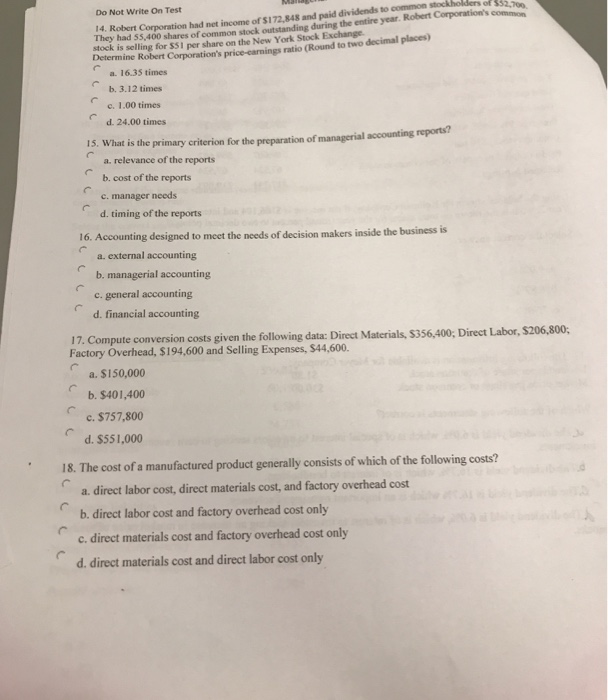

Question: M Do Not Write On Test 14. Robert Corporation had net income of $172.848 and paid dividends to common stockholders of They had 55,400 shares

M Do Not Write On Test 14. Robert Corporation had net income of $172.848 and paid dividends to common stockholders of They had 55,400 shares of common stock outstanding during the entire year. Robert Corporation's com stock is selling for SS1 per share on the New York Stock Exchange Determine Robert Corporation's price-carnings ratio (Round to two decimal places a. 16.35 times b. 3.12 times c. 1.00 times d. 24.00 times 15. What is the primary criterion for the preparation of managerial accounting reports a. relevance of the reports b. cost of the reports c. manager needs d. timing of the reports 16. Accounting designed to meet the needs of decision makers inside the business is a. external accounting b. managerial accounting c. general accounting d. financial accounting 17. Compute conversion costs given the following data: Direct Materials, S356,400, Direct Labor, $206,800; Factory Overhead, $194,600 and Selling Expenses, $44.600. a. $150,000 b. $401,400 c. $757,800 d. $551,000 18. The cost of a manufactured product generally consists of which of the following costs? a direct labor cost, direct materials cost, and factory overhead cost b. direct labor cost and factory overhead cost only c. direct materials cost and factory overhead cost only d. direct materials cost and direct labor cost only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts