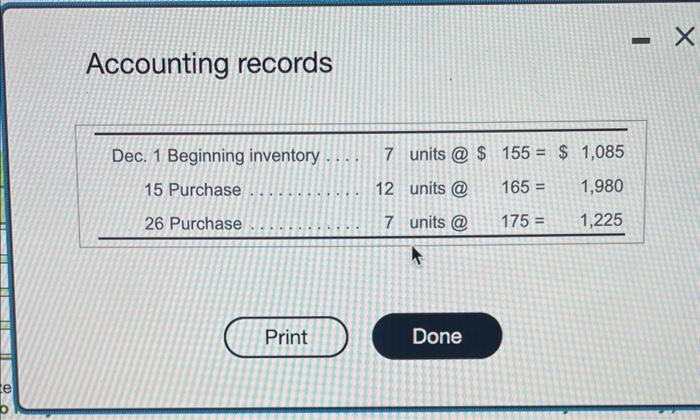

Question: Lyndheint Inc. inventory tecords for a particular development progran show the folowing at Decomber 31, 2020 : Fif8 (Click the leon to vlew the accounting

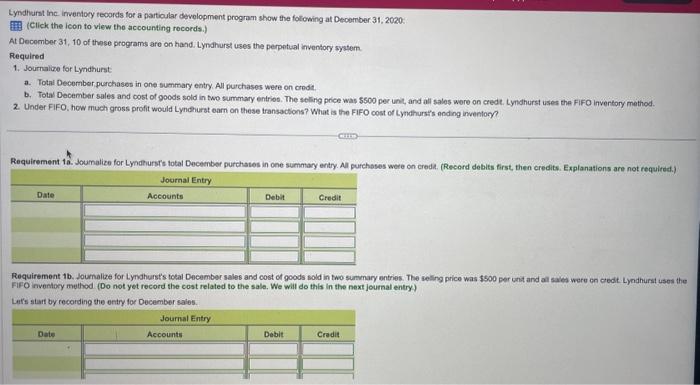

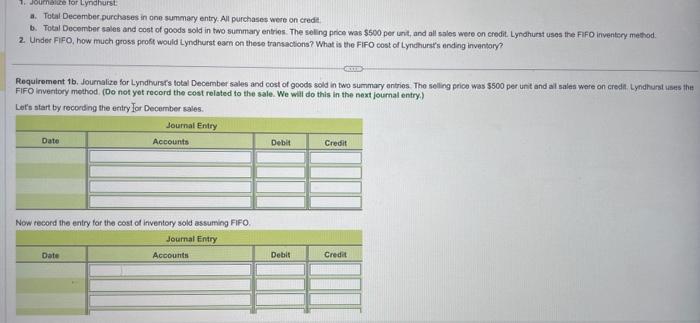

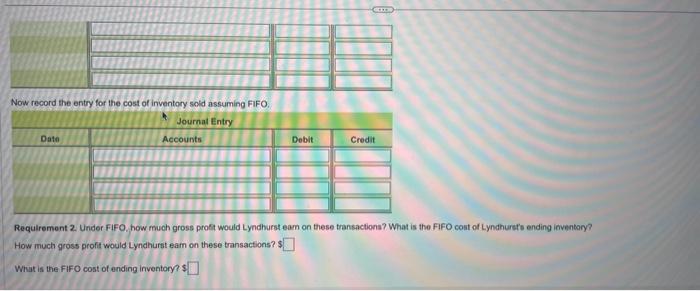

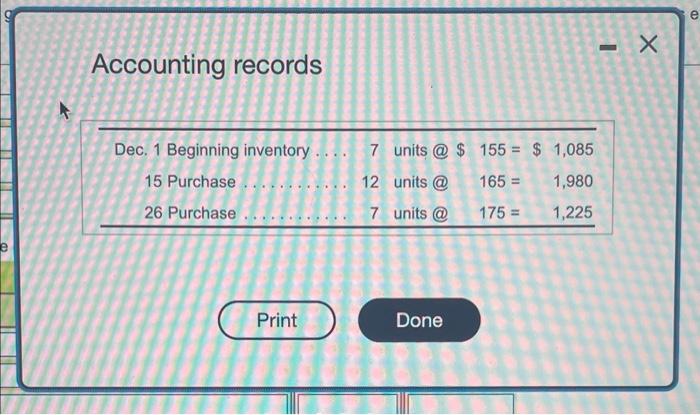

Lyndheint Inc. inventory tecords for a particular development progran show the folowing at Decomber 31, 2020 : Fif8 (Click the leon to vlew the accounting rocords.) At December 31, 10 of these programs are on hand. Lynahurst uses the perpntual inventory system. Required 1. Journaice for Lyndhurst a. Total December, purchases in one summary entry. All purchases were on credt. b. Total December sales and cost of goods sold in two summary entrioe. The seling price was 5500 per unit, and all sales were on credt. Lyndhurst uses the FIFO invertary mathod. 2. Under FIFO, how much gross profit would Lynchurat eam on these transactions? What is the FIFO cost of Lynahurst's noding inwentory? Requirement 1a. Joumalize for Lyndhurst's total Deceenber purchates in one summary entry. All purchases were on creda. (Record debits first, then credits. Explanations are not requited.) Requirement tb. Joumalize for Lyndhurst's total December sales and cost of goods sold in two surknary ontries. The seling price was $500 per unit and ail saies were en cedt Lyndhurst ises the FiFO inventory method. (Do not yet record the cost related to the sale. We will do this in the next journal entry) Lits start by recording the entry for December sales. a. Total December purchases in one summary entry. All purchases were on credt, b. Total December sales and coot of goods sold in two summary entries. The soling price was 5500 per unt, and all soles were on credit. Lynahurst uses the Fifo inventery method. 2. Under FIFO, how much gross proft would Lyndhurat eacn on these transactions? What is the FIFO cost of Lynchurst's anding inventory? Requirement 16 . Journalize for Lyndhurs's total December sales and cost of goods sold in two summary ontries. The seling prico was $500 per unit and al sales were on credit. Lyndhurst uses the FIFO inveritory method. (Do not yot record the cost related to the sale. We will do this in the next joumal entry) Let's start by recording the entry for December sales. Now recond the entry for the cost of inventory sold assuming FIFO. Now record the entry for the cost of inventory soid assuming FIFO. Requirement 2. Under FiFO, how much gross proft would Lyndhurst eam on these transactions? What is the FIFO colt of Lyndhursts ending inventary? How much gross profit would Lyndhurst eam on these transactions? $ What is the FIFO cost of ending inventory? $ Accounting records Accounting records

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts