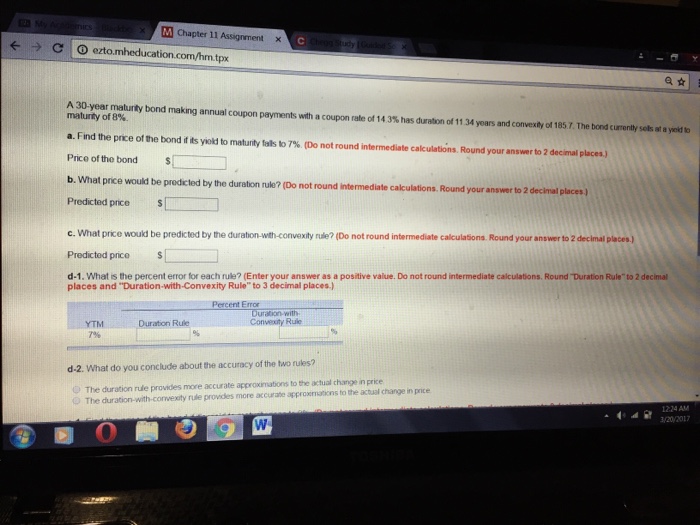

Question: M Chapter 11 Assignment x C O ucat A30-year maturity bond making annual coupon payments with a coupon rate of 14.3% has duraton of 1134

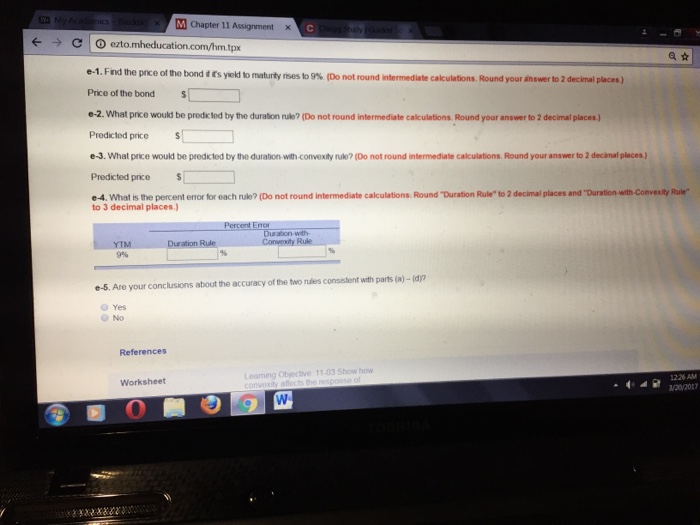

M Chapter 11 Assignment x C O ucat A30-year maturity bond making annual coupon payments with a coupon rate of 14.3% has duraton of 1134 years and convexity of 1857 The bond curently sels ata yeldto maturity of a. Find the price ofthe bond fits yold to maturity lals to 7%. (Do not round intermediate calculations. Round your answer to 2 decimal places) Price of the bond b. What price would be predicted by the duraton nule? (Do not roundintermediate calculations. Round your answer to 2 decimal places.) Predicted price s c. What price would be predicted by the duration-wth conve rule? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Predicted price d-1. What is the percent error for each rule? (Enter your answer as a positive value. Do not round intermediate calculations, Round Duration Rule" to 2 decimal places and "Duration-with-Convexity Rule" to 3 decimal places) Percent Error uration with YTM Duration Rule d-2. What do you conclude about the accuracy of the two rules? The duration rule provides more accurate approximations to the actual change in price in price The duration with convexity rule provides more accurate approximations to the actual change 3020/2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts