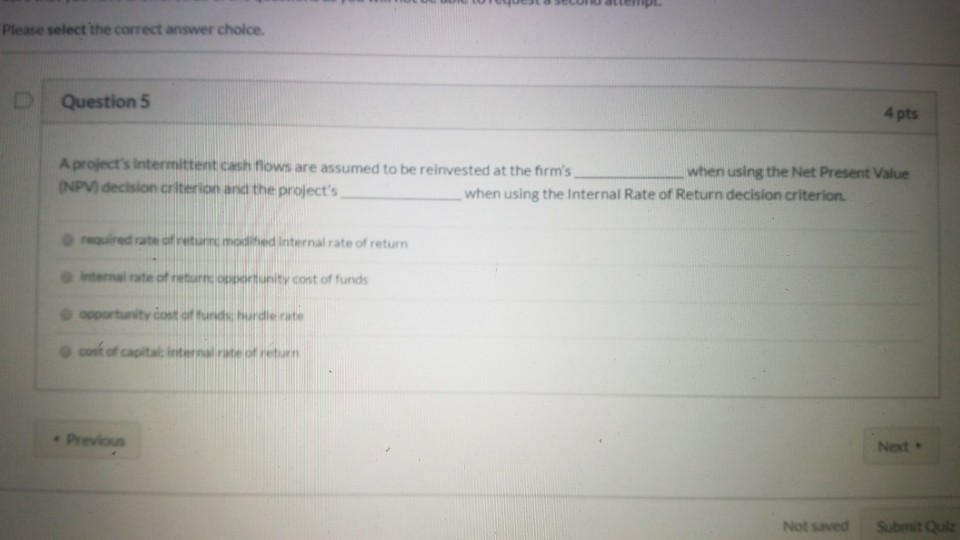

Question: LUULELE Please select the correct answer choice. Question 5 4 pts A project's intermittent cash flows are assumed to be reinvested at the firm's when

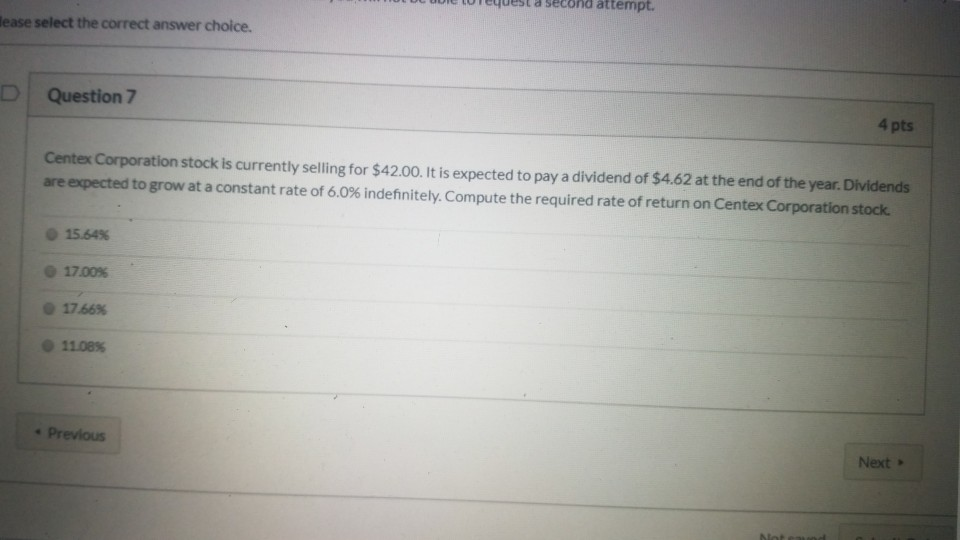

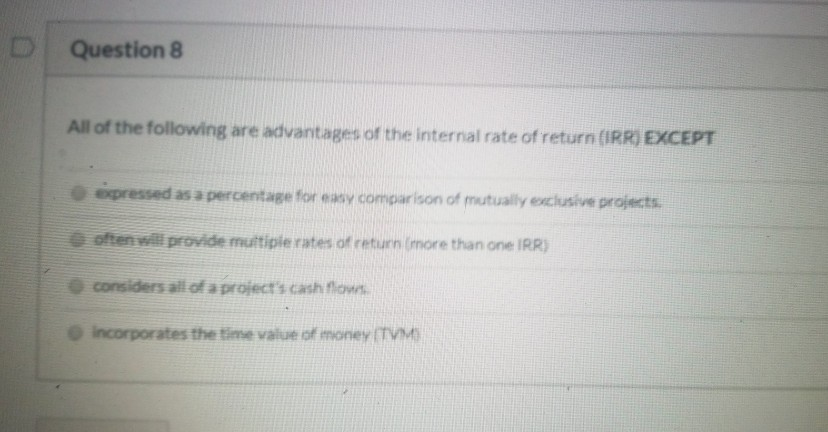

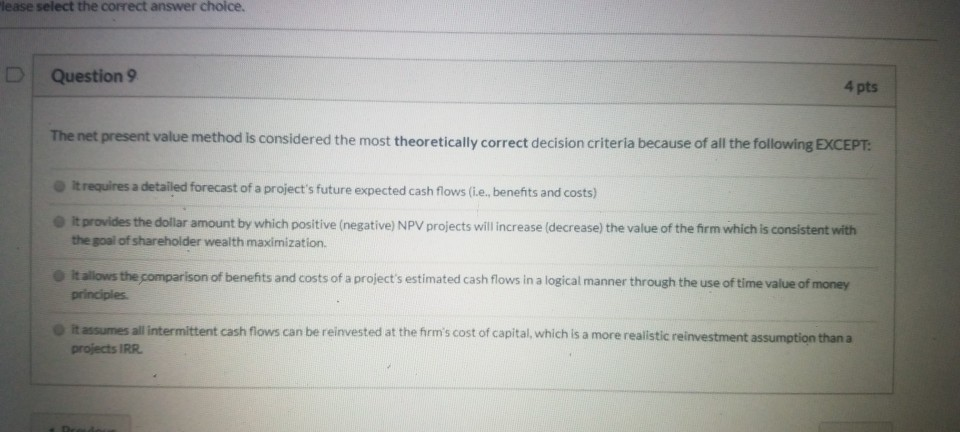

LUULELE Please select the correct answer choice. Question 5 4 pts A project's intermittent cash flows are assumed to be reinvested at the firm's when using the Net Present Value (NPV) decision criterion and the project's when using the Internal Rate of Return decision criterion required torture modified Internal rate of return Internal rate of return opportunity cost of funds opportunity cost of funds hurdle rate cost of capitaine eturn Previous Next Not saved Submit Quiz reyesla se oleme -ase select the correct answer choice. Question 7 4 pts Centex Corporation stock is currently selling for $42.00. It is expected to pay a dividend of $4.62 at the end of the year. Dividends are expected to grow at a constant rate of 6.0% indefinitely. Compute the required rate of return on Centex Corporation stock. 15.64% 17.0055 17.66% 11085 Previous Next Question 8 All of the following are advantages of the internal rate of return (IRR) EXCEPT expressed as a percentage for easy comparison of mutually exclusive projects. often will provide multiple rates of return (more than one IRR) considers all of a project's cash flows incorporates the time value of money (TVM) ect the correct answer choice. Question 9 4 pts The net present value method is considered the most theoretically correct decision criteria because of all the following EXCEPT: it requires a detailed forecast of a project's future expected cash flows (i.e., benefits and costs) it provides the dollar amount by which positive (negative) NPV projects will increase (decrease) the value of the firm which is consistent with the goal of shareholder wealth maximization itallows the comparison of benefits and costs of a project's estimated cash flows in a logical manner through the use of time value of money principles it assumes all intermittent cash flows can be reinvested at the firm's cost of capital, which is a more realistic reinvestment assumption than a projects IRR LUULELE Please select the correct answer choice. Question 5 4 pts A project's intermittent cash flows are assumed to be reinvested at the firm's when using the Net Present Value (NPV) decision criterion and the project's when using the Internal Rate of Return decision criterion required torture modified Internal rate of return Internal rate of return opportunity cost of funds opportunity cost of funds hurdle rate cost of capitaine eturn Previous Next Not saved Submit Quiz reyesla se oleme -ase select the correct answer choice. Question 7 4 pts Centex Corporation stock is currently selling for $42.00. It is expected to pay a dividend of $4.62 at the end of the year. Dividends are expected to grow at a constant rate of 6.0% indefinitely. Compute the required rate of return on Centex Corporation stock. 15.64% 17.0055 17.66% 11085 Previous Next Question 8 All of the following are advantages of the internal rate of return (IRR) EXCEPT expressed as a percentage for easy comparison of mutually exclusive projects. often will provide multiple rates of return (more than one IRR) considers all of a project's cash flows incorporates the time value of money (TVM) ect the correct answer choice. Question 9 4 pts The net present value method is considered the most theoretically correct decision criteria because of all the following EXCEPT: it requires a detailed forecast of a project's future expected cash flows (i.e., benefits and costs) it provides the dollar amount by which positive (negative) NPV projects will increase (decrease) the value of the firm which is consistent with the goal of shareholder wealth maximization itallows the comparison of benefits and costs of a project's estimated cash flows in a logical manner through the use of time value of money principles it assumes all intermittent cash flows can be reinvested at the firm's cost of capital, which is a more realistic reinvestment assumption than a projects IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts