Question: Lucky, LLC, has four members: Amber, Brandon, Crystal, and Drew. Amber and Brandon each contributed $30,000, and Crystal and Drew each contributed $50,000 to form

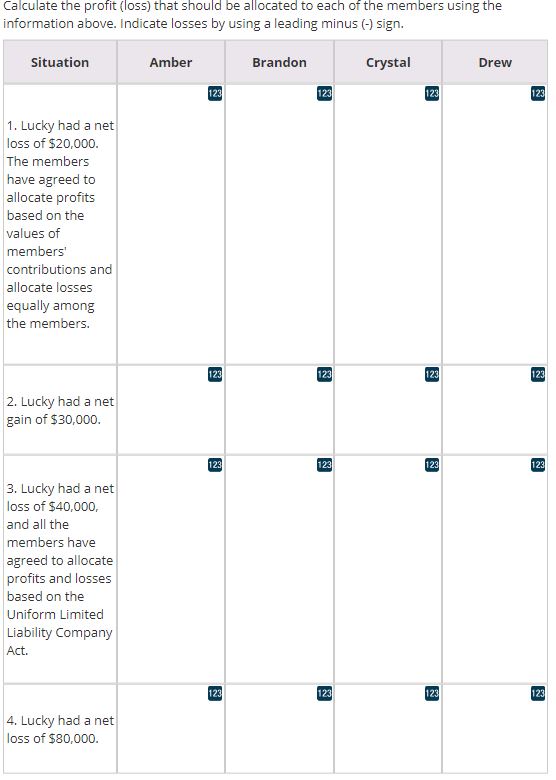

Lucky, LLC, has four members: Amber, Brandon, Crystal, and Drew. Amber and Brandon each contributed $30,000, and Crystal and Drew each contributed $50,000 to form the company. Profits and losses are shared based on the values of members' contributions, unless stated otherwise. Calculate the profit (loss) that should be allocated to each of the members using the information above. Indicate losses by using a leading minus (-) sign.

Situation

1. Lucky had a net loss of $20,000. The members have agreed to allocate profits based on the values of members' contributions and allocate losses equally among the members.

2. Lucky had a net gain of $30,000.

3. Lucky had a net loss of $40,000, and all the members have agreed to allocate profits and losses based on the Uniform Limited Liability Company Act.

4. Lucky had a net loss of $80,000.

Calculate the profit (loss) that should be allocated to each of the members using the information above. Indicate losses by using a leading minus (-) sign. Situation 1. Lucky had a net loss of $20,000. The members have agreed to allocate profits based on the values of members' contributions and allocate losses equally among the members. 2. Lucky had a net gain of $30,000. 3. Lucky had a net loss of $40,000, and all the members have agreed to allocate profits and losses based on the Uniform Limited Liability Company Act. 4. Lucky had a net loss of $80,000. Amber 123 Brandon Crystal 123 123 Drew 123 123 123 123 123 123 123 123 123 123 123 123 123

Step by Step Solution

There are 3 Steps involved in it

Member Contributions Amber 30000 Brandon 30000 Crystal 50000 Drew 50000 Total Contributions 160000 Allocation Method Profits Based on the values of me... View full answer

Get step-by-step solutions from verified subject matter experts