Question: Lu Inbox X Lu Topic: Discussion X BMAL 560 - Critic X * Aries Weekly Hor X Lu Homework: What X Question 5 - Hon

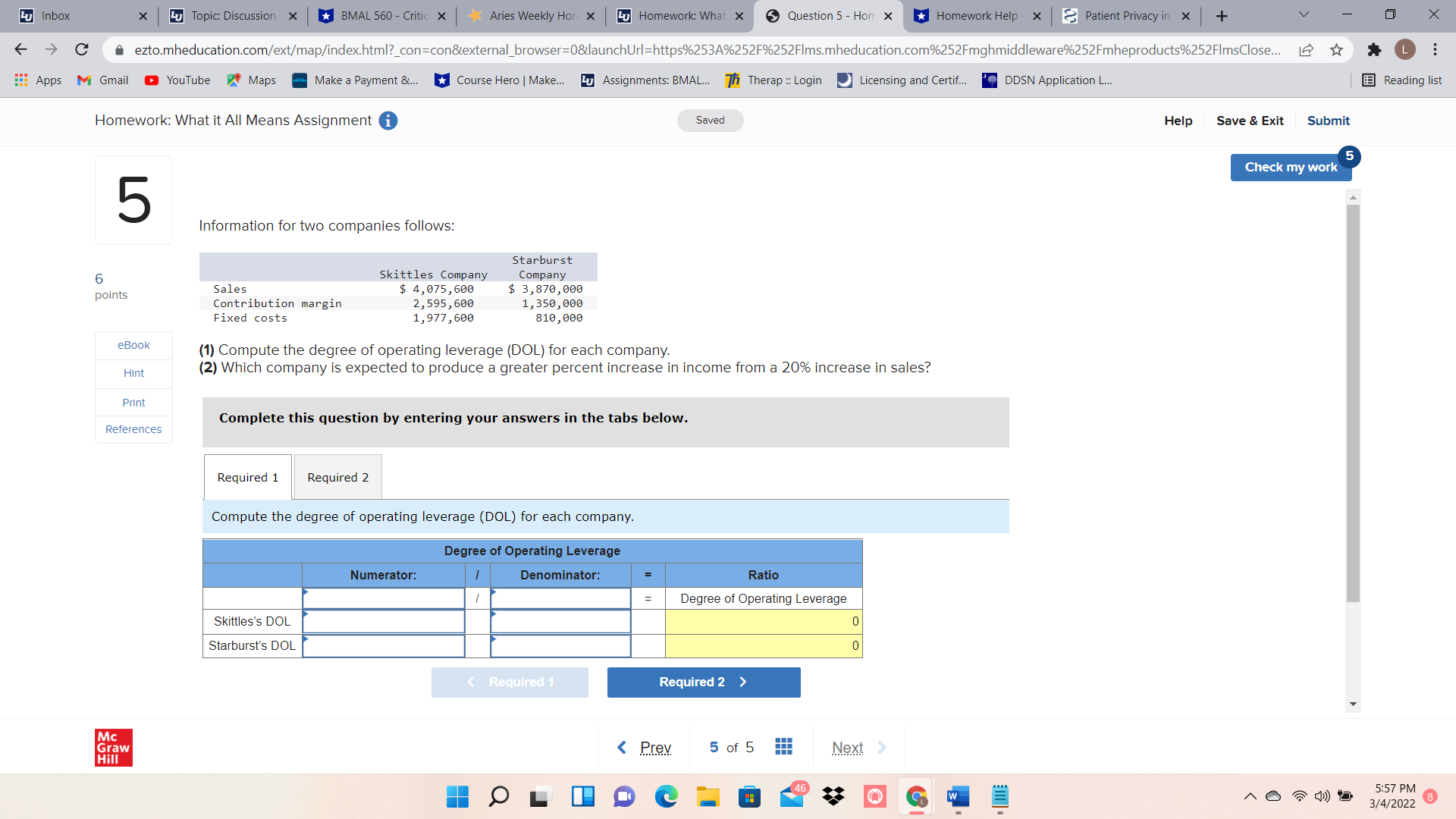

Lu Inbox X Lu Topic: Discussion X BMAL 560 - Critic X * Aries Weekly Hor X Lu Homework: What X Question 5 - Hon X *Homework Help X Patient Privacy in X + V X -> C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252FIms.mheducation.com%252Fmghmiddleware%252Fmheproducts%252FImsClose... :: Apps M Gmail YouTube Maps Make a Payment &... Course Hero | Make... Lu Assignments: BMAL... Th Therap : Login Licensing and Certif... DDSN Application L... Reading list Homework: What it All Means Assignment i Saved Help Save & Exit Submit Check my work 5 Information for two companies follows: Starburst 6 Skittles Company Company points Sales $ 4, 075, 600 $ 3, 870,000 Contribution margin 2, 595, 600 1, 350, 000 Fixed costs 1, 977, 600 810, 000 eBook (1) Compute the degree of operating leverage (DOL) for each company. Hint (2) Which company is expected to produce a greater percent increase in income from a 20% increase in sales? Print Complete this question by entering your answers in the tabs below. References Required 1 Required 2 Compute the degree of operating leverage (DOL) for each company. Degree of Operating Leverage Numerator: Denominator: = Ratio = Degree of Operating Leverage Skittles's DOL Starburst's DOL Mc Graw Hill 46 W E 5:57 PM 3/4/2022 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts