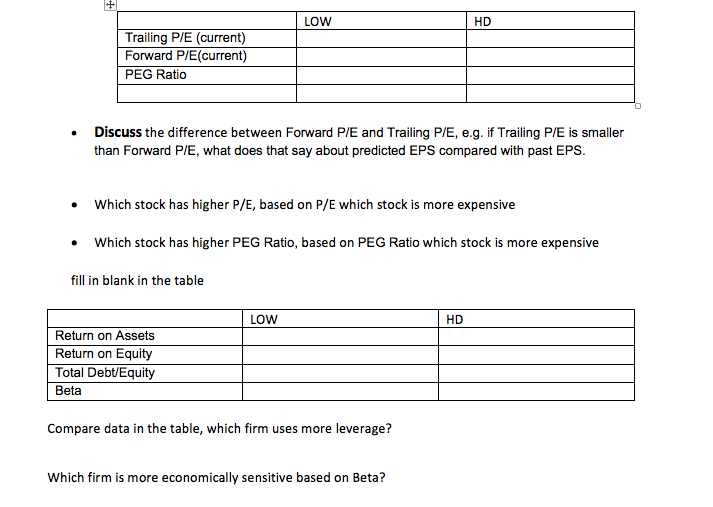

Question: | LOW HD Trailing P/E (current) Forward P/E(current) PEG Ratio Discuss the difference between Forward P/E and Trailing P/E, e.g. if Trailing P/E is smaller

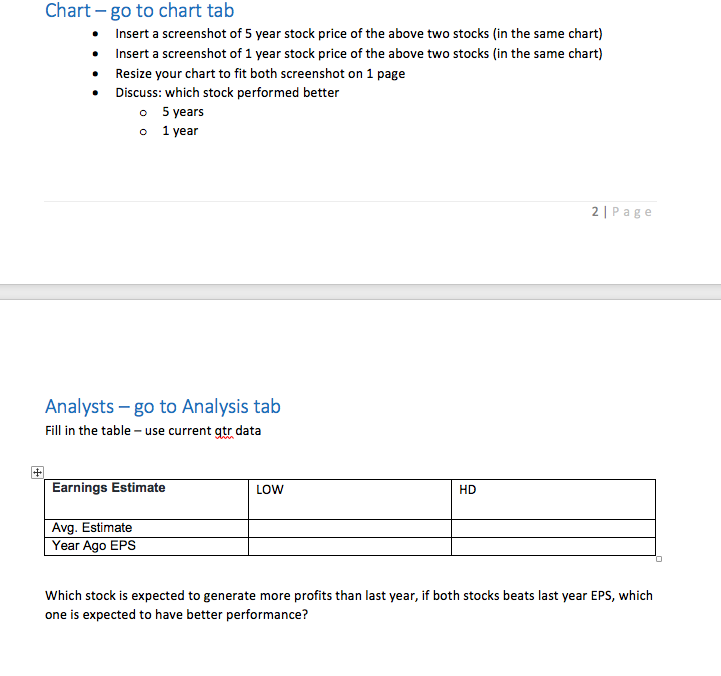

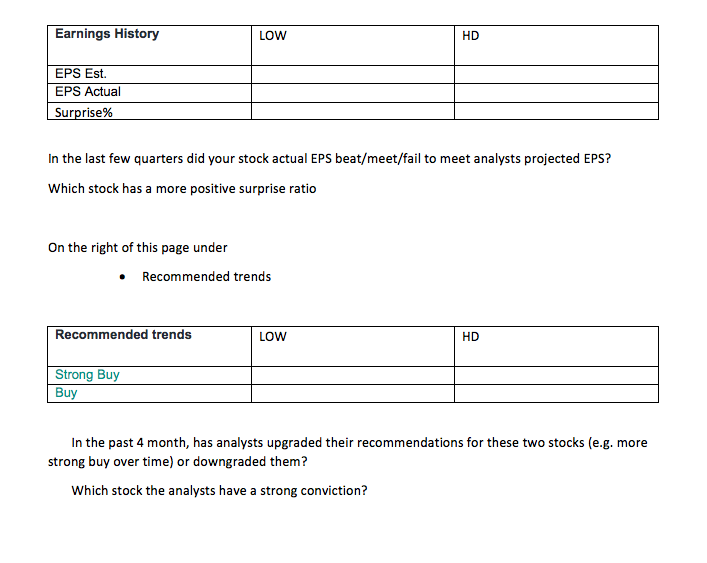

| LOW HD Trailing P/E (current) Forward P/E(current) PEG Ratio Discuss the difference between Forward P/E and Trailing P/E, e.g. if Trailing P/E is smaller than Forward P/E, what does that say about predicted EPS compared with past EPS. Which stock has higher P/E, based on P/E which stock is more expensive . Which stock has higher PEG Ratio, based on PEG Ratio which stock is more expensive fill in blank in the table LOW HD Return on Assets Return on Equity Total Debt/Equity Beta Compare data in the table, which firm uses more leverage? Which firm is more economically sensitive based on Beta? Chart - go to chart tab Insert a screenshot of 5 year stock price of the above two stocks (in the same chart) Insert a screenshot of 1 year stock price of the above two stocks (in the same chart) Resize your chart to fit both screenshot on 1 page Discuss: which stock performed better o 5 years o 1 year 2 Page Analysts - go to Analysis tab Fill in the table - use current gtr data Earnings Estimate LOW HD Avg. Estimate Year Ago EPS Which stock is expected to generate more profits than last year, if both stocks beats last year EPS, which one is expected to have better performance? | Earnings History LOW HD EPS Est EPS Actual Surprise % In the last few quarters did your stock actual EPS beat/meet/fail to meet analysts projected EPS? Which stock has a more positive surprise ratio On the right of this page under Recommended trends | Recommended trends LOW HD Strong Buy Buy In the past 4 month, has analysts upgraded their recommendations for these two stocks (e.g. more strong buy over time) or downgraded them? Which stock the analysts have a strong conviction? | LOW HD Trailing P/E (current) Forward P/E(current) PEG Ratio Discuss the difference between Forward P/E and Trailing P/E, e.g. if Trailing P/E is smaller than Forward P/E, what does that say about predicted EPS compared with past EPS. Which stock has higher P/E, based on P/E which stock is more expensive . Which stock has higher PEG Ratio, based on PEG Ratio which stock is more expensive fill in blank in the table LOW HD Return on Assets Return on Equity Total Debt/Equity Beta Compare data in the table, which firm uses more leverage? Which firm is more economically sensitive based on Beta? Chart - go to chart tab Insert a screenshot of 5 year stock price of the above two stocks (in the same chart) Insert a screenshot of 1 year stock price of the above two stocks (in the same chart) Resize your chart to fit both screenshot on 1 page Discuss: which stock performed better o 5 years o 1 year 2 Page Analysts - go to Analysis tab Fill in the table - use current gtr data Earnings Estimate LOW HD Avg. Estimate Year Ago EPS Which stock is expected to generate more profits than last year, if both stocks beats last year EPS, which one is expected to have better performance? | Earnings History LOW HD EPS Est EPS Actual Surprise % In the last few quarters did your stock actual EPS beat/meet/fail to meet analysts projected EPS? Which stock has a more positive surprise ratio On the right of this page under Recommended trends | Recommended trends LOW HD Strong Buy Buy In the past 4 month, has analysts upgraded their recommendations for these two stocks (e.g. more strong buy over time) or downgraded them? Which stock the analysts have a strong conviction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts