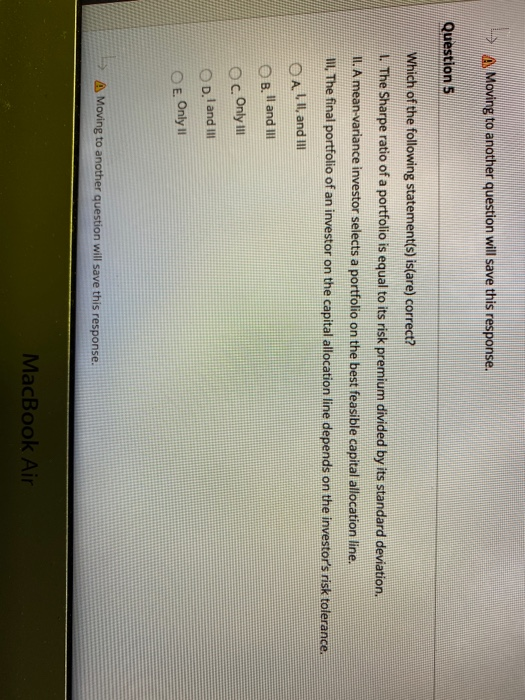

Question: M AN Moving to another question will save this response. Question 5 Which of the following statement(s) is(are) correct? V The Sharpe ratio of a

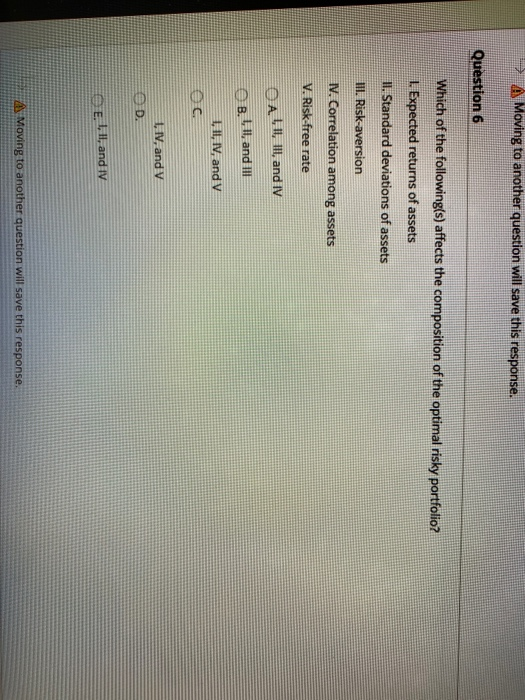

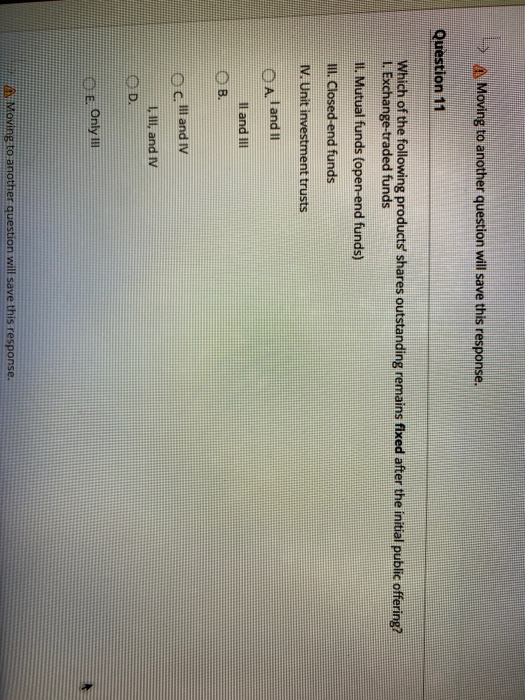

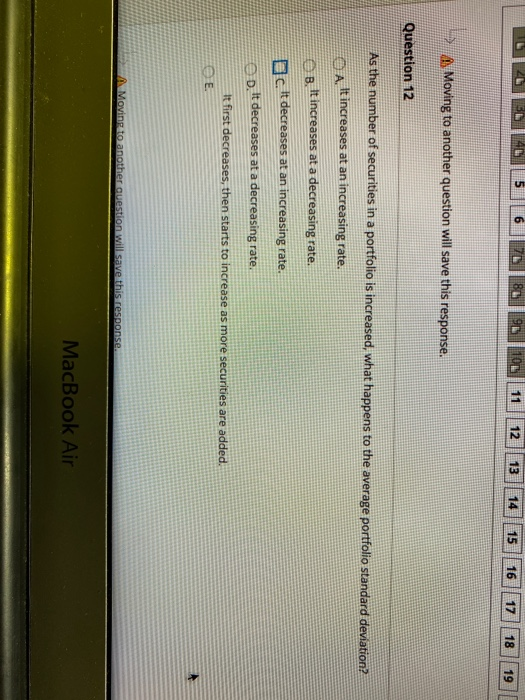

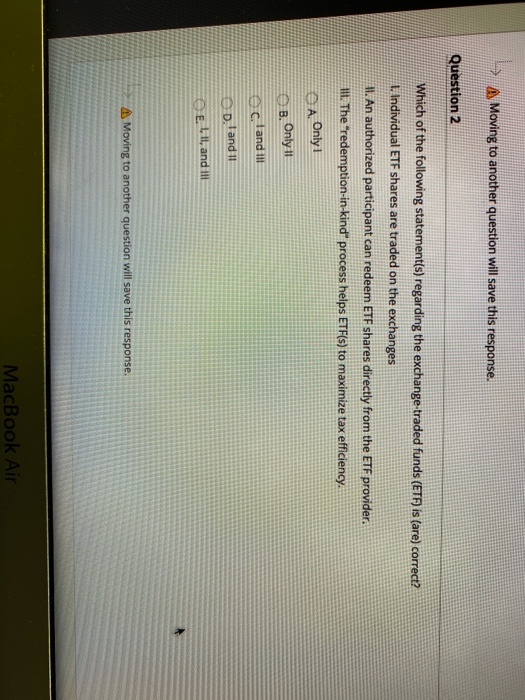

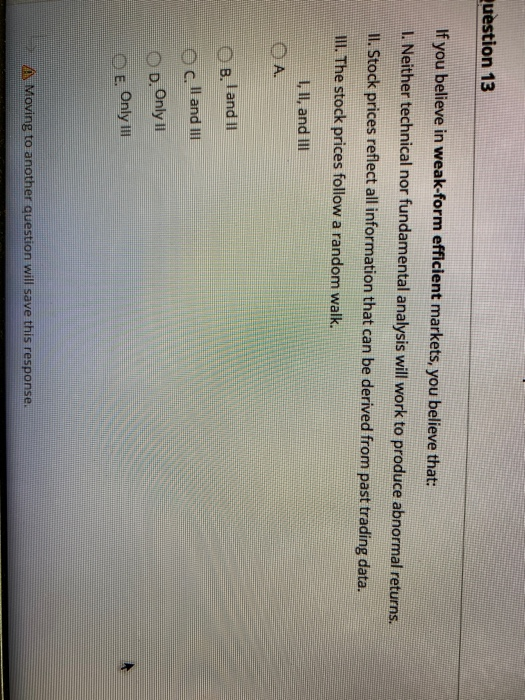

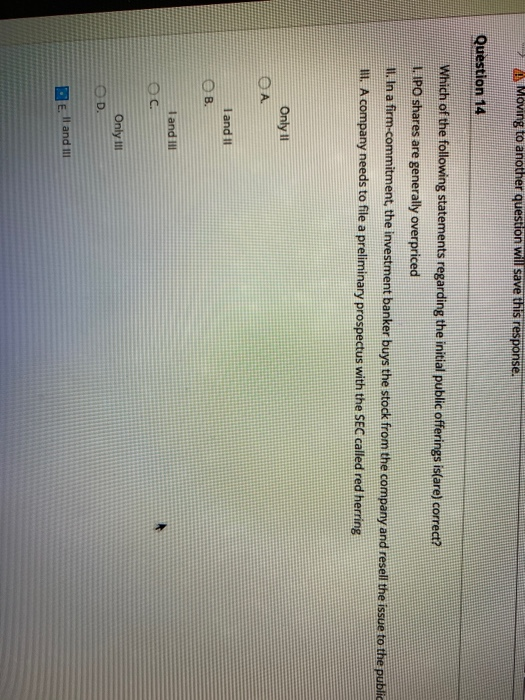

M AN Moving to another question will save this response. Question 5 Which of the following statement(s) is(are) correct? V The Sharpe ratio of a portfolio is equal to its risk premium divided by its standard deviation. II. A mean-variance investor selects a portfolio on the best feasible capital allocation line. NII, The final portfolio of an investor on the capital allocation line depends on the investor's risk tolerance. O AL II, and Il B. I and I Oc Only OD. I and II O E Only 11 > A Moving to another question will save this response. MacBook Air 7 A Moving to another question will save this response. Question 6 Which of the following(s) affects the composition of the optimal risky portfolio? 1. Expected returns of assets 11. Standard deviations of assets III. Risk-aversion N. Correlation among assets V. Risk-free rate ALI, III, and IV B.1., and I II, IV, and V 1, 1V, and V 1, ll, and IV A Moving to another question will save this response. A Moving to another question will save this response. Question 11 Which of the following products' shares outstanding remains fixed after the initial public offering? 1. Exchange-traded funds 11. Mutual funds (open-end funds) III. Closed-end funds 1. Unit investment trusts Aland and all OB. cil and IV 1. lll, and IV E Only ! ex Moving to another question will save this response. LLLLLLL 11 12 13 14 15 16 17 18 19 > As Moving to another question will save this response. Question 12 As the number of securities in a portfolio is increased, what happens to the average portfolio standard deviation? A It increases at an increasing rate. B. It increases at a decreasing rate. Belt decreases at an increasing rate. p. It decreases at a decreasing rate. It first decreases, then starts to increase as more securities are added A Moving to another question will save this response. MacBook Air A Moving to another question will save this response. Question 2 Which of the following statement(s) regarding the exchange-traded funds (ETF) is (are) correct? I. Individual ETF shares are traded on the exchanges M. An authorized participant can redeem ETF shares directly from the ETF provider. III. The redemption-in-kind process helps ETF(s) to maximize tax efficiency. A. Only! B. Only ! cland I OD.land I ELI, and I A Moving to another question will save this response. MacBook Air Question 13 If you believe in weak-form efficient markets, you believe that: 1. Neither technical nor fundamental analysis will work to produce abnormal returns. II. Stock prices reflect all information that can be derived from past trading data. III. The stock prices follow a random walk. 1, l, and I OB. I and 11 c and op. Only II O E. Only Ili A Moving to another question will save this response A Moving to another question will save this response. Question 14 Which of the following statements regarding the initial public offerings is(are) correct? 1. IPO shares are generally overpriced M. In a firm-commitment, the investment banker buys the stock from the company and resell the issue to the public III. A company needs to file a preliminary prospectus with the SEC called red herring Only 11 EA land 11 B. I and III Only III Ell and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts