Question: LR Problem ARB-55 Given: A zero coupon bond maturing in one year (time T) with a maturity value $1. XYZ stock. It will not pay

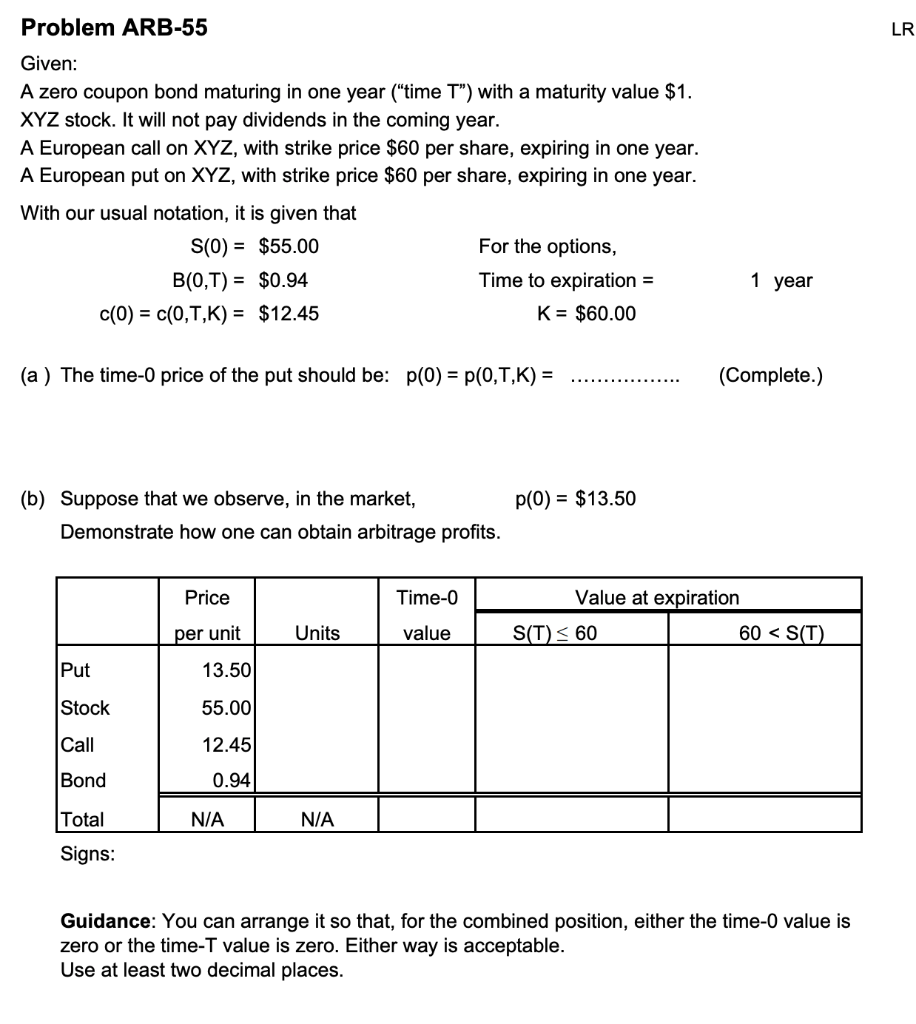

LR Problem ARB-55 Given: A zero coupon bond maturing in one year ("time T") with a maturity value $1. XYZ stock. It will not pay dividends in the coming year. A European call on XYZ, with strike price $60 per share, expiring in one year. A European put on XYZ, with strike price $60 per share, expiring in one year. With our usual notation, it is given that S(0) = $55.00 For the options, B(0,T) = $0.94 Time to expiration = c(0) = c(0,T,K) = $12.45 K = $60.00 1 year (a ) The time-o price of the put should be: p(0) = P(0,1,K) = (Complete.) p(0) = $13.50 (b) Suppose that we observe, in the market, Demonstrate how one can obtain arbitrage profits. Price Time-o Value at expiration S(T)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts