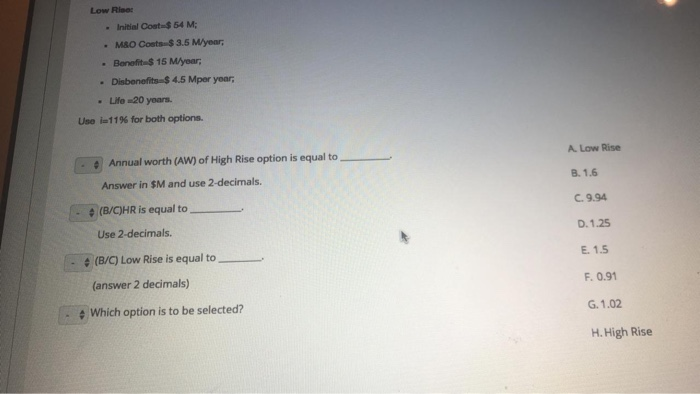

Question: Low Rive: . Initial Cost-$ 54 M; . MO Costs $3.5 Myear, Benefit-$ 15 M/year, Disbenefits $ 4.5 Mper year, Life 20 years. Une i=11%

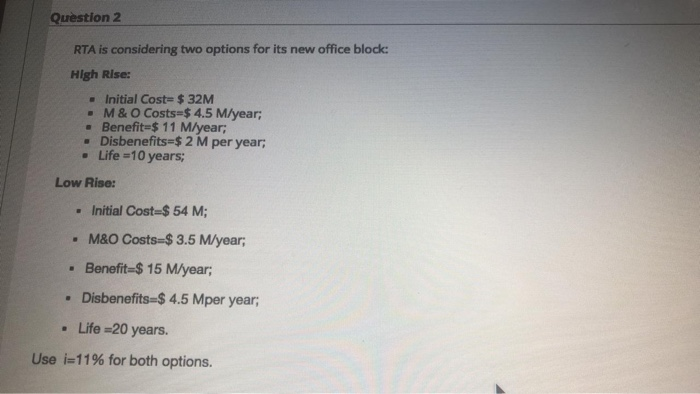

Low Rive: . Initial Cost-$ 54 M; . MO Costs $3.5 Myear, Benefit-$ 15 M/year, Disbenefits $ 4.5 Mper year, Life 20 years. Une i=11% for both options. A Low Rise Annual worth (AW) of High Rise option is equal to Answer in $M and use 2-decimals. B.1.6 (B/C)HR is equal to Use 2-decimals. C. 9.94 D. 1.25 E. 1.5 (B/C) Low Rise is equal to F. 0.91 (answer 2 decimals) G. 1.02 . Which option is to be selected? H. High Rise Question 2 RTA is considering two options for its new office block: High Rise: . Initial Cost=$ 32M . M & O Costs=$4.5 M/year; Benefit=$ 11 M/year; Disbenefits $2 M per year; Life =10 years; Low Rise: . Initial Cost=$ 54 M; M&O Costs=$ 3.5 M/year; Benefit=$ 15 M/year; Disbenefits-$ 4.5 Mper year, Life =20 years. Use i=11% for both options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts