Question: LUDO What are the two p a mins the capis 7795717 What are the two projects IER? India Problems 8-20 108 Edelmanngineering is considering including

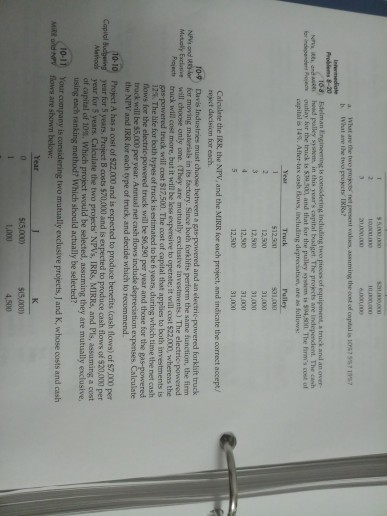

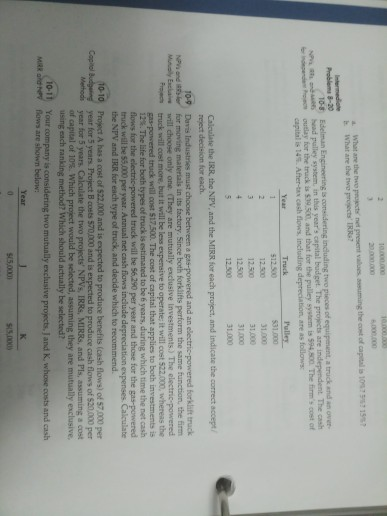

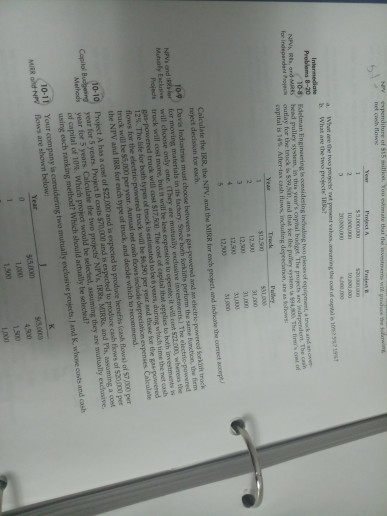

LUDO What are the two p a mins the capis 7795717 What are the two projects IER? India Problems 8-20 108 Edelmanngineering is considering including two pieces of equipment, rick and an over th, and head pulley in this was capital de The projects are independent. The cash for independent Project outlay for the truck is $400 and that for the pulley is on the im's cost of capital is 149. Ale baxcash flows, including depreciation are as follows: Truck 512.500 53,000 12,500 31,000 Pulley 12.500 12.500 31,000 31,000 Calculate the IRR, the NPV and the MIRR for each project and indicate the correct accept reject decision for each 10.9 Davis Industries must choose between a gas-powered and an electric powered forklift truck N ond for for moving materials in its factory. Since both forklifts perform the same function, the firm Mutuely Eat will choose only one. They are mutually exclusive investinents. The electric powered che truck will cost more, but it will be less expensive to operate; it will cost $22000, whereas the 945-powered truck will cost $17.500. The cost of capital that applies to both investments is 12. The life for both types of truck is estimated to be years, during which time the net cash Tlows for the electric powered truck will be $0,20 per year and those for the pas-powered truck will be 35.000 per year. Annual net cash flows include depreciation expenses. Calculate the NPV and IRR for each type of truck, and decide which to recommend 10-10 Project A has a cost of $72,000 and is expected to produce benefits (cash flows) of $7.000 per Capital ding year for 5 years Project B costs $70,000 and is expected to produce cash flows of 1,000 per Mahas year for 5 years. Calculate the two projects' NPVS, IRRS, MIRRS, and Pis, assuming a cust of capital of 10 Which project would be selected, assuming they are mutually exclusive, using each ranking method? Which should actually be selected? 10-1 Your company is considering two mutually exclusive projects. J and K, whose costs and cash MIRKOND NY Pows are shown below: Year 505000) 50.000) LOOK 4.500 10 100 22000 . . What are the potent present assuming the cost of capital 100 What are the two TRT 1551 endir 10-8 Edelman Engine condering including two pieces of equipment truck and had pulley System in this year's capital budget. The projects are independent. The cash outlay for the truck is 19500 and that for the pulley system is 59.500 The cost of capital is 145. After-tax cash flows including depreciation are as follows Truck Hulle 512 500 331.000 12.500 31.000 12.500 31.000 12.500 31.000 12.500 31.000 NPond 10-9 o r Calculate the IRR the NPV, and the MIRR for each project, and indicate the correct accept Teiect decision for each Davis Industries must choose between a gas-powered and an electric powered for it truck for moving materials in its factory. Since both forklifts perform the same function, the firm will choose only one. They are mutually exclusive Investments) The electric powered truck will cost more, but it will be less expensive to operate; it will cost 522,000 whereas the gas-powered truck will cost $17.500. The cost of capital that applies to both investments is 12. The life for both types of truck is estimated to be years, during which time the net cash flows for the electric powered truck will be 56,250 per year and those for the gas-powered truck will be 55.000 per year. Annual net cash flows include depreciation expenses. Calculate the NPV and IRR for each type of truck and decide which to recommend Project A has a cost of $2.000 and is expected to produce benefits (cash flows) of 57.000 per year for 5 years. Project B costs 5000 and is expected to produce cash flows of 5 0 per year for 5 years Calculate the two projects NPV, RR, MIRRS, and Pls, assuming a cost of capital of 107. Which project would be selected, assuming they are mutually exclusive, using och ranking method? Which should actually be selected? Your company is considering two mutually exclusive projects. J and K, whose costs and cash ows are shown below 10-10 Copco Budgering Methods 10-11 MR N $5,000 $15.000 B000 What the wap wat povest i 10 What are the two projects Intermediate Problems 8-70 10-8 Edelman Engineering considering in two people track NPVA R O MARSed pulley System. In this year's opal budget. The propere depende for independent o utlay for the s a nd that the pury wystem 990 The capital is 14. After-tax cash mdg deretana $12.500 12.50 Calculate the IRR NPV, and the MIRR Irench proget, d e themet 10 Davis Industries must choose between NPV and powered and hot for movins materials in its factory Smooth o checte powered to track p en M oly Lace will choose only one. They are mutually the same function them sevents. The electate power Palettruck will cost more, but it will be less expensive to operate it will w as the - powered truck will cost $17.00. Then of capital that applies to both etmen 129. The lide for both types of track is estimated to be hea ring which time the cash flows for the electric powered truck will be a peryod those for the powered truck will be s per year. Annual net shows include depreciation expertes Calculate the NPV and IRR for exch type of cand decide which med 10-10 Project A has a cost of $22. and is expected to produce benc h flows o p er Capitol Bucing year for 5 years. Project costs 50.000 and is expected to produce cash oso n o per Methods year for 5 years Calculate the two projects' NIVERRA, MIRRS, and s t anga od capital of 10 Which pript would be selected assuming they are w ally due using each ranking methodWhich should actually be selected whose costs and cash 10-11 Your company is considering to mutually exchisive projects, and MERON fws are shown below Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts