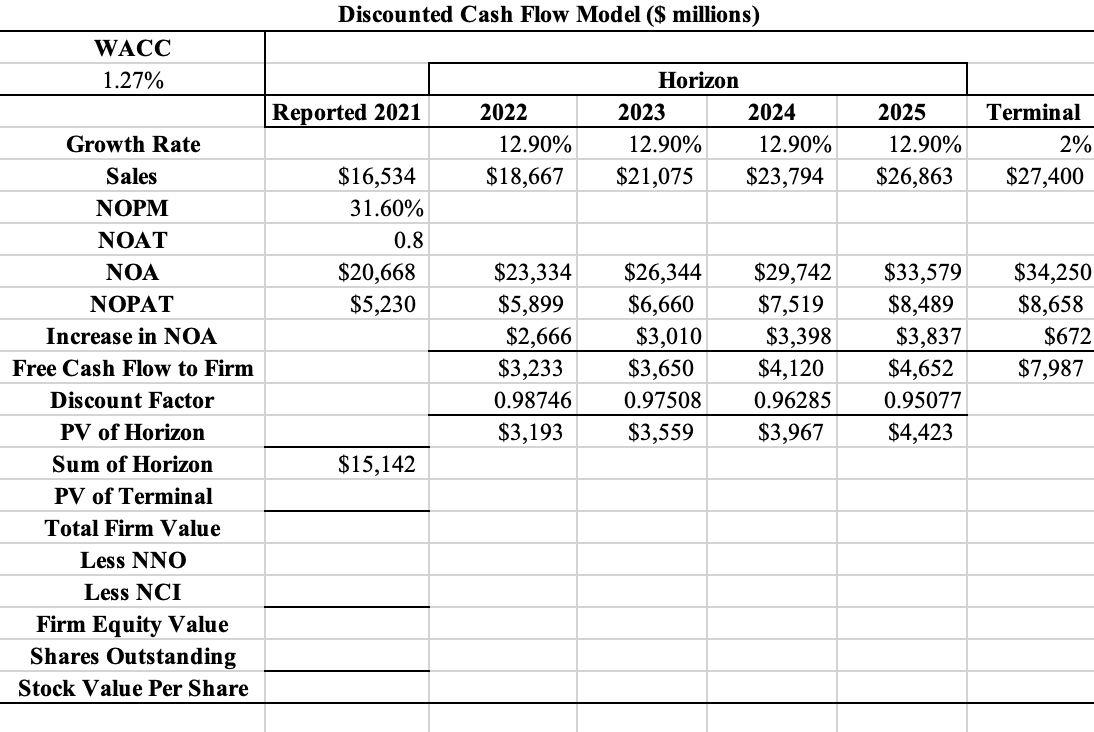

Question: Looking to complete this DCF Model using the information provided. How do you calculate PV of Terminal, Total Firm Value, Less NNO, Less NCI, Firm

Looking to complete this DCF Model using the information provided. How do you calculate PV of Terminal, Total Firm Value, Less NNO, Less NCI, Firm Equity Value, Shares Outstanding, and Stock Value per Share?

WACC 1.27% Growth Rate Sales NOPM NOAT NOA NOPAT Increase in NOA Free Cash Flow to Firm Discount Factor PV of Horizon Sum of Horizon PV of Terminal Total Firm Value Less NNO Less NCI Firm Equity Value Shares Outstanding Stock Value Per Share Discounted Cash Flow Model ($ millions) Reported 2021 $16,534 31.60% 0.8 $20,668 $5,230 $15,142 2022 12.90% $18,667 Horizon 2023 2024 12.90% 12.90% $21,075 $23,794 $3,010 $23,334 $26,344 $29,742 $33,579 $5,899 $6,660 $7,519 $8,489 $2,666 $3,398 2025 $3,233 $3,650 $4,120 0.98746 0.97508 0.96285 $3,193 $3,559 $3,967 12.90% $26,863 $3,837 $4,652 0.95077 $4,423 Terminal 2% $27,400 $34,250 $8,658 $672 $7,987 WACC 1.27% Growth Rate Sales NOPM NOAT NOA NOPAT Increase in NOA Free Cash Flow to Firm Discount Factor PV of Horizon Sum of Horizon PV of Terminal Total Firm Value Less NNO Less NCI Firm Equity Value Shares Outstanding Stock Value Per Share Discounted Cash Flow Model ($ millions) Reported 2021 $16,534 31.60% 0.8 $20,668 $5,230 $15,142 2022 12.90% $18,667 Horizon 2023 2024 12.90% 12.90% $21,075 $23,794 $3,010 $23,334 $26,344 $29,742 $33,579 $5,899 $6,660 $7,519 $8,489 $2,666 $3,398 2025 $3,233 $3,650 $4,120 0.98746 0.97508 0.96285 $3,193 $3,559 $3,967 12.90% $26,863 $3,837 $4,652 0.95077 $4,423 Terminal 2% $27,400 $34,250 $8,658 $672 $7,987

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts