Question: LP I. The Currency Exchange Planning Problem 1. How would the L.P. model related to this problem, the optimal solution and the optimal value be

LP

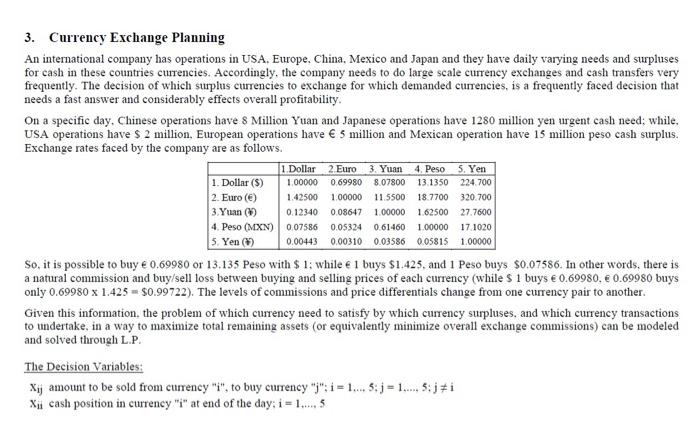

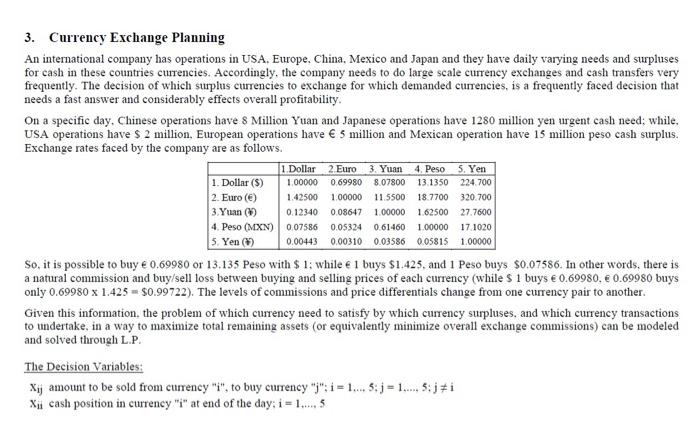

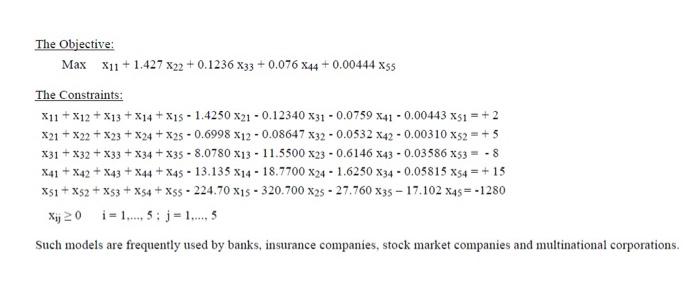

I. The Currency Exchange Planning Problem 1. How would the L.P. model related to this problem, the optimal solution and the optimal value be effected, after the following alterations additions? Regarding possible changes in the optimal solution and/or the optimal value, just state whether a change is expected or not, and the direction of the change if it is expected. i) An additional 0.5 % commission (or tax) being imposed on all currency exchange transactions? (For example, while originally 13.135 Peso were received in exchange for S 1, now 13.135 x 0.995 = 13.069 Peso would be received; equivalently, while S 0.07586 were received in exchange for 1 Peso, now 0.07586 x 0.995 - $ 0.07548 would be received) ii) As a measure against currency exchange risks, the company would like to follow a poliy of having its cash stocks in any currency not exceeding 40% of its total cash stocks, at end of any day. 1.00000 1.42500 1.00000 3. Currency Exchange Planning An international company has operations in USA. Europe. China, Mexico and Japan and they have daily varying needs and surpluses for cash in these countries curencies. Accordingly, the company needs to do large scale currency exchanges and cash transfers very frequently. The decision of which surplus currencies to exchange for which demanded currencies, is a frequently faced decision that needs a fast answer and considerably effects overall profitability. a On a specific day, Chinese operations have 8 Million Yuan and Japanese operations have 1280 million yen urgent cash need: while. USA operations have $ 2 million, European operations have 5 million and Mexican operation have 15 million peso cash surplus. Exchange rates faced by the company are as follows. 1 Dollar 2 Euro 3. Yuan 4. Peso 5. Yen 1. Dollar ($) 0699808.07800 13.1350 224.700 2. Euro () 1.00000 11.5500 18.7700 320.700 3. Yuan (C) 0.12340 0.08647 1.62500 27.7600 4. Peso (MXN) 0.07586 0.61460 1.00000 17.1020 5. Yen (1) 0.00443 0.00310 0.03586 0.05815 1.00000 So, it is possible to buy 0.69980 or 13.135 Peso with $ 1: while 1 buys $1.425. and 1 Peso buys $0.07586. In other words, there is a natural commission and buy sell loss between buying and selling prices of each currency (while $ 1 buys 0.69980. 0.69980 buys only 0.69980 X 1.425 - $0.99722). The levels of commissions and price differentials change from one currency pair to another. Given this information, the problem of which currency need to satisfy by which currency surpluses, and which currency transactions to undertake, in a way to maximize total remaining assets (or equivalently minimize overall exchange commissions) can be modeled and solved through L.P. The Decision Variables: Xij amount to be sold from currency "i", to buy currency"j"; i = 1....5: j = 1.5ji Xcash position in currency "i" at end of the day; i =1.....5 0.05324 The Objective: Max X11 +1.427 x22 +0.1236 X33 +0.076X44 +0.00444 Xss The Constraints: X11 + x12 + X13 + X14 + X15 - 1.4250 x21 - 0.12340 X31 - 0.0759 x41 -0.00443 x1 = + 2 X21 + X22 + X23 + x24 + X25 - 0.6998 X12 - 0.08647 X32 -0.0532 X42 -0.00310 Xs2 - +5 X31 + x32 + x33 + x34 + x35 - 8.0780 x13 - 11.5500 X23 - 0.6146 x43 -0.03586 X53 = -8 X41 + x42 + X43 +244 + X45 - 13.135 X14 - 18.7700 X24 - 1.6250 X34 -0.05815 854 = + 15 X51 + X$2 +X53 +354 + X55 - 224.70 X15 - 320.700 X25 - 27.760 X35 - 17.102 x45=-1280 i = 1.....5: j = 1.....5 Such models are frequently used by banks, insurance companies, stock market companies and multinational corporations. Xij 20 I. The Currency Exchange Planning Problem 1. How would the L.P. model related to this problem, the optimal solution and the optimal value be effected, after the following alterations additions? Regarding possible changes in the optimal solution and/or the optimal value, just state whether a change is expected or not, and the direction of the change if it is expected. i) An additional 0.5 % commission (or tax) being imposed on all currency exchange transactions? (For example, while originally 13.135 Peso were received in exchange for S 1, now 13.135 x 0.995 = 13.069 Peso would be received; equivalently, while S 0.07586 were received in exchange for 1 Peso, now 0.07586 x 0.995 - $ 0.07548 would be received) ii) As a measure against currency exchange risks, the company would like to follow a poliy of having its cash stocks in any currency not exceeding 40% of its total cash stocks, at end of any day. 1.00000 1.42500 1.00000 3. Currency Exchange Planning An international company has operations in USA. Europe. China, Mexico and Japan and they have daily varying needs and surpluses for cash in these countries curencies. Accordingly, the company needs to do large scale currency exchanges and cash transfers very frequently. The decision of which surplus currencies to exchange for which demanded currencies, is a frequently faced decision that needs a fast answer and considerably effects overall profitability. a On a specific day, Chinese operations have 8 Million Yuan and Japanese operations have 1280 million yen urgent cash need: while. USA operations have $ 2 million, European operations have 5 million and Mexican operation have 15 million peso cash surplus. Exchange rates faced by the company are as follows. 1 Dollar 2 Euro 3. Yuan 4. Peso 5. Yen 1. Dollar ($) 0699808.07800 13.1350 224.700 2. Euro () 1.00000 11.5500 18.7700 320.700 3. Yuan (C) 0.12340 0.08647 1.62500 27.7600 4. Peso (MXN) 0.07586 0.61460 1.00000 17.1020 5. Yen (1) 0.00443 0.00310 0.03586 0.05815 1.00000 So, it is possible to buy 0.69980 or 13.135 Peso with $ 1: while 1 buys $1.425. and 1 Peso buys $0.07586. In other words, there is a natural commission and buy sell loss between buying and selling prices of each currency (while $ 1 buys 0.69980. 0.69980 buys only 0.69980 X 1.425 - $0.99722). The levels of commissions and price differentials change from one currency pair to another. Given this information, the problem of which currency need to satisfy by which currency surpluses, and which currency transactions to undertake, in a way to maximize total remaining assets (or equivalently minimize overall exchange commissions) can be modeled and solved through L.P. The Decision Variables: Xij amount to be sold from currency "i", to buy currency"j"; i = 1....5: j = 1.5ji Xcash position in currency "i" at end of the day; i =1.....5 0.05324 The Objective: Max X11 +1.427 x22 +0.1236 X33 +0.076X44 +0.00444 Xss The Constraints: X11 + x12 + X13 + X14 + X15 - 1.4250 x21 - 0.12340 X31 - 0.0759 x41 -0.00443 x1 = + 2 X21 + X22 + X23 + x24 + X25 - 0.6998 X12 - 0.08647 X32 -0.0532 X42 -0.00310 Xs2 - +5 X31 + x32 + x33 + x34 + x35 - 8.0780 x13 - 11.5500 X23 - 0.6146 x43 -0.03586 X53 = -8 X41 + x42 + X43 +244 + X45 - 13.135 X14 - 18.7700 X24 - 1.6250 X34 -0.05815 854 = + 15 X51 + X$2 +X53 +354 + X55 - 224.70 X15 - 320.700 X25 - 27.760 X35 - 17.102 x45=-1280 i = 1.....5: j = 1.....5 Such models are frequently used by banks, insurance companies, stock market companies and multinational corporations. Xij 20

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock