Question: Lorch Company prepares monthly cash budgets. Relevant data from operating budgets for 2021 are as follows: January February Sales $351,000 $400,000 Direct materials purchases 119,000

Lorch Company prepares monthly cash budgets. Relevant data from operating budgets for 2021 are as follows:

| January | February | ||||

| Sales | $351,000 | $400,000 | |||

| Direct materials purchases | 119,000 | 109,000 | |||

| Direct labour | 84,000 | 113,000 | |||

| Manufacturing overhead | 59,000 | 74,000 | |||

| Selling and administrative expenses | 76,000 | 81,000 |

All sales are on account. Lorch expects collections to be 50% in the month of sale, 40% in the first month following the sale, and 10% in the second month following the sale. It pays 30% of direct materials purchases in cash in the month of purchase and the balance due in the month following the purchase. Other data are as follows:

| 1. | Credit sales: November 2020, $200,000; December 2020, $281,000 |

| 2. | Purchases of direct materials: December 2020, $89,000 |

| 3. | Other receipts: Januarycollection of December 31, 2020, notes receivable $4,000; Februaryproceeds from sale of securities $5,000 |

| 4. | Other disbursements: Februarypayment of $20,000 for land |

The company expects its cash balance on January 1, 2021, to be $51,000. It wants to maintain a minimum cash balance of $40,000.

Prepare schedules for (1) the expected collections from customers.

| Month | January | February | |||

| November | $ | $ | |||

| December | |||||

| January | |||||

| February | |||||

| $ | $ |

(2) the expected payments for direct materials purchases.

| Month | January | February | |||

| December | $ | $ | |||

| January | |||||

| February | |||||

| $ | $ |

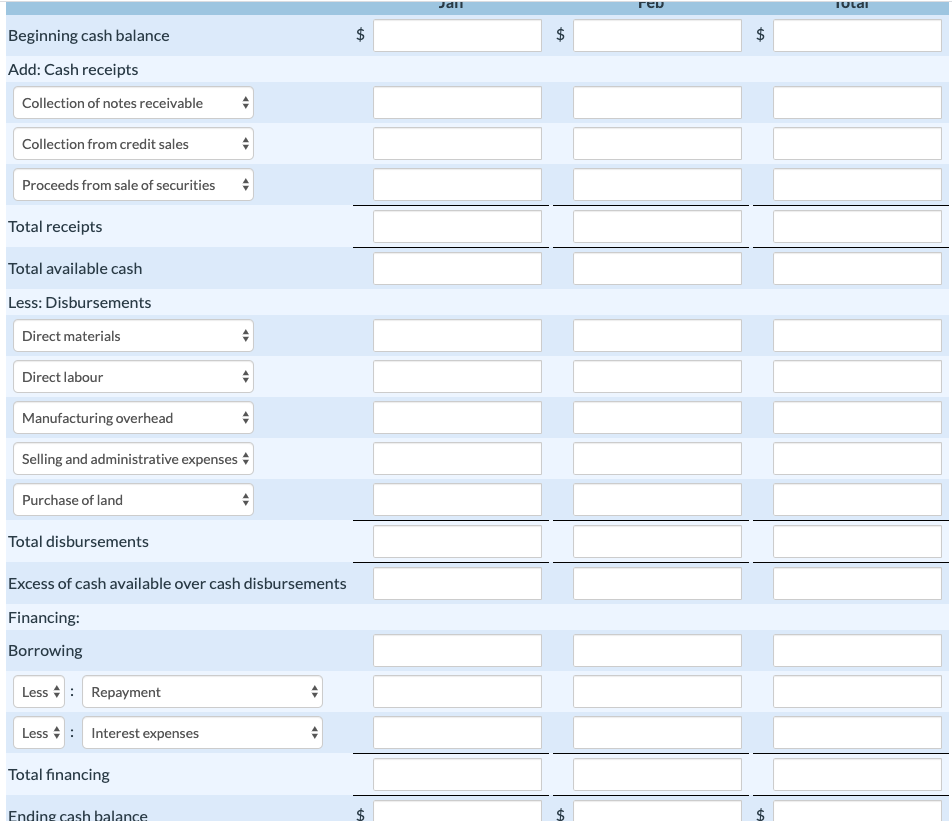

Prepare a cash budget for January and February using columns for each month.

JdIn TEN TULAI Beginning cash balance $ $ Add: Cash receipts Collection of notes receivable Collection from credit sales - Proceeds from sale of securities - Total receipts Total available cash Less: Disbursements Direct materials Direct labour Manufacturing overhead Selling and administrative expenses Purchase of land Total disbursements Excess of cash available over cash disbursements Financing: Borrowing Less : Repayment Less : Interest expenses Total financing Ending cash balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts