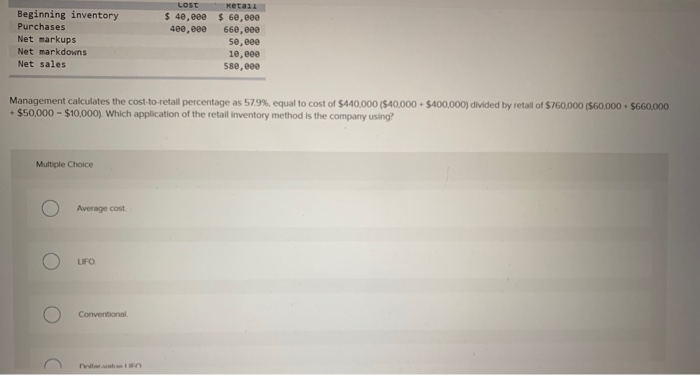

Question: LOST $ 40,eee 400,eee Beginning inventory Purchases Net markups Net markdowns Net sales Retail $ 60, eee 660, eee 50, eee 10, eee 580, eee

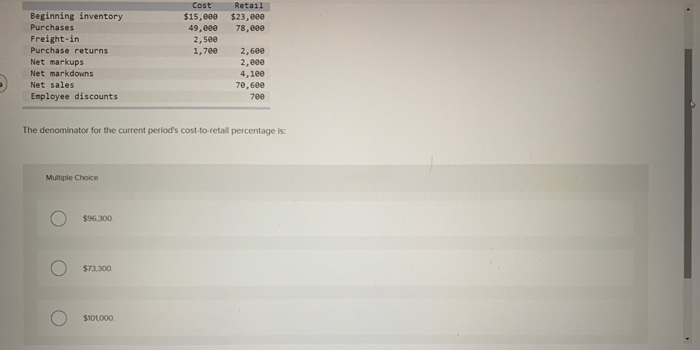

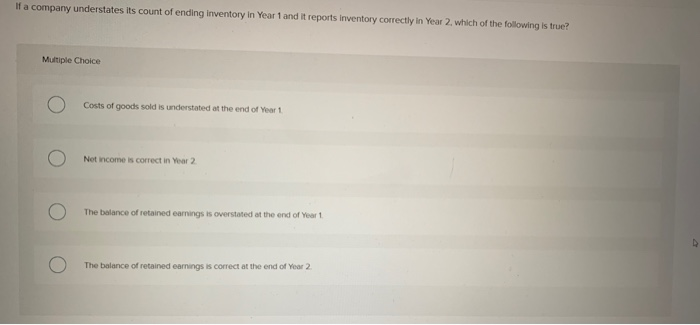

LOST $ 40,eee 400,eee Beginning inventory Purchases Net markups Net markdowns Net sales Retail $ 60, eee 660, eee 50, eee 10, eee 580, eee Management calculates the cost to retail percentage as 579%, equal to cost of $440,000 ($40,000 + $50,000 - $10,000). Which application of the retail inventory method is the company using? $400,000) divided by retail of $760,000 ($60,000 - $660,000 Multiple Choice Average cost O no O Conventional Cost $15,000 49,000 2,5ee 1,7ee Retail $23,000 78, eee Beginning inventory Purchases Freight-in Purchase returns Net markups Net markdowns Net sales Employee discounts 2,600 2,eee 4,100 70.600 7ee The denominator for the current period's cost to retail percentage is: Multiple Choice O $96,300 O $73,300 0 $100,000 If a company understates its count of ending Inventory in Year 1 and it reports Inventory correctly in Year 2. which of the following is true? Multiple Choice C ) Costs of goods sold is understated at the end of Year 1 O Net income is correct in Year 2 ) The balance of retained earnings is overstated at the end of Year 1 The balance of retained earnings is correct at the end of Year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts