Question: (Low value pool, asset with part private use) QUESTION 10.9 Scooby Montana is employed as a salesperson. Scooby uses a low value pool which, at

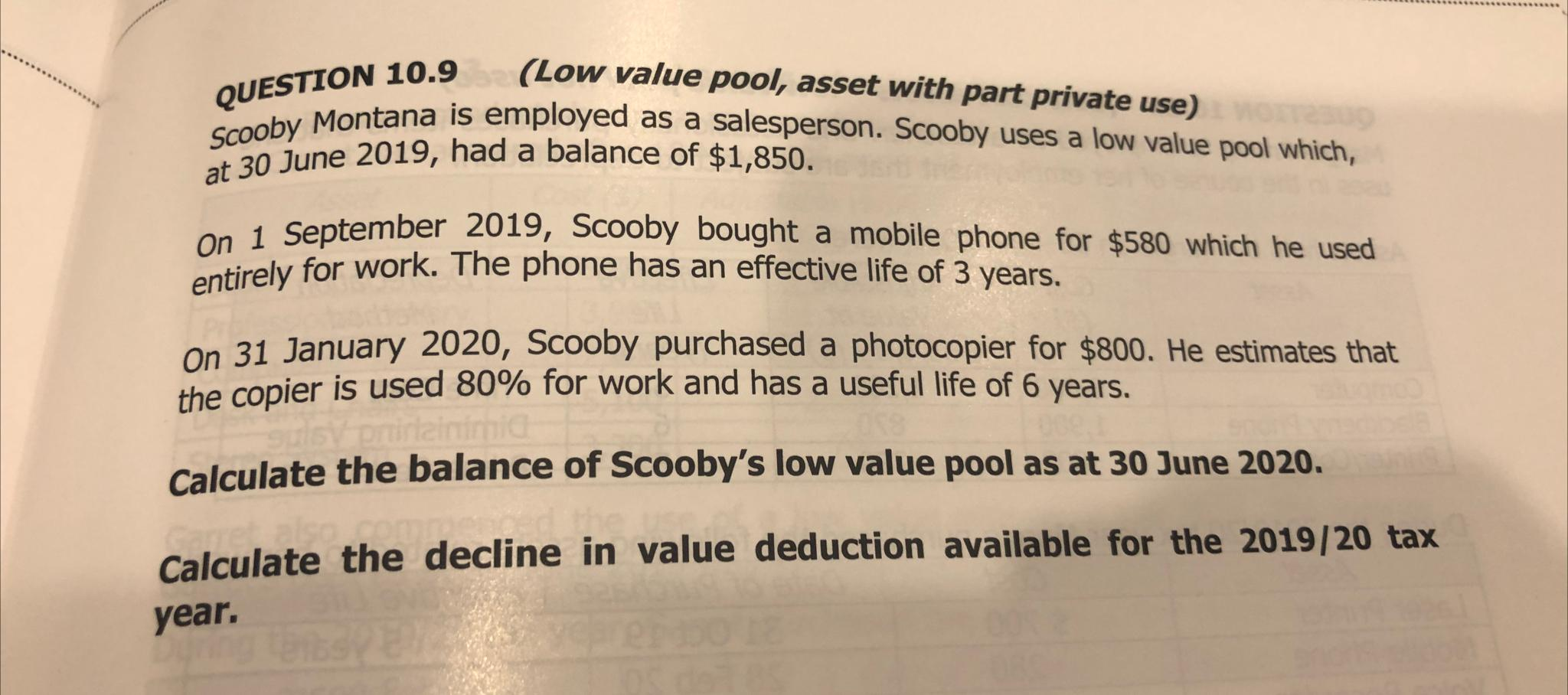

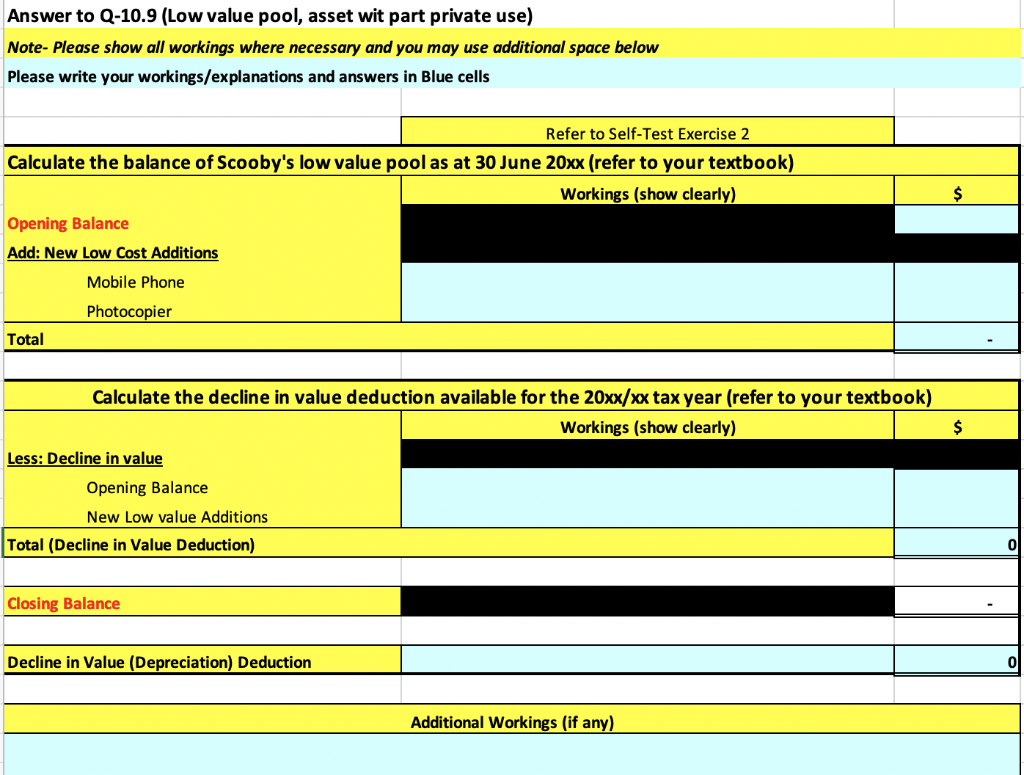

(Low value pool, asset with part private use) QUESTION 10.9 Scooby Montana is employed as a salesperson. Scooby uses a low value pool which, at 30 June 2019, had a balance of $1,850. entirely for work. The phone has an effective life of 3 years. on 1 September 2019, Scooby bought a mobile phone for $580 which he used On 31 January 2020, Scooby purchased a photocopier for $800. He estimates that the copier is used 80% for work and has a useful life of 6 years. Calculate the balance of Scooby's low value pool as at 30 June 2020. Calculate the decline in value deduction available for the 2019/20 tax year. Answer to Q-10.9 (Low value pool, asset wit part private use) Note- Please show all workings where necessary and you may use additional space below Please write your workings/explanations and answers in Blue cells Calculate the balance of Scooby's low value pool as Refer to Self-Test Exercise 2 30 June 20xx (refer to your textbook) Workings (show clearly) $ Opening Balance Add: New Low Cost Additions Mobile Phone Photocopier Total Calculate the decline in value deduction available for the 20xx/xx tax year (refer to your textbook) Workings (show clearly) $ Less: Decline in value Opening Balance New Low value Additions Total (Decline in Value Deduction) 0 Closing Balance Decline in Value (Depreciation) Deduction 0 Additional Workings (if any) (Low value pool, asset with part private use) QUESTION 10.9 Scooby Montana is employed as a salesperson. Scooby uses a low value pool which, at 30 June 2019, had a balance of $1,850. entirely for work. The phone has an effective life of 3 years. on 1 September 2019, Scooby bought a mobile phone for $580 which he used On 31 January 2020, Scooby purchased a photocopier for $800. He estimates that the copier is used 80% for work and has a useful life of 6 years. Calculate the balance of Scooby's low value pool as at 30 June 2020. Calculate the decline in value deduction available for the 2019/20 tax year. Answer to Q-10.9 (Low value pool, asset wit part private use) Note- Please show all workings where necessary and you may use additional space below Please write your workings/explanations and answers in Blue cells Calculate the balance of Scooby's low value pool as Refer to Self-Test Exercise 2 30 June 20xx (refer to your textbook) Workings (show clearly) $ Opening Balance Add: New Low Cost Additions Mobile Phone Photocopier Total Calculate the decline in value deduction available for the 20xx/xx tax year (refer to your textbook) Workings (show clearly) $ Less: Decline in value Opening Balance New Low value Additions Total (Decline in Value Deduction) 0 Closing Balance Decline in Value (Depreciation) Deduction 0 Additional Workings (if any)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts