Question: Lyrtricks Ltd. which has a December 31 year end, had the following transactions in December 2020 and January 2021: 2020 Dec. 1 Dec 31 The

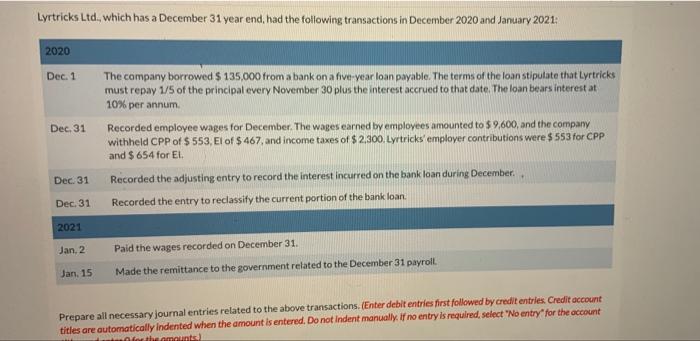

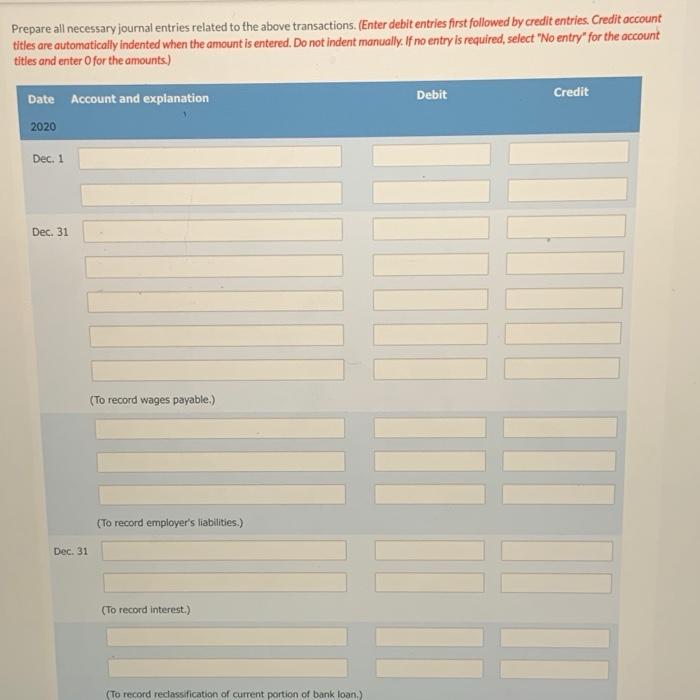

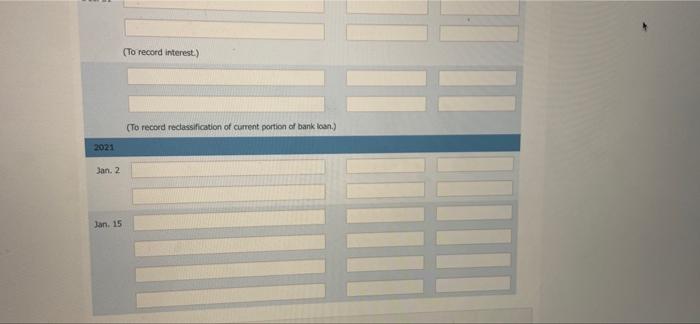

Lyrtricks Ltd. which has a December 31 year end, had the following transactions in December 2020 and January 2021: 2020 Dec. 1 Dec 31 The company borrowed $ 135,000 from a bank on a five-year loan payable. The terms of the loan stipulate that Lyrtricks must repay 1/5 of the principal every November 30 plus the interest accrued to that date The loan bears interest at 10% per annum Recorded employee wages for December. The wages earned by employees amounted to $ 9,600, and the company withheld CPP of $ 553, El of $ 467, and income taxes of $ 2.300. Lyrtricks'employer contributions were $ 553 for CPP and $ 654 for El Recorded the adjusting entry to record the interest incurred on the bank loan during December Dec. 31 Dec. 31 Recorded the entry to reclassify the current portion of the bank loan. 2021 Jan, 2 Paid the wages recorded on December 31. Jan. 15 Made the remittance to the government related to the December 31 payroll Prepare all necessary journal entries related to the above transactions. (Enter debit entries first followed by credit entries Credit account titles are automatically Indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry for the account for the amount Prepare all necessary journal entries related to the above transactions. (Enter debit entries first followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account tities and enter for the amounts.) Debit Credit Date Account and explanation 2020 Dec. 1 Dec. 31 (To record wages payable.) (To record employer's liabilities.) MILLE Dec. 31 (To record interest.) (To record reclassification of current portion of bank loan.) To record interest.) III (To record reclassification of current portion of bank loan.) 2021 Jan. 2 Jan. 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts