Question: Low leverage $ 1,000 $ 200 $ 800 $ 200 High leverag $ 1,000 $ 600 Project cost a) Debt b) Equity c) Revenue from

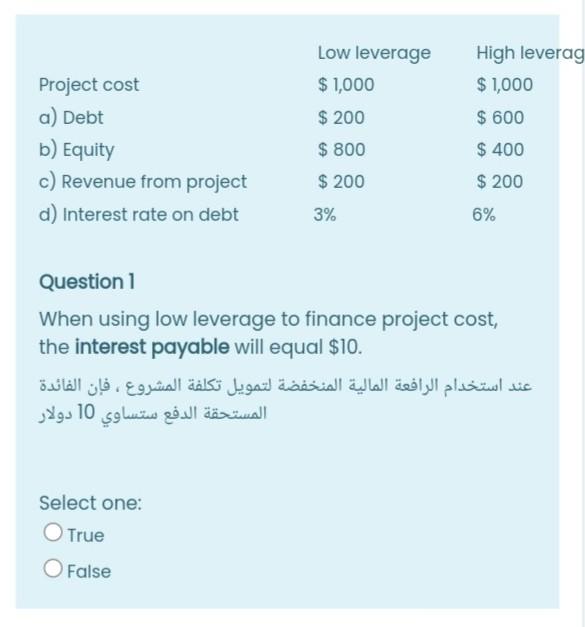

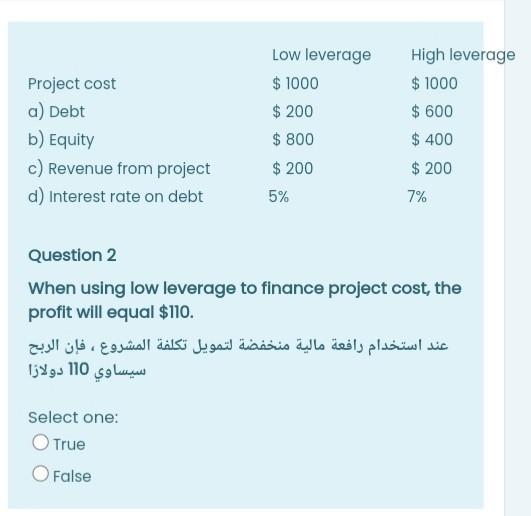

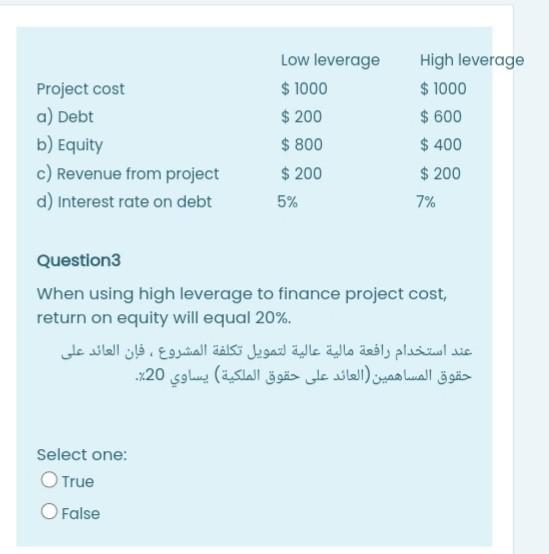

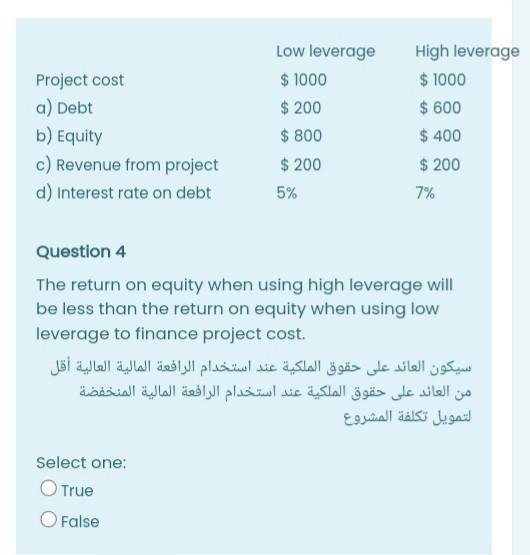

Low leverage $ 1,000 $ 200 $ 800 $ 200 High leverag $ 1,000 $ 600 Project cost a) Debt b) Equity c) Revenue from project d) Interest rate on debt $ 400 $ 200 3% 6% Question 1 When using low leverage to finance project cost, the interest payable will equal $10. 10 Select one: O True O False Low leverage $ 1000 $ 200 $ 800 $ 200 High leverage $ 1000 $ 600 Project cost a) Debt b) Equity c) Revenue from project d) Interest rate on debt $ 400 $ 200 7% 5% Question 2 When using low leverage to finance project cost, the profit will equal $110. . 110 Select one: True O False Project cost a) Debt b) Equity c) Revenue from project d) Interest rate on debt Low leverage $ 1000 $ 200 $ 800 $ 200 5% High leverage $ 1000 $ 600 $ 400 $ 200 7% Question3 When using high leverage to finance project cost, return on equity will equal 20%. ( ) 20%. Select one: True O False Project cost a) Debt b) Equity c) Revenue from project d) Interest rate on debt Low leverage $ 1000 $ 200 $ 800 $ 200 5% High leverage $ 1000 $ 600 $ 400 $ 200 7% Question 4 The return on equity when using high leverage will be less than the return on equity when using low leverage to finance project cost. Select one: O True O False

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock