Question: Looking to solve the problem below. 4. Individual Problems 54 A university spent $1.3 million to install solar panels atop a parking garage. These panels

Looking to solve the problem below.

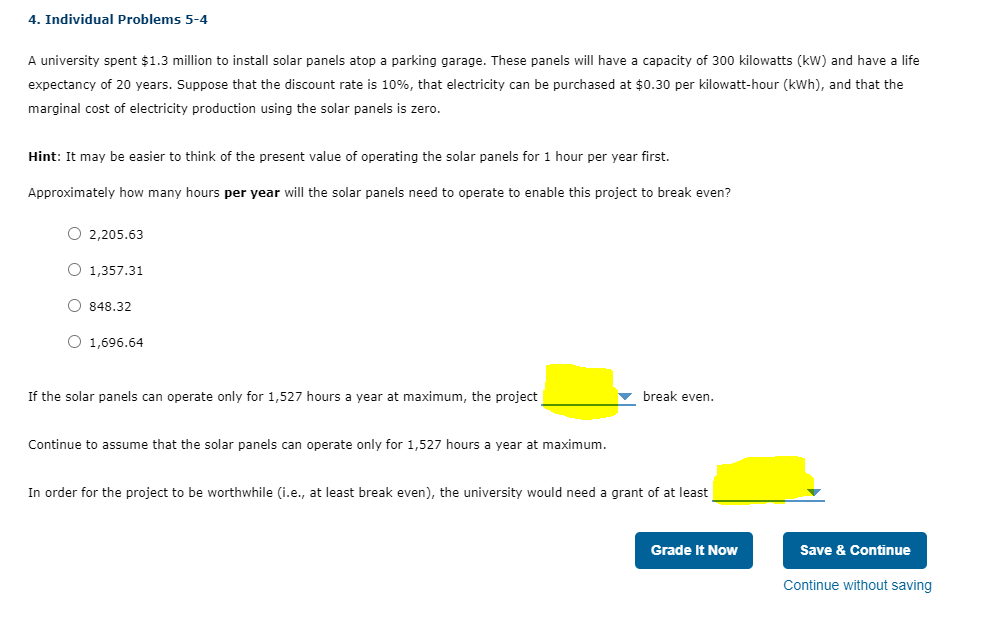

4. Individual Problems 54 A university spent $1.3 million to install solar panels atop a parking garage. These panels will have a capacity of 300 kilowatts (kw) and have a life expectancy of 20 years. Suppose that the discount rate is 10%, that electricity can be purchased at $0.30 per kilowatthour (kWh), and that the marginal cost of electricity production using the solar panels is zero. Hint: It may be easier to think of the present value of operah'ng the solar panels for 1 hour per year rst. Approximately hovrI many hours per year will the solar panels need to operate to enable this project to break even? O 2,205.53 0 1,357.31 O 848.32 0 1,595.54 If the solar panels can operate only for 1,52? hours a year at maximum, the project V break even. Continue to assume that the solar panels can operate only for 1,52? hours a year at maximum. In order for the project to be worthwhile (i.e., at least break even), the university would need a grant of at least V Continue with out saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts