

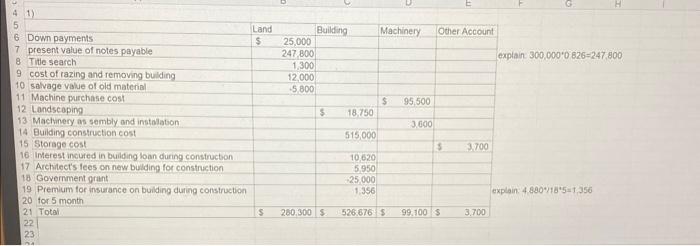

Required: 1. Prepare a spreadsheet with following columns. Assume company follows IFRS. Determine the amounts that should be included in the Land, Building, and Machinery accounts. If the cost does not fall under one of these accounts, indicate the account it should be debited to in the "other" category. Show calculations. (19 marks) 2. Assume on January 1, 2021 they decided to trade their Machine for a NEW machine. As part of this trade, the company (Stuff inc.) also paid $10,600 in cash. Assume that the old machine had a market value of $58,000 on January 1, 2021 (the date of the trade). The NEW machine has a market value of $68,650. Double deciining balance Depreciation method was used for the old machine assuming an original usoful life of 5 years. Show all calculations inctuding Depreciation of the old machine, Prepare the joumal entry on January 1,2021 to record the trade (6 marks) 1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts