Question: looking for work to determine if project should be accepted. if using excel, please tell me what you did in detail. As a financial consultant

looking for work to determine if project should be accepted. if using excel, please tell me what you did in detail.

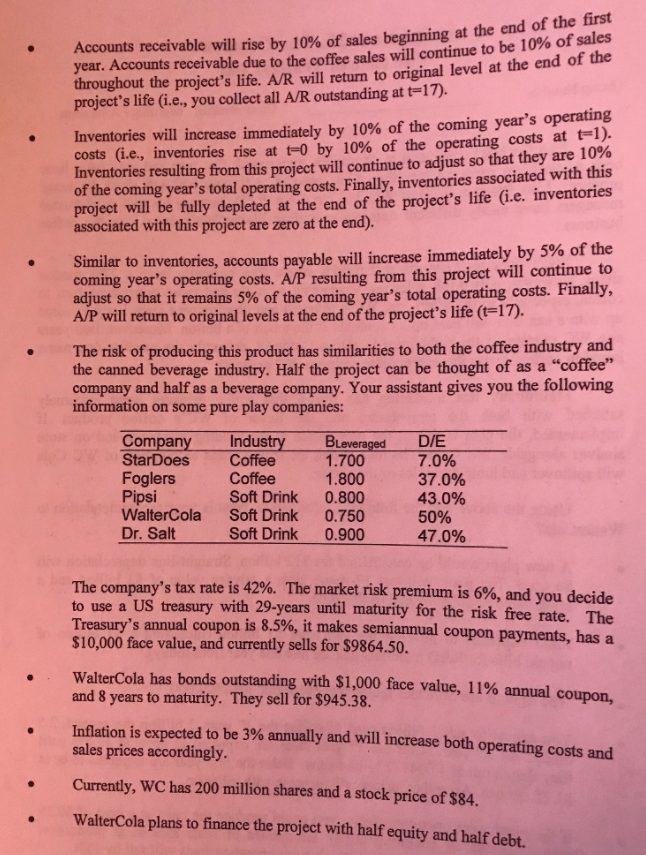

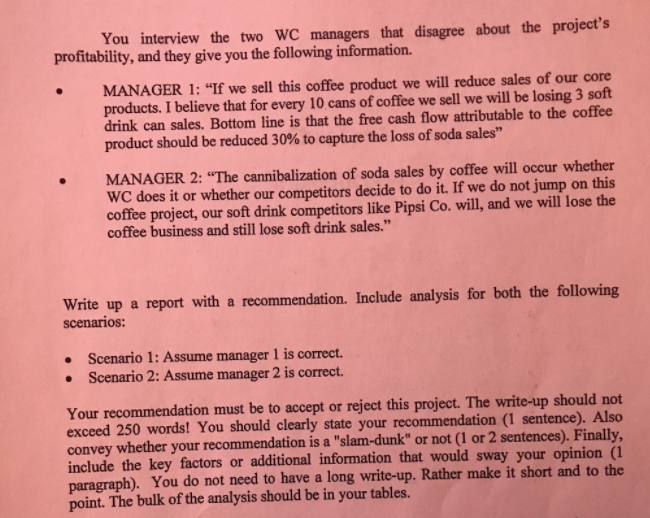

As a financial consultant at Alexandra Anderson&Co., you and your team have assigned to work on the WalterCola account, a fortune 500 soft drink beverage because his two most trusted producer. Max Prophet, CEO of WC, has hired AA &Co. managers have vastly different opinions regarding WalterCola's entry into the coffee business. WC's core products are soft drinks, where they currently have a 27% market share. However, soft drink sales are weakening as more and more consumers turn to coffee, especially in the afternoon. WC's research and development team has just come up with a can that will heat up its contents at the touch of a button. Moreover, two y ago WC purchased the right from SunDoes CoffeeTM, currently the number one name brand in coffee, to use its secret coffee recipe in WC products. Preliminary test marketing has shown that coffee drinkers were extremely satisfied with both the temperature and the flavor of WC's coffee product. If implemented, the plan is to sell the new coffee in the vending machines and on store shelves alongside WC Cola. The idea is that the strong brand recognition of WC Cola will spillover and jumpstart sales of the coffee. Using the above and the following information, what is your recommendation to WalterCola? A new plant would be constructed for $12 billion. Straight-line depreciation will be used. The plant will last 17-years, have a salvage value of $3 billion and a book value of $0 at the end of this time. R&D expenses to develop the can were $3 billion (including a $1 billion of unpaid bills for R&D materials that are due one year from today The right to use SunDoes recipe was purchased for $800,000. You expect to sell 1 billion cans of coffee the 1st year, 2 billion the second, 2.5 billion the 3rd year. After the 3rd year sales are expected to grow at 12.5% until they flatten out at 4.004517 billion cans. Sales the first year are expected to be at $1.25 per can. After that, prices will increase with inflation. If the plant were operating today, you could produce the cans at a cost of $0.35 each includes all operating costs). Economies of scale kick-in at production levels of over 2.5 billion cans at which point operating costs will fall by 15%. As a financial consultant at Alexandra Anderson&Co., you and your team have assigned to work on the WalterCola account, a fortune 500 soft drink beverage because his two most trusted producer. Max Prophet, CEO of WC, has hired AA &Co. managers have vastly different opinions regarding WalterCola's entry into the coffee business. WC's core products are soft drinks, where they currently have a 27% market share. However, soft drink sales are weakening as more and more consumers turn to coffee, especially in the afternoon. WC's research and development team has just come up with a can that will heat up its contents at the touch of a button. Moreover, two y ago WC purchased the right from SunDoes CoffeeTM, currently the number one name brand in coffee, to use its secret coffee recipe in WC products. Preliminary test marketing has shown that coffee drinkers were extremely satisfied with both the temperature and the flavor of WC's coffee product. If implemented, the plan is to sell the new coffee in the vending machines and on store shelves alongside WC Cola. The idea is that the strong brand recognition of WC Cola will spillover and jumpstart sales of the coffee. Using the above and the following information, what is your recommendation to WalterCola? A new plant would be constructed for $12 billion. Straight-line depreciation will be used. The plant will last 17-years, have a salvage value of $3 billion and a book value of $0 at the end of this time. R&D expenses to develop the can were $3 billion (including a $1 billion of unpaid bills for R&D materials that are due one year from today The right to use SunDoes recipe was purchased for $800,000. You expect to sell 1 billion cans of coffee the 1st year, 2 billion the second, 2.5 billion the 3rd year. After the 3rd year sales are expected to grow at 12.5% until they flatten out at 4.004517 billion cans. Sales the first year are expected to be at $1.25 per can. After that, prices will increase with inflation. If the plant were operating today, you could produce the cans at a cost of $0.35 each includes all operating costs). Economies of scale kick-in at production levels of over 2.5 billion cans at which point operating costs will fall by 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts