Question: looking for the answer to 25 *E13.25 (LO 5) (Term Modification with Gain -Creditor's Entries) Using the same information as in E13.22 and E13,24, answer

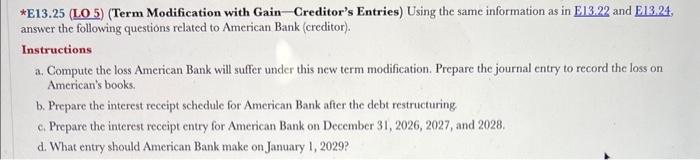

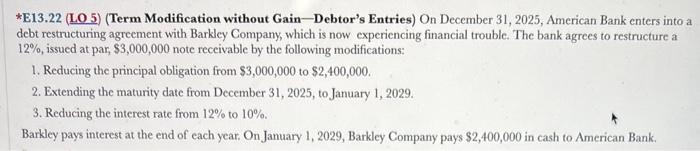

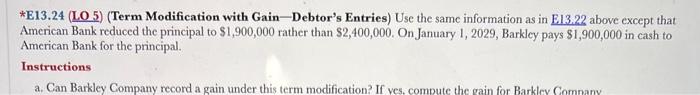

*E13.25 (LO 5) (Term Modification with Gain -Creditor's Entries) Using the same information as in E13.22 and E13,24, answer the following questions related to American Bank (creditor). Instructions a. Compute the loss American Bank will suffer under this new term modification. Prepare the journal entry to record the loss on American's books. b. Prepare the interest reccipt schedule for American Bank after the debt restructuring c. Prepare the interest reccipt entry for American Bank on December 31, 2026, 2027, and 2028. d. What entry should American Bank make on January 1, 2029? *E13.22 (LO 5) (Term Modification without Gain-Debtor's Entries) On December 31, 2025, American Bank enters into a debt restructuring agreement with Barkley Company, which is now experiencing financial trouble. The bank agrees to restructure a 12%, issued at par, $3,000,000 note receivable by the following modifications: 1. Reducing the principal obligation from $3,000,000 to $2,400,000. 2. Extending the maturity date from December 31, 2025, to January 1, 2029. 3. Reducing the interest rate from 12% to 10%. Barkley pays interest at the end of each year. On Jamuary 1, 2029, Barkley Company pays $2,400,000 in cash to American Bank. *E13.24 (LO 5) (Term Modification with Gain-Debtor's Entries) Use the same information as in E13.22 above except that American Bank reduced the principal to $1,900,000 rather than $2,400,000. On January 1, 2029, Barkley pays $1,900,000 in cash to American Bank for the principal. Instructions a. Can Barkley Company record a gain under this term modification? If yes, compute the gain for Barkley Comnany

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts