Question: Ly Final Test ~ Lyryx Learning Inc - Google Chrome X lifa1.lyryx.com/quiz-servlets/QuizServlet?ccid=11218 Andrew Martin, Jan Taylor, and Bonnie Northrup invested $90,000, $60,000, and $150,000, respectively

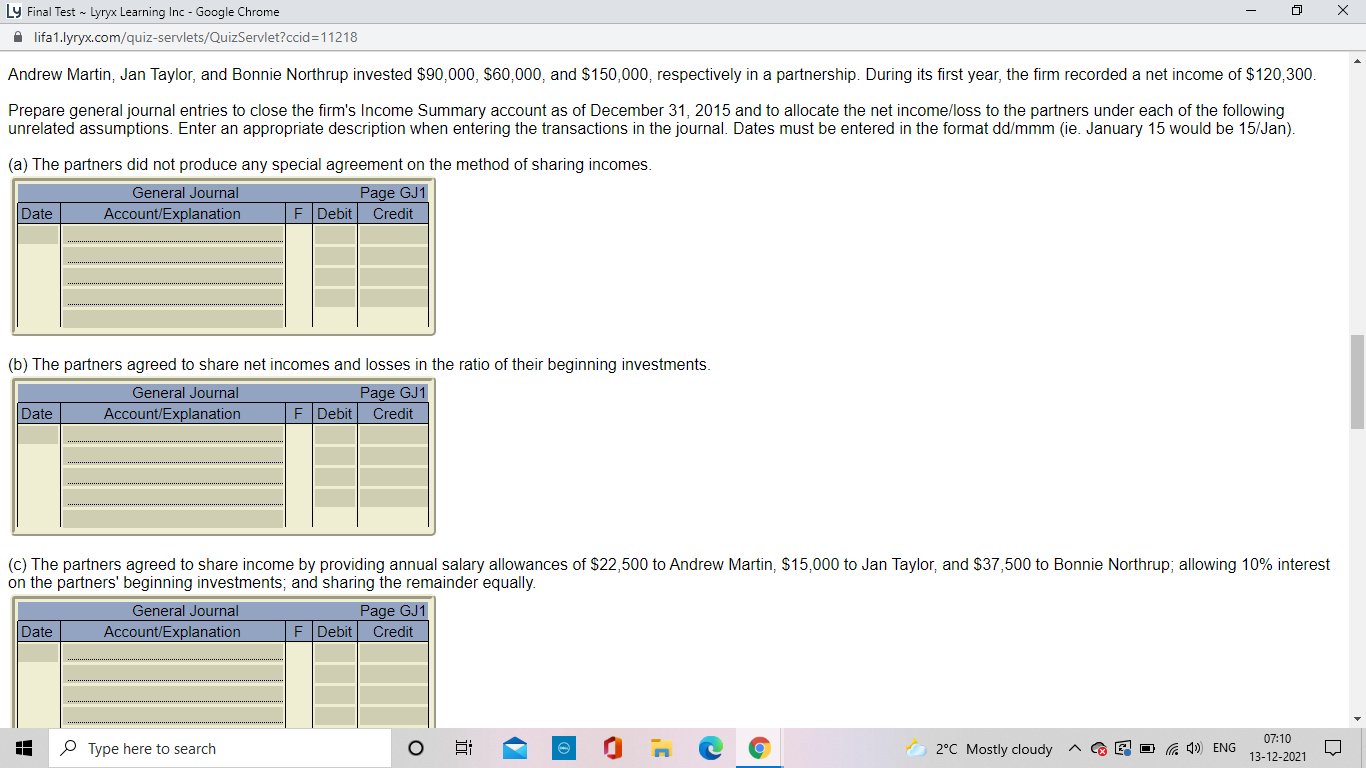

Ly Final Test ~ Lyryx Learning Inc - Google Chrome X lifa1.lyryx.com/quiz-servlets/QuizServlet?ccid=11218 Andrew Martin, Jan Taylor, and Bonnie Northrup invested $90,000, $60,000, and $150,000, respectively in a partnership. During its first year, the firm recorded a net income of $120,300. Prepare general journal entries to close the firm's Income Summary account as of December 31, 2015 and to allocate the net income/loss to the partners under each of the following unrelated assumptions. Enter an appropriate description when entering the transactions in the journal. Dates must be entered in the format dd/mmm (ie. January 15 would be 15/Jan). (a) The partners did not produce any special agreement on the method of sharing incomes. General Journal Page GJ1 Date Account/Explanation F |Debit Credit (b) The partners agreed to share net incomes and losses in the ratio of their beginning investments. General Journal Page GJ1 Date Account/Explanation F |Debit Credit (c) The partners agreed to share income by providing annual salary allowances of $22,500 to Andrew Martin, $15,000 to Jan Taylor, and $37,500 to Bonnie Northrup; allowing 10% interest on the partners' beginning investments; and sharing the remainder equally. General Journal Page GJ1 Date Account/Explanation F Debit Credit Type here to search O 2'C Mostly cloudy ^ ( @ D (() ENG 07:10 13-12-2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts